Home Regulations Hub CBAM

Home Regulations Hub CBAM

Access our CBAM summary document, with all the essential information you need.

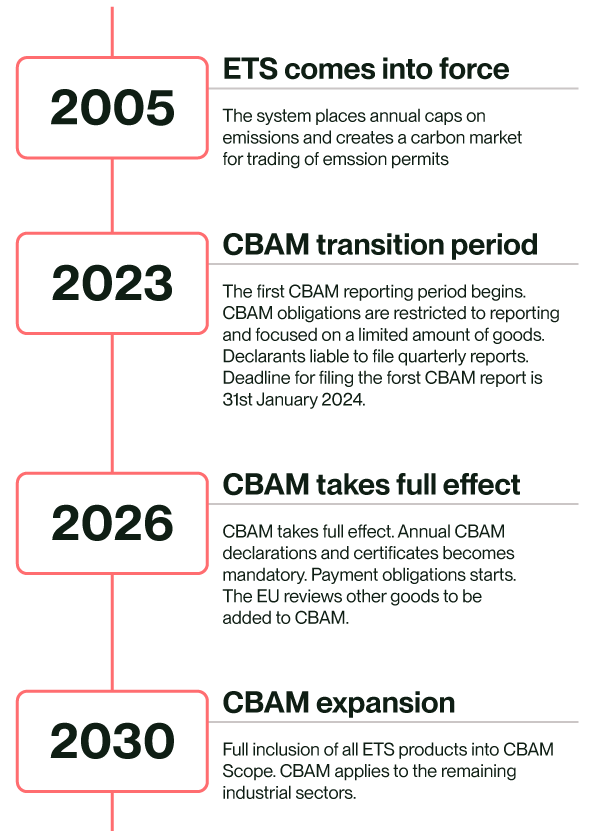

On 10th May 2023, the European Parliament and Council established a regulation to prevent carbon-intensive imports from undermining the EU’s climate objectives and to encourage the adoption of cleaner production practices, known as the Carbon Border Adjustment Mechanism (CBAM).

CBAM is a significant step forward for the EU’s commitment to sustainable trade and a sign of the times, as businesses and governments around the world are increasingly recognising the need to take action on climate change.

The Carbon Border Adjustment Mechanism, or CBAM, is a new regulation that puts a price on carbon emissions embedded in goods imported into the EU, and requires affected companies to report and purchase special emission allowances, CBAM certificates, for associated emissions; helping to level the playing field for European businesses and encourages other countries to reduce their emissions.

This carbon border tax is to serve as an essential element of the EU’s toolbox for meeting the objective of a climate-neutrality by 2050 in line with the Paris Agreement. It addresses the risk of carbon leakage that results from the EU’s increased climate ambition. The CBAM is also expected to contribute to promoting decarbonisation in third countries – such as those which do not tax carbon at an EU-approved level – according to the EU Regulation 2023/956.

The regulation targets manufacturers and importers of products with materials that are from carbon-intensive sectors.

The move to CBAM embedded emissions will advance businesses to reduce their carbon footprint. The CBAM aims to create a level playing field between EU producers (EU ETS) and importers.

The Carbon Border Adjustment Mechanism (CBAM) aims to prevent carbon leakage by charging for emissions linked to imported goods produced in countries with looser climate regulations. It ensures equal treatment by applying a carbon price to both imported and domestic goods, promotes cleaner industrial practices in non-EU countries, supports EU climate objectives, and incentivises third countries to adopt greener policies.

Currently in the transitional phase until 31st Dec 2025, the new CBAM reporting obligations act as a financial lever applied to the embodied carbon of goods imported into the EU. The CBAM reporting obligations for importers take effect during this transitional phase and impact all EU member states without the need for transposing into each member state’s laws.

Specific goods are listed in the regulation:

There are exemptions for good originating in Liechtenstein, Norway and Iceland, as they are part of the EU ETS, and the Switzerland ETS is linked to the EU ETS making Switzerland exempt as well. This wave of impact will ultimately extend to include various energy products as part of future policy considerations.

May 2023 marked the official ratification of the CBAM transition phase, and reporting periods began from 1st October 2023. The schedule of declarations follows a regular quarterly cycle. The inaugural report submission is slated for January 31, 2024 in respect of goods imported during the fourth quarter of 2023. The last report should be submitted by 31 January 2026 in respect of goods imported during the fourth quarter of 2025.

Get ahead of upcoming regulations with our expert-led webinar. Learn how the EU Carbon Border Adjustment Mechanism (CBAM) will impact your business and the steps you need to take to prepare.

During the transitional phase organisations must begin to gather data and prepare registrations. This will be submitted to the CBAM Authority and include a report on the volume of in-scope goods imported and the embedded GHG in those goods on a quarterly basis from 01/10/2023 to 31/12/2025. Access and registration to the registry should be requested through the CBAM Portal.

The immediate steps organisations must take are to:

Non-compliance with can lead to significant consequences, including financial penalties, correction procedures, and fines. The penalty for failing to report embedded emissions in CBAM goods ranges from €10 to €50 per ton, depending on the severity and duration of non-compliance, with higher penalties if the issue persists for more than six months. If a CBAM report is missing, inaccurate, or incomplete, the National Competent Authority (NCA) will initiate a correction procedure, allowing the reporting party to rectify errors. However, if corrective actions are not taken, further penalties may be applied.

Additionally, starting in 2027, authorised CBAM declarants who fail to surrender the required CBAM certificates by May 31 will face fines of €100 per ton of CO2.

Since the start of 2023 the scope of this regulation has narrowed, removing previously proposed chemicals and polymers, but clarity has improved on the detailed nature of data reporting requirements.

Surrender of the declared GHG emissions of products will be done through the purchasing of CBAM certificates, based on the EU ETS pricing. These certificates, instrumental in the carbon price framework, will be procured from a centralised platform overseen by the EC (European Commission). The fees linked to these certificates will be calculated by the EC, tethered to the conclusive proceedings of EU ETS allowances.

Two costs are created on businesses through CBAM:

Additional products are planned to be included in the reporting requirements by 2026, and the full inclusion of all EU ETS products is planned by 2030.

In 2026 authorisation will be required to import CBAM goods, and reporting will switch to annual declarations. The supply of CBAM certificates is expected to be the financial levy that will be used to cover the GHG footprint from the data declarations made for the previous year.

1st October was the first major milestone with transitionary reporting commencing. The next milestone will be in late 2025 and from 1st January 2026 when the scope of products will be increased. This will likely involve more businesses, mirroring the journey of initial stakeholders, and sets the stage for increased business participation in the CBAM landscape.

As with all taxation systems, a CBAM impact assessment and road mapping is our recommended first step. Reporting will be mandatory for some organisations, and later this will become taxed through certificates and will focus on scope and cost liabilities. The roadmap leads to deeper insights into supply chain dynamics, carbon measurement, and data collection, all tethered to the defined parameters within the Regulation, on a per product basis.

CBAM mandates organisations to embark on a comprehensive exploration of their supply chains. As a minimum, this entails understanding the origins of goods, but then collaboratively to determine the GHG emissions associated with those products. This will involve a lot of data.

Annex II specifies 138 mandatory and 21 conditional data parameters. When considering each product in scope this quickly scales into a huge data-driven project desperately in need of a digital solution and automation.

Over the longer term, the financial lever of CBAM certificates will impact imported products. The data derived from reporting will also give a clear picture of the GHG footprint of where products are manufactured and where they end up being sold, helping to uncover the mystery of GHG further up the supply chain.

The data reporting is being implemented through EU taxation so it is possible responsibility may initially fall to finance departments who might not be immediately familiar with carbon measurement at installation, production, and embedded levels. Nevertheless, dedicated systems exist to streamline scoping and reporting, all dependent on data availability.

Anthesis has a long history in GHG inventories, a team of climate reporting experts, and digital tools to support your CBAM compliance journey. Although CBAM is new, the process we follow for; assessment, data gathering and compliance, is familiar to our team. Tailoring reporting obligations to the organisation and estimated financial liability through CBAM certificates will be priority findings our clients use to inform their onward journey and level of impact across the supply chain.

Our combined experience and library of carbon data makes us ideally placed to support clients in implementing new compliance systems for CBAM.