Home – Regulations – Sustainable Finance Disclosure Regulation (SFDR)

Table of contents

- What is the SFDR?

- What firms must disclose

- Classification of products

- Impacts of SFDR

- Implementation considerations of SFDR

- Anthesis support

Share this guide

In this guide, we introduce the SFDR, including what it is, who it applies to, what the requirements are, an explanation of Article 6, 8 and 9, and how Anthesis can help with your SFDR strategy.

What is the EU Sustainable Finance Disclosure Regulation?

The EU Sustainable Finance Disclosure Regulation (SFDR) aims to improve transparency, reduce greenwashing, and promote sustainable investments. It requires financial service providers, asset managers, and owners of financial products to assess and disclose environmental, social, and governance (ESG) considerations publicly. The requirements are detailed in the Regulatory Technical Standards (RTS).

The SFDR came into effect in March 2021, with further requirements for financial products beginning on 1st January 2023. Firms must make their SFDR disclosures by 30th June on an annual basis.

Who does EU SFDR apply to?

The regulation applies to all financial market participants (“FMPs”) and financial advisors (“FAs”) in the EU – including any with EU shareholders or marketing themselves in the EU – and sets out clear disclosure requirements.

FMPs include:

- An insurance company that makes available an insurance-based investment product

- Investment firms that provide portfolio management

- An institution for occupational retirement provision

- A manufacturer of pension products

- An alternative investment fund manager

- A pan-European personal pension product provider

- A manager of a qualifying venture capital fund

- A manager of a qualifying social entrepreneurship fund

- A management company for UCITS (Undertakings for the Collective Investments in Transferable Securities)

- A credit institution that provides portfolio management

The products that it encompasses include (not exhaustive): investment and mutual funds, UCITS, insurance-based investment products, private and occupational pensions and insurance and investment advice.

What must firms disclose?

The SFDR disclosure obligations are divided into three categories:

1. The adverse impacts of investment decisions on sustainability factors

Obligated firms must disclose the potentially negative consequences an investment decision may have on sustainability factors and how they are mitigating the impacts, known as Principle Adverse Impacts (“PAIs”). These sustainability factors include environmental aspects, such as energy performance and water usage, and social aspects like employee matters and respect for human rights.

Firms below the 500-employee threshold can chose to opt in or out of PAI reporting at firm level under Article 4 and at product level under Article 7. Article 4 embeds a “comply or explain” principle, broadly phrased as follows:

- Firms can choose to report the PAIs of their investment activity, publishing prescribed information on their website, whilst FMPs must also report such information to investors; OR

- Firms can choose not to disclose PAIs (if below the 500-employee threshold), but must explain why they do not consider the adverse impacts of their investment activity on sustainability factors.

Several firms have instead charted a third course: explaining that whilst they do not consider PAIs within the meaning of the SFDR, they nonetheless report meaningful ESG data.

2. Consideration of sustainability (ESG) risks in investment processes

Firms must disclose where an ESG event could negatively impact material investments and align their remuneration policies with sustainability risk management.

3. Provision of sustainability information concerning financial products

Where a product is categorised as an Article 8 or Article 9 product (see below), additional disclosures need to be made.

Classification of SFDR Products

To enhance transparency, reduce greenwashing, and substantiate asset managers’ sustainability claims, the SFDR distinguishes between three types of product classification:

Funds that claim to align with ESG or sustainability factors must be classified as either Article 8 or 9. Article 8 funds promote environmental and social characteristics, and follow good governance practices, but do not have sustainability as the core objective. Article 9 funds, however, have stricter disclosure requirements and must have sustainability as their core objective.

The SFDR has 2 levels of disclosure:

| Entity-Level 1 Disclosure Requirements: obligations for the entities themselves concerning their policies on decision-making on sustainability risks. | Product-level 2 Disclosure Requirements: obligations concerning the financial products and their sustainability risks. |

|---|---|

| Details on how sustainability risks are integrated into the entity’s investment decision-making process or financial advice [Article 3 SFDR]. A firm must publish a statement of intent on its website to demonstrate which Article it intends to align to. | Firms must provide additional disclosures depending on the objective of each product. |

| A statement outlining policies regarding the consideration of Principal Adverse Impacts (PAIs) on sustainability factors [Article 4 SFDR]. | For firms considering PAIs, an explanation of how financial products address these impacts should be furnished. This applies to all products offered by the firm, regardless of whether they aim to achieve sustainability objectives [Article 7 SFDR]. |

| Information on how remuneration policies align with the integration of sustainability risks [Article 5 SFDR]. | Products promoting “environmental” or “social” characteristics must provide information on how these objectives are met, including disclosure on the extent of alignment with the EU Taxonomy Regulation of underlying economic activities [Article 8 SFDR]. |

| Pre-contractual disclosures concerning the integration of sustainability risks, including assessments of how financial product performance may be influenced by these risks [Article 6 SFDR]. | Products with a sustainable investment objective must explain how these objectives are pursued, along with additional disclosure on alignment with the EU Taxonomy Regulation [Article 9 SFDR]. |

On their websites, FMPs shall also publish their policies for due diligence on the adverse impacts of their investment decisions on sustainability factors.

What is the impact of the regulation?

The regulation aims to reduce greenwashing and the overstating of green credentials. The European Commission found in an assessment of 344 “seemingly dubious claims” on the environment that nearly half (43%) were false or deceptive and 37% included purposely misleading or vague statements like “eco-friendly” or “sustainable”.

Not only will the SFDR help organisations focus on ESG risks during the investment process, but in addressing an existing gap in mandatory rules for ESG disclosure, the SFDR aims to spark a behavioural change for FMPs.

It follows a wave of new policies preserving investor value by stimulating greater investment in ESG disclosure. With recent years proving that organisations with strong sustainability credentials can significantly outperform conventional funds during shocks, the focus on legitimising green credentials can be seen as a vital push to protect revenues and asset values from future disruption. This also follows a broader cultural shift, with climate policy being a key point in many national elections and ESG risks at the forefront of investors’ minds following the aftershocks of the COVID-19 pandemic.

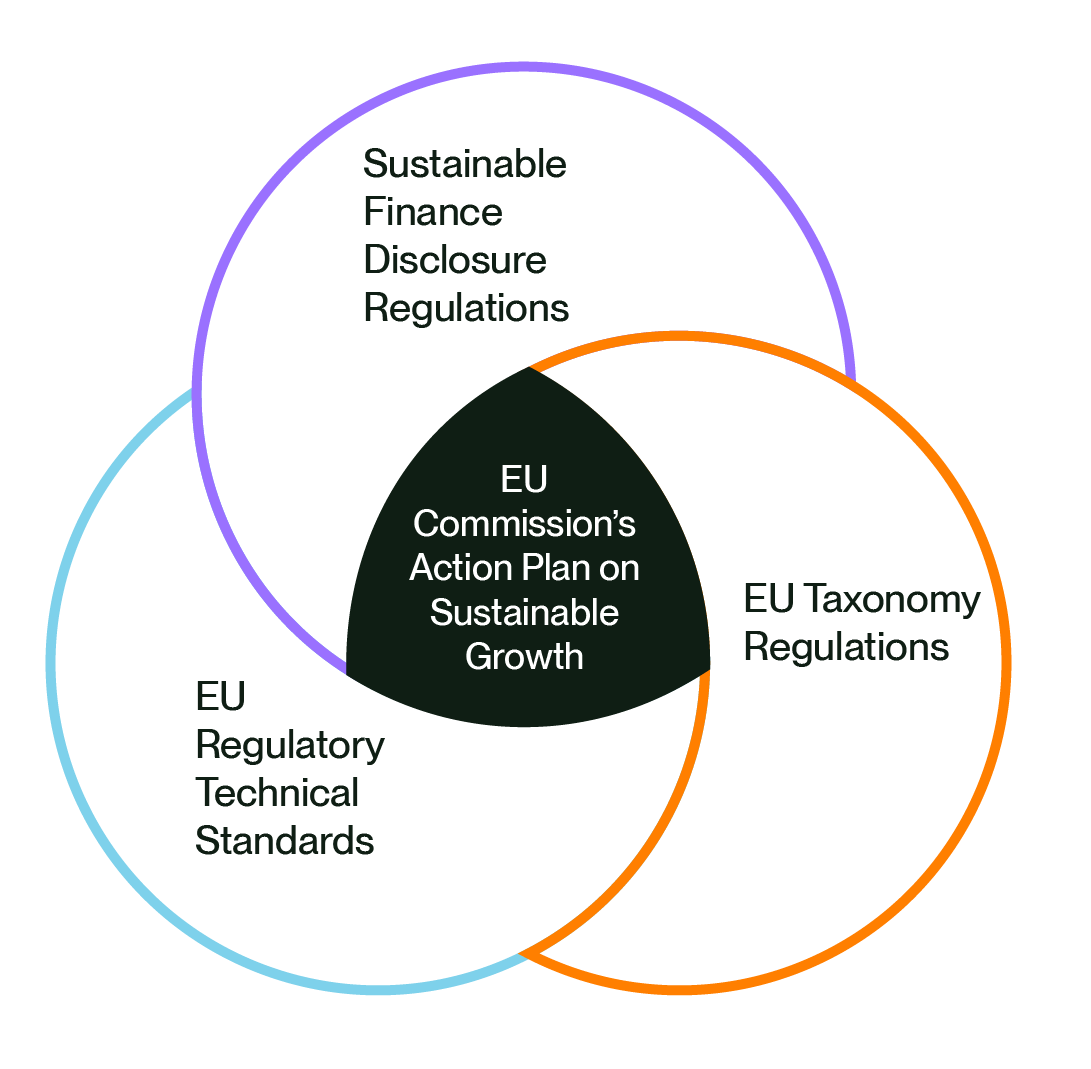

The SFDR is a gateway to further ESG-related legislative activity as part of the European Commission’s Sustainable Finance Action Plan. It complements the EU Taxonomy Regulation, which looks to establish whether an economic activity is environmentally sustainable. Complying with obligations for financial products under the SFDR activates disclosure requirements from the taxonomy. Similarly, entities follow the taxonomy regulation to comply with the SFDR.

Implementation Considerations for FMPs and FAs

For FMPs and FAs that operate in the EU to market investments as Article 8 or 9, they will need to review the whole lifecycle of their products, from initial product development, marketing, and contracting, through to monitoring, reporting, and updating their policies and processes.

The following areas need to be addressed:

- Update the policies in place to cover sustainability risks and PAIs.

- Review all current investment products and allocate product classifications under Articles 6, 8 and 9. Document all product assessments that fit the criteria for Articles 8 and 9.

- Update all policies and processes for new fund set-up or new product development to ensure alignment with product classification under SFDR.

- Have clear checklists and process steps for each type of investment/product.

- Develop clear product risk and PAI disclosures for each product where applicable.

- Disclose whether a specific index has been designated as a reference benchmark and, if so, explain what the alignment is with the sustainable investment objective of the fund.

- For Article 9 only, and if aiming to reduce carbon emissions, disclose whether the EU Climate Benchmark is a reference indicator or whether there is a Paris-Aligned benchmark; if not, explain how the fund seeks to make a continued effort to attain the objective of reducing carbon emissions.

- Review the current due diligence process for investing in new products and update for SFDR requirements, including data requests from issuers.

- Update research checklists and processes on investments to include ESG considerations.

- For assets where the FMP engages with the issuer, new requirements for data will be needed: data requests, storage of information received, and inclusion in decision-making documentation.

- Ensure there is an overall risk management policy and framework for ESG and SFDR within the business.

- Update risk management policies and procedures for SFDR considerations concerning sustainability risks and PAIs.

- Ensure metrics at the fund and investment level are reviewed regularly.

- Develop a solution to gather and store the information needed for the policies outlined above and for disclosure requirements. Ensure capability to manage, monitor, and report.

- Benchmark existing disclosures and perform a gap analysis between current the position and SFDR requirements; outline how to close the gaps and prepare an implementation plan.

- Ensure that disclosure requirements are built into pre-contractual documentation, marketing documentation and website disclosures.

How can Anthesis help?

Anthesis’ Sustainable Finance Team can provide support to your firm through the development of an SFDR framework, a roadmap to disclosure, and relevant reporting templates to support your PAI data collection process. We can also undertake EU Taxonomy-aligned workstreams to support the evidencing of Do No Significant Harm (“DNSH”) criteria, PAI calculations, and broader disclosure support. Our experience with financial institutions and fund managers enables us to incorporate the requirements of the SFDR into due diligence tools for private equity firms and develop SFDR screening frameworks for firms to assess and evidence the entity and product-level impact against PAIs.

To ensure your SFDR strategy aligns with your broader ESG or Investment strategy, we can help to align corporate sustainability and private equity strategy against the ever-changing landscape of standards and regulations. This can involve an assessment of materiality, benchmarking, and peer reviews, as well as ESG metrics and KPI setting and annual report writing.

We also conduct climate risk assessments for corporates and private equity clients to help them align with the requirements of EU Taxonomy climate criteria in addition to the Task Force on Climate-Related Financial Disclosures (TCFD).

Frequently Asked Questions

The SFDR was not retained in UK law during the Brexit process. However, a UK-specific regulation is in the works, called the Sustainable Disclosure Regulation (SDR), which is expected to work similarly to the EU SFDR.

Get in touch

Related Content

Get in touch

We’d love to hear from you

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.