Table of Contents

- First report highlights

- Impacts, Risks, and Opportunities

- How is the information reported?

- Assurance

- How Anthesis can support

Share this article

The European Sustainability Reporting Standards (ESRS) have raised the bar, even for the most experienced reporters. Despite the proposed changes under the EU Omnibus package, the ESRS continue to set the benchmark for best-practice reporting.

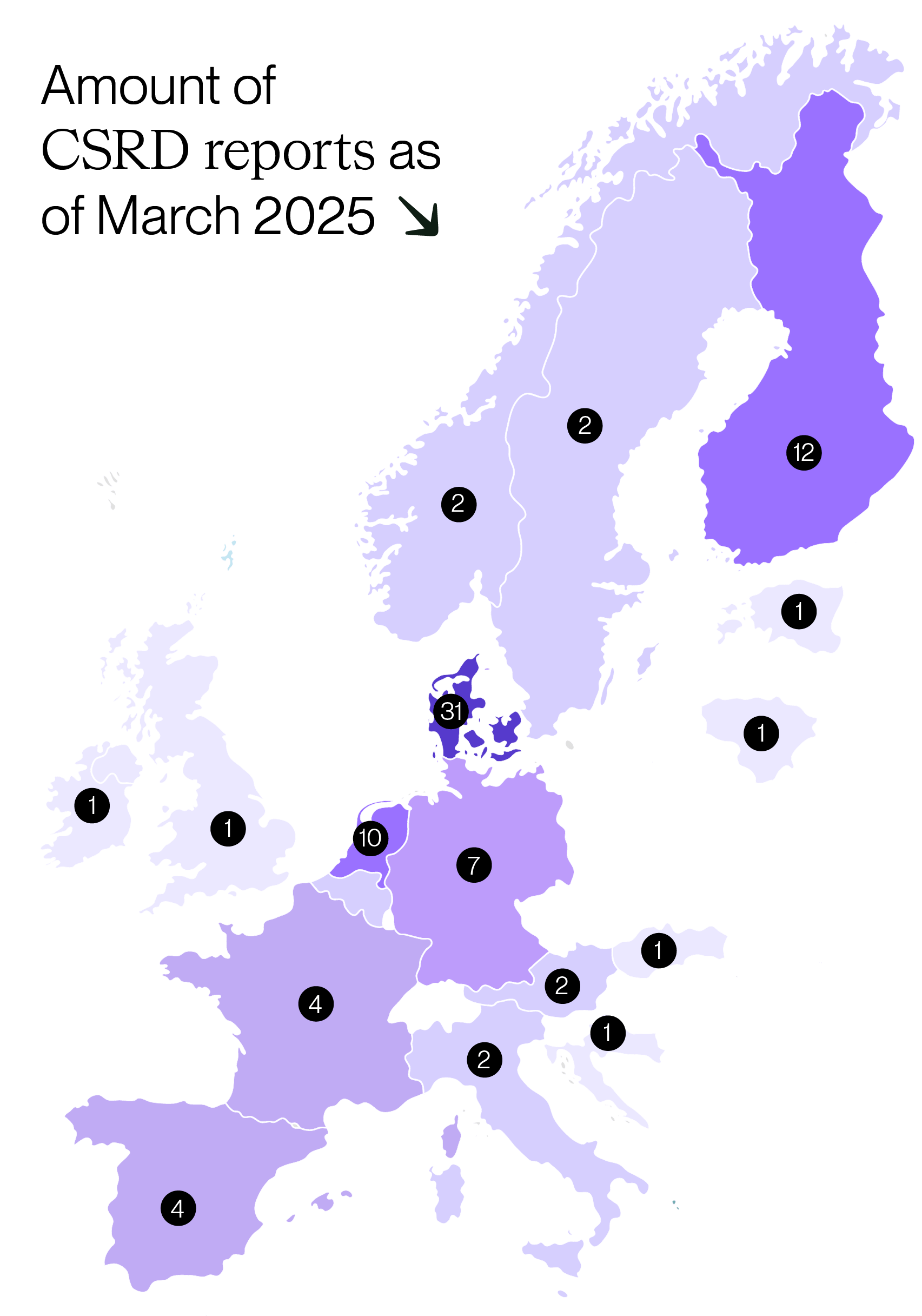

With the first CSRD reports now published and many more on the way, we have analysed the initial round to identify key insights on how companies are approaching these new requirements and what they are focusing their efforts on.

What do the first CSRD reports highlight?

Substantial, detailed disclosures

The most immediate takeaway? Sustainability Statements are substantial disclosures. On average, they exceed 98 pages and typically include material disclosures from 6-7 of the 10 topical ESRS standards.

Unsurprisingly, the ESRS standards related to Climate Change (E1), Workforce (S1), and Business Conduct (G1) were almost universally reported on. Every company reviewed disclosed information on E1, all but one reported against S1, and just six had no material topics under the G1 standard. This trend is also reflected in the maturity of performance against these topics.

Going beyond the minimum on climate

All companies reporting under the Climate Change (E1) standard must establish a net zero target date by 2050. However, many are going further.

A significant number have conducted climate scenario analyses, and nearly a third have set net zero targets before 2050, going beyond the minimum requirement.

Less commonly reported standards

The least reported standards were Affected Communities (S3), Water & Marine (E3), and Pollution (E2).

The industries most likely to report against these standards are:

- Affected Communities (S3): Engineering and construction, energy (electricity generation, utilities, oil and gas and renewables), commercial banks and food retailers.

- Water & Marine (E3): Pharmaceuticals, food, alcoholic beverages, chemicals and, engineering and construction.

- Pollution (E2): Pharmaceuticals, engineering and construction, air freight and logistics, and medical equipment and supplies.

This indicates where these industries might want to invest valuable time and resources for maximum impact while also keeping up with the maturity of their peers and customers.

Material impacts, risks and opportunities (IROs)

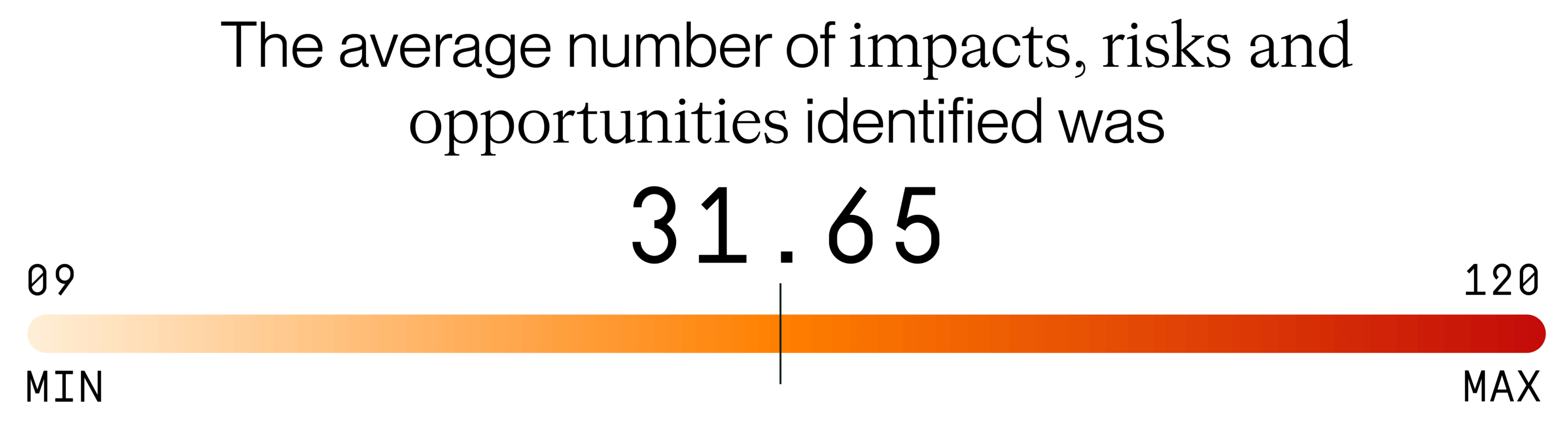

There is a wide variation in the number of identified IROs. The average number identified is 31.7, with one company reporting as many as 120 material IROs and some as few as 9. Unsurprisingly, the more carbon-intensive industries tend to identify more IROs. The approach to defining IROs varies significantly, ranging from brief, generic descriptions to highly-specific explanations.

A higher number of identified IROs generally correlates with a longer overall report, with approximately 1 IRO per 3 pages of content.

Balance is needed between being specific enough for the IROs to be useful and insightful while keeping the number low enough to be manageable. IROs – both wording and scoring – should be regularly reviewed to ensure they are complete and useful.

How is the information reported?

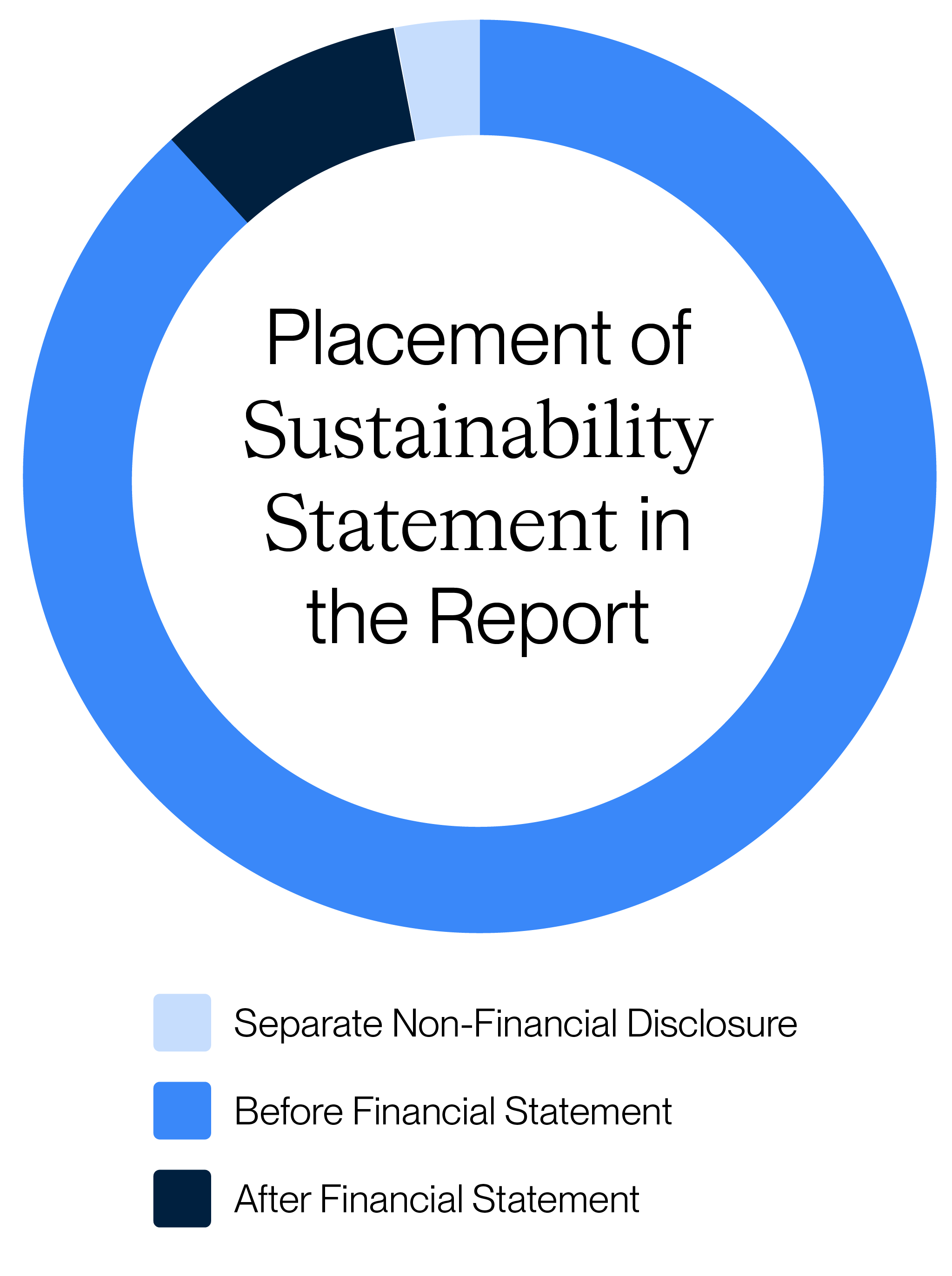

Most Sustainability Statements are presented before the financial statements within annual reports.

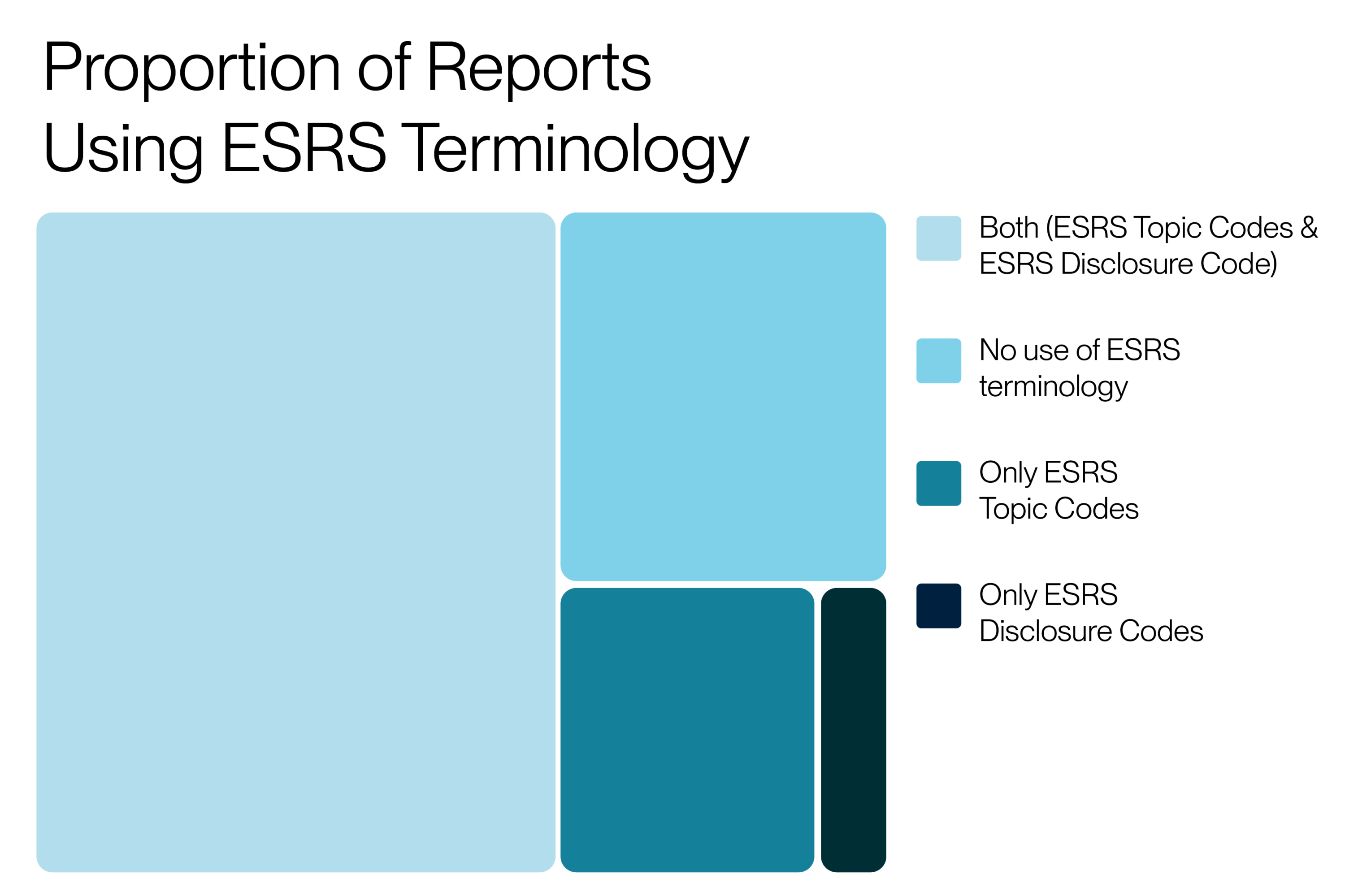

Companies often use ESRS-specific terminology throughout the main body of text, whether this be topic codes, disclosure codes, or both. Over time, we would expect to see companies referencing ESRS terminology less in their reporting. However, as we learn and adjust to this new form of reporting, this provides useful structure for the report creator and reader. Given the complexity of ESRS, companies may hang on to this referencing for longer than expected.

Assurance

Unsurprisingly, given that we are still in the early days of ESRS reporting, almost all the reports received an unqualified opinion from an auditor, meaning the statements were deemed to be fair and transparent. One company received a qualified opinion, while another did not state whether the opinion was qualified or unqualified.

It is clear from the first reports and conversations with our clients that the spend on assurance through audit firms is significant – typically 20% of the financial audit budget. For companies still in scope of the CSRD post-omnibus, both listed and non-listed large EU firms, there is now an opportunity to reassess this spending, ensuring it is proportionate. By better preparing for the audit process in year two, businesses can ensure that more of the budget is allocated to projects that generate sustainable impact and strategic value for the organisation.

How Anthesis can support

The first wave of CSRD reports marks the beginning of a more robust, transparent, and consistent approach to sustainability reporting, whatever happens next with the EU Omnibus.

At Anthesis, our CSRD experts guide clients through every step of the journey. We help cut through complexity to not only ensure compliance but also unlock insight, inform strategy, and create lasting advantage.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.