Home – Regulations Hub – SEC Disclosure – SEC FAQ

Contents

- What has happened?

- Am I affected?

- Do I need to include global operations?

- What will I need to do to comply?

- What about GHG emissions and Scope 3?

- What is the definition of ‘materiality’? What are the thresholds?

- What time period do I need to consider?

- What is the consequence of not complying?

- When do I need to start reporting?

- How much is this going to cost?

- What financial information will be needed?

- What exemptions are there for businesses?

- Contact Us

Share this article

Under the proposed climate disclosure rule, companies must provide detailed reporting of their climate-related risks, greenhouse gas (GHG) emissions (Scopes 1,2 & 3), Net Zero plans, as well as governance approaches based on these factors. The proposal from the commission has further laid out plans to increase pressure on organisations asserting environmental claims and Net Zero commitments.

What has happened?

On March 6th, the Securities and Exchange Commission voted 3-2 along bipartisan lines to adopt as Final the Draft Rules set out in March 2022 to enhance and standardize climate-related disclosures by public companies and in public offering, albeit with significant revisions.

A series of lawsuits immediately followed, filed by parties with vested interests in keeping climate disclosure at a minimum as well environmental advocacy parties with interests in robust climate disclosure. These numerous lawsuits have been combined and will be heard in the U.S. 8th Circuit Court of Appeals in Missouri.

These lawsuits will need to include consideration that SEC already issued Guidance in 2010 under existing disclosure rules to recommend disclosure of the impacts of climate change and climate events on the business and financial condition.

This is the first phase in what is expected to be an active legal battle to allow climate risk and GHG accounting to be provided to investors as well as other interested stakeholders. Watch this space.

Am I affected?

You are affected if your organization is a Large Accelerated Filer (LAF), an Accelerated Filer (AF), a Non-Accelerated Filer (NAF) or an Emerging Growth Company (ECG) although the timeframes which impact you will differ. The SEC indicated their final rule impacts about 2,800 firms.

Do I need to cover my global operations or just US-based?

Our interpretation of the final rule is that affected companies need to provide climate risk related disclosure consistent with the entity boundary used for financial statement disclosure. If this boundary is different from that applied to calculate and disclose GHG emissions, that is acceptable with an explanation from the company as to how and why the boundaries are different.

What will I need to do to comply?

For climate risk, central to determining what needs to be disclosed is what your company deems to be material for investors, in the context of climate-related risks. This final rule adopts the definition of materiality consistent with the SEC and Supreme Court precedent: “a matter is material if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.” (p105)

For material climate-related risks, you will need to provide narrative descriptions similar to the content covered in TCFD recommendations, covering material impacts including:

- Disclosure of a description of the board oversight of climate-related risks

- Identification of any board committee or subcommittee responsible for the oversight of climate-related risks

- A description of the processes by which the board is informed about such risks

- Whether and how the board oversees progress against established climate-related target(s) or transition plan

- A description of management’s role in assessing and managing material climate-related risks

- Whether and which management positions or committees are responsible for assessing and managing climate-related risks, and the relevant expertise of such position holders or committee members in such detail as necessary to fully describe the nature of the expertise

- The processes by which such positions or committees assess and manage climate-related risks

- Whether such positions or committees report information about such risks to the board of directors or a committee or subcommittee of the board of directors

- Any climate-related risks identified by that have had or are reasonably likely to have a material impact on the registrant, including on its strategy, results of operations, or financial condition in the short-term (i.e., the next 12 months) and in the long-term (i.e., beyond the next 12 months)

- The actual and potential material impacts of any identified climate-related risks on your strategy, business model, and outlook, including, as applicable, any material impacts on a non-exclusive list of items

- If your company has an established transition plan disclose the relevant metrics and targets used to manage physical and transition risks as well as any progress against those goals taken during the reporting year. Disclosure of climate related opportunities in the transition plan is not required.

- If you have mitigation, adaptation or transition plans1, either within your strategy or as stand-alone items, you’ll need to disclose quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that, in management’s assessment, directly result from such mitigation or adaptation activities, or the transition plan.

- If you use scenario analysis to identify and assess climate-related risks and determine that a climate-related risks is reasonable likely to have a material impact on your business, results of operations or financial condition, then the company must describe the scenario, a description of the analysis including parameters and assumptions, the expected material impacts including financial impacts under each scenario.

- If your company uses an internal carbon price and its implementation is material to how the company manages and evaluates a climate-related risk, the company is required to disclose the price per metric ton CO2e and the total price, including how the total price is estimated to change over time.

1 the final rules define (in Item 1500) a “transition plan” to mean a registrant’s strategy and implementation plan to reduce climate-related risks, which may include a plan to reduce its GHG emissions in line with its own commitments or commitments of jurisdictions within which it has significant operations.

- Description of any processes the registrant has for identifying, assessing, and managing material climate-related risk

- How the company decides whether to mitigate, accept or adapt to the material climate risk

- How the company prioritizes whether to address the climate-related risk

- If a registrant is managing a material climate-related risk, it must disclose whether and how any of the processes it has described for identifying, assessing, and managing the material climate-related risk have been integrated into the registrant’s overall risk management system or processes

- Disclose any climate-related target or goal if such target or goal has materially affected or is reasonably likely to materially affect the registrant’s business, results of operations, or financial condition

- Any relevant context related to the target such as the scope of activities included in the target, the unit of measurement, the time horizon in which the target is to be achieved, the target baseline, qualitative description of how the company plans to meet the target. We reasonably expect this to include disclosure of the GHG inventory serving as the basis for the climate targets, consistent with the TCFD framework.

- Disclosure of any progress toward meeting the target or goal and how such progress has been achieved

What about GHG emissions? What’s happened to Scope 3?

While disclosure of Scopes 1 & 2 are required if material. Scope 3 emissions disclosure is not required in the final rule.

SEC’s materiality determination is a fact-based standard and includes qualitative considerations. Emissions are material if a reasonable investor consider it important when determining whether to buy or sell securities or how to vote; view omission of the disclosure as having significantly altered the total mix of information available; and would want to know whether the company has made progress toward achieving a target, goal or a transition plan.

If material, Scopes 1 and 2 are to be reported in two ways: disaggregated by individual GHG and aggregated in CO2e, in absolute terms, by tonnes per fiscal year of the business.

Constituent GHGs anticipated to be material will vary by industry. For example, these include Methane for oil and gas, waste, food processing and agriculture sectors. For the electronics manufacturing sector, material constituent GHGs include: Sulfur Hexafluoride (SF6), Nitrogen Trifluoride, Hydrofluorocarbons (HFCs), and Perfluorocarbons.

A brief description of the methodology (market-based versus location-based, for example) is required along with identification of the emissions factors applied. The reference standard that is to be applied for GHG reporting is the Greenhouse Gas Protocol.

Initial reporting for GHG Scopes 1 and 2 is due in 2026 (LAFs) and in 2028 for (AFs), based on data for the prior fiscal year (2025 or 2027). For audit requirements, these are phased in by organization size, initially Limited Assurance is required, transitioning to Reasonable Assurance over 3 years’ time.

What is the definition of ‘materiality’? What are the thresholds?

Given that ‘materiality’ is central to what is reported, the definitions with respect to climate risk or GHGs themselves are not straight forward. The SEC states that “…The Commission has been and remains agnostic about whether or how registrants consider or manage climate-related risks”. They are seeking to align definitions of materiality with current understandings associated more generally with financial reporting and risk disclosure rules, so as to avoid being too deterministic within the context of climate. This is understandable given some of the opposition to the rules coming from those who accuse the SEC of overreach.

However, the definition included states that “…As defined by the Commission and consistent with Supreme Court precedent, a matter is material if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available. The materiality determination is fact specific and one that requires both quantitative and qualitative considerations”.

There is frequent reference to how businesses report other similar aspects of materiality in companies’ Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) covered by Regulation S-K to draw parallels.

This includes a temporal dimension which is laid out as “…risks [that are] reasonably likely to manifest in the short-term (i.e., the next 12 months) and separately in the long-term (i.e., beyond the next 12 months)”

They also note that materiality within the different emerging climate disclosures may differ, subject to the intended design of those rules, using California’s SB 261 as an example which was designed with public health in mind, rather than investor protection.

What time period do I need to consider?

The final rule defines the short-term as the next twelve months and the long-term as greater than 12 months to connect it with the MD&A standards.

SEC has left it largely up to the company to decide what will help investors outside of the reporting period. “Although a registrant may choose to include forward-looking information or discuss any climate-related metrics or financial information in response to Item 1502(c), the final rule leaves it up to each registrant to determine, based on its particular facts and circumstances, what disclosure is necessary to help investors understand whether and how management has incorporated the material impacts of its climate-related risks into its business strategy, financial planning, and capital allocation.”

What is the consequence of not complying?

There are currently no defined penalties or fines associated with noncompliance within the published materials. However, over time, there is likely to be reputational and legal risk, outside of any financial penalty, with respect to the appropriate level of disclosure along with the need for increasing accuracy as demonstrated through the need for limited to reasonable assurance on GHG emissions disclosure for larger affected entities.

When do I need to start reporting?

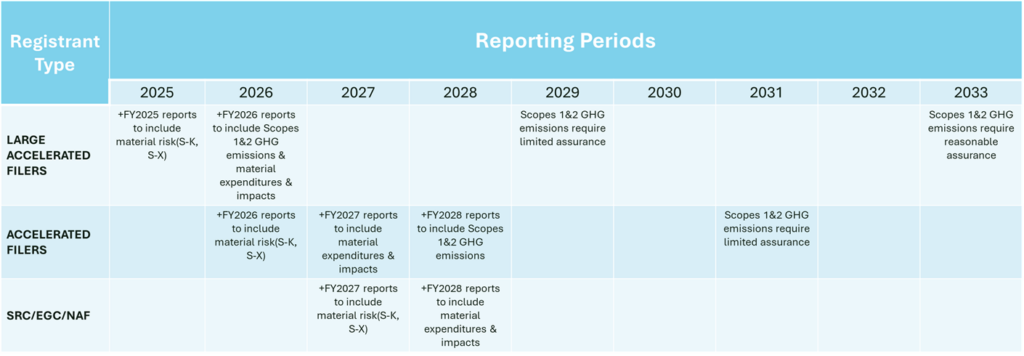

Subject to the size of your organization, you may need to start assessing and measuring your climate risk and GHG emissions as early as next year in 2025 for reporting in 2026. The final rule adopts a phased-in compliance approach based on filer status.

As an example, a Large Accelerated Filer with a January 1 fiscal year start and a December 31 fiscal year end date would follow the below compliance timeline:

- 2026: first 10K disclosure based on FY2025 data (except disclosures pertaining to GHG emissions and those related to Item 1502(d)(2),[2] Item 1502(e)(2), and Item 1504(c)(2)[3], if applicable)

- 2027: first 10K* disclosure of Scope 1 & 2 emissions for FY2026 data, if required

- 2030: Limited Assurance on Scope 1 & 2 emissions for FY2029 data, if required

- 2034: Reasonable Assurance on Scope 1 & 2 emissions for FY2033 data, if required

*For GHG emissions disclosures, registrants can include this disclosure in the 10K filing or other registration statement that is required to include financial information for the same fiscal year data i.e., 10Q.

[2] Item 1502(d)(2) will require a registrant to describe quantitatively and qualitatively the material expenditures incurred and material impacts on financial estimates and assumptions that, in management’s assessment, directly result from activities to mitigate or adapt to climate-related risks disclosed.

[3] Item 1504(c)(2) requires disclosure regarding material impacts that directly result from actions taken by a registrant to achieve a disclosed target or goal.

Key Acronyms

- LAF: Large Accelerated Filers

- AF: Accelerated Filers

- NAF: Non-Accelerated Filers

- SRC: Smaller Reporting Companies

- EGC: Emerging Growth Companies

How much is this going to cost?

There are wide estimates for the costs of disclosure. Like introducing any new system, it will require investment in people, processes and the integration of systems to generate the disclosure.

However, given much of this information will be useful for other disclosure purposes as well as purposes of risk management and strategy development, this should be seen as an investment.

We estimate that it will require between $150,000 and $500,000 subject to starting position, size, complexity and system requirements to meet compliance, excluding costs associated with audit or systems integration.

What financial information will be needed?

Much of the disclosure is narrative-led in terms of describing the actual and potential impacts on the company’s strategy, business model, and outlook of those climate-related risks.

However, quantitative disclosure may be required, including of “capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds”. This applied for both the income statement and balance sheet. Disclosures should be of aggregate amounts before consideration of any recoveries such as insurance.

In addition, it requires disclosure of both capitalized and expensed expenditures associated with adaptation or mitigation carried out within the fiscal reporting year as related to achieving disclosed climate-related targets and/or transition plans.

Capital costs, expenses and losses related to purchases of carbon offsets and renewable energy certificates (RECs) are required to be disclosed.

Specifically, the rules do require qualitative and quantitative disclosure of climate-related events and initiatives in the financial statement footnotes:

- If carbon offsets and/or RECs contribute materially to the company’s strategy to achieve its climate-related targets, companies must disclose the aggregate amount expensed, capitalized and the amount of losses incurred related to the use of carbon offsets and/or RECs. Companies must also disclose which financial statement line items are affected by the use of carbon offsets and/or RECs.

- If carbon offsets and/or RECs contribute materially to the company’s strategy to achieve its climate-related targets, companies must disclose the aggregate amount expensed, capitalized and the amount of losses incurred related to the use of carbon offsets and/or RECs. Companies must also disclose which financial statement line items are affected by the use of carbon offsets and/or RECs.

- Companies must disclose whether, and if, severe weather events and other natural conditions as well as climate-related targets or transition plans materially affected estimates and assumptions applied in the financial statements.

What exemptions are there for businesses?

Scope 3 is currently not required to be disclosed, even if you are reporting this for other purposes.

In addition, forward looking information such as transition plans, scenario analysis, internal carbon pricing, and targets and goals are protected from litigation and market risk by placing them in a ‘safe-harbor’ due to their “mixture of both forward-looking and factual information related to climate-related risks and assumptions concerning those risks”.

Disclaimer: This summary is provided for informational purposes only and does not constitute legal advice. The information contained herein is based on our understanding of the SEC Final Rule document and may not reflect the entirety or nuances of the original text. Recipients are encouraged to consult with qualified legal professionals to obtain advice tailored to their specific circumstances. Anthesis assumes no liability for any inaccuracies, errors, or omissions in this summary.

Helpful Resources

We are the world’s leading purpose driven, digitally enabled, science-based activator, and always welcome inquiries and partnerships to drive positive change together.