Contents

- Importance of ESG for M&A

- Impact of Regulations

- What ESG Due Diligence Looks Like

- Future-focused Compliance

Share this article

Anthesis’ Tim Clare reflects on how the mergers and acquisitions (M&A) market has come to demand ESG due diligence services.

Traditionally, when organisations reached out to us for M&A support, they asked for Environmental Due Diligence (EDD) or Environmental, Health & Safety Due Diligence (EHSDD) when acquiring industrial and/or real estate-heavy businesses. Often this might only be because the “banks” requested an independent report.

That report spoke to the presence, or hopefully otherwise, of liability issues such as contaminated land, other hazardous materials like asbestos and compliance with environmental and health and safety legislation. The endpoint was a report detailing actual or potential issues, their likelihood and timescale of occurrence, and potential severity, i.e., cost in terms of fines, remedial costs, or CapEx or OpEx. These risks remain real for many businesses and indeed have always been relevant to many more organisations in theoretically “less risky” sectors that did not benefit from such assessment.

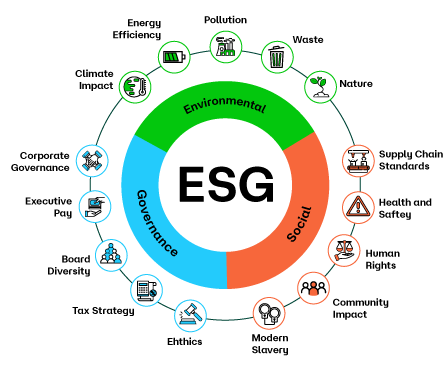

Those EHS topics are now just one part of the broader Environmental, Social, and Governance (ESG) agenda, comprising only a few of the 15 headline and 40 or so sub-topics under the ESG umbrella.

To incorporate ESG issues into investment analysis and decision-making and ownership policies, was a key driver to undertaking routine ESGDD.

But in assessing the growing number of topics, a broader ESG due diligence (ESGDD) assessment is not just about risk but also about identifying areas of opportunity, resilience and potential weakness. It is about evaluating the operating model and Management Team’s preparedness for future market changes, and whether a business’ activities can be considered “sustainable” or creating social “impact” in line with voluntary frameworks or increasingly regulatory definitions.

Crucially, ESGDD does not consider the operation of a business or asset in isolation; it looks to the wider context, including the value chain and external stakeholders and the potential impacts and risks on both. Using a double materiality type lens, it asks how the business will impact the wider world and increasingly how the wider world will impact the business.

The importance of ESG for M&A

The drivers to do ESGDD during a deal are changing. Anthesis has always done, and continues to do, EHSDD, it being the original professional background of many of our due diligence practitioners. And for many of our clients they have always seen Anthesis as an ESG adviser and came to us as one of the first movers in the space, voluntarily committing to understand ESG considerations associated with a Target ahead of acquisition.

Many were also enlightened enough to see pre-acquisition due diligence as the first step in a two-stage process that would also see Anthesis return to work with the new portfolio company post-acquisition to help them onboard, understand their investor’s core ESG KPIs and other requirements, and develop a broader ESG action plan that considered those issues most material to the business.

For many of those clients, being a signatory of the Principles for Responsible Investment (PRI) and seeking to honour its first two principles, to incorporate ESG issues into investment analysis and decision-making and ownership policies, was a key driver to undertaking routine ESGDD. But it is the combination of the PRI’s annual reporting process becoming more rigorous, increased asks from their investors, and now the specific requirements of EU regulations, that is now driving greater take up of ESGDD as a standard requirement.

The impact of regulations in ESG in M&A

Like being a PRI signatory, if a Fund is Article 8 or 9 aligned under the EU’s Sustainable Finance Disclosure Regulations (“SFDR”), then it is obligated to incorporate ESG issues into its investment decision making. Secondly, and perhaps more importantly, there is a need to evaluate whether the Target could sit comfortably within such a fund. This may partly relate to whether it could be considered to be a “Sustainable Investment”, aligning with the requirements of the EU Taxonomy, and definitely whether it would be able to show continued improvement against the suite of Principle Adverse Impact area KPIs and demonstrate it has strong social and governance controls in place.

The role of the SFDR and Taxonomy is to redirect capital to genuinely sustainable enterprises. The sustainability agenda has altered markets, whether through changing consumer preferences, and/or governments using policy levers to achieve their goals, such as decarbonising energy markets and transport. Both create opportunities to invest in the new solutions and the risk of finding oneself invested in stranded assets. Together with the risk of being accused of greenwashing, both regulations drive the necessity to undertake a new type of due diligence that considers where it sits within a sustainable future.

The most sustainable businesses will be providing solutions; for all there is a need to show that they will be a good corporate citizen and be able to stand the impacts of a changing world. In the EU, the forthcoming Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) will also drive obligations and transparency on the level of performance in these areas.

This latter element talks to ESGDD’s value in understanding the real ESG risks starting to manifest themselves and impact asset value. Covid demonstrated that businesses and their supply chains can be impacted by existential and systemic risks. Businesses with strong ESG systems were considered more resilient and their values benefited. Many management teams are thus now more willing to accept that climate change may impact them, and with mandatory climate reporting on the way in numerous jurisdictions, need to evaluate the likely impacts and demonstrate they have robust mitigations in place where required.

Beyond climate change, supply chain concerns, particularly around human rights, are increasingly damaging for businesses’ reputations when exposed, and topics such as biodiversity, and how much businesses are reliant on fragile natural resources and eco-system services, are becoming more apparent.

So, what does an ESG Due Diligence look like?

At Anthesis, we seek to look at a high level across the full suite of circa 40 core ESG topics and then take a deeper dive into the 5-10 topics typically considered most material to a business operating in that industry and/or geography. Our questions build a picture of the core policies and procedures in place and the level of action taken on specific topics, for instance greenhouse gas management or whistleblowing. The nested questions allow us to perform a gap analysis and assign a maturity score that enable both peer benchmarking and a baseline to monitor future improvements. ESGDD is currently less rigidly prescribed than EDD or EHSDD, allowing the flexibility to focus on the most material topics.

Benchmarking ESG

Benchmarking can also include doing a peer review, actively evaluating what a sample of the Target’s peers are doing on ESG topics. There is great value in doing this if the peers disclose enough information to give an insight, but there are many companies who hide their good practice, especially in the private markets space and for smaller businesses where there are less regulatory obligations to do so. Thus, Anthesis tends to offer such direct peer reviews as an option, preferring to share instead our experience of working with countless private and public companies, from SMEs to some of the largest companies in the world, for our benchmarks.

Growing due diligence topics

While ESGDD has the flexibility to focus, some topics are growing in importance and require a deeper analysis as standard. Climate change risk and opportunity and supply chain management probably being the current key examples, but with nature and biodiversity showing signs of being the next headline subject.

Defining what’s material to your organisation

Beyond our core question sets, Anthesis then sets about answering a series of questions. Firstly, does the Target company perform a service or deliver a product that could be considered a sustainable solution or a provider of social impact? If so, does that align with a recognised framework or regulatory definition, such as that provided by the Sustainable Development Goals or, more recently, the EU Taxonomy? Connected to this is a consideration of whether the Target has, or could have, a valid “ESG narrative”: a story about its purpose or level of ESG performance that can be used to reinforce its brand without risking greenwashing. The fear of accusations of greenwashing having risen the list of our client’s reasons for undertaking ESGDD.

Lastly, how does it perform against specific criteria such as the SFDR’s PAIs or the Data Convergence Initiatives’ standard KPIs. This element is often tailored to our clients, and where we work with them on onboarding, we can often diligence the Target’s performance against the Client’s standard ESG requirements.

Future-focused compliance

Although ESGDD is currently less of a compliance audit than an EDD or EHSDD, we believe this will become a more important component as regulations and regulatory scrutiny grow. This is partly necessitated by the fact that getting to a point of complete clarity on all the ESG topics relevant to a typical company is unlikely to be achieved within the time and disclosure constraints of most transaction processes. It is also because most topics are unlikely to be deal killing red flag issues, but they are issues that could be longer term value drags and it is better to be open to and understand these ahead of acquisition.

Often, what our clients value the most from us is simply a sense of where we think the Management Team are in understanding ESG topics and their importance; how they articulate ESG issues and whether they think they could or could not materially impact their business’ future performance, which can say a lot about the breadth of their horizon scanning.

As well as ESG advisers such as Anthesis, ESG considerations are also becoming part of the other transactions workstreams, especially for the legal and finance advisers. Cyber security is often now a standalone workstream. This duplication is a good thing. Different advisers will apply different lenses and provide a solid, balanced picture on many topics.

In many respects, ESGDD is still firmly in its infancy, seeking to find its form whilst the lists of topics considered to be ESG issues and drivers and uses for the process continue to grow. ESGDD already informs investment decision making and the onboarding process. The reports are now starting to have a greater role in helping to secure ESG or sustainability-linked financing for the deals and/or of the new portfolio company’s operations. But crucially, its take-up is now seemingly on a solid path to being the industry norm, adopted both voluntarily and as a regulatory requirement. We have no doubt it adds value, helping to identify and ensure the mitigation of both old and new ESG risks and fundamentally helping to identify the successful businesses of the future.