Table of Contents

- DJSI Eligibility

- CSA Participation

- Questionnaire Structure

- CSA vs. ESG Scores

- Improving Your CSA Score

- Contact Us

Share this article

The S&P Corporate Sustainability Assessment (CSA) is an ESG-focused questionnaire administered annually by S&P Global. The CSA is designed to evaluate the sustainability performance of companies worldwide, measuring their management of material ESG risks, opportunities, and impacts.

Results of the assessment are publicly available on S&P’s website, distributed to subscribers via S&P’s Capital IQ Pro platform, and are featured on Bloomberg’s ESG dashboard. Most prominently, the resulting scores are used to determine the composition of several sustainability-focused equity indexes, including the Dow Jones Sustainability Index (DJSI) family of indexes*. In fact, many in the industry still refer to the questionnaire itself as the DJSI, partly the result of the questionnaire having changed hands from RobecoSAM to S&P, while the DJSI has remained the most relevant use of results.

*Note: In February 2025, the DJSI family of indexes will be renamed the Dow Jones Best-In-Class indexes in response to the ESMA Guidelines on funds’ names using ESG or sustainability-related terms.

DJSI Eligibility

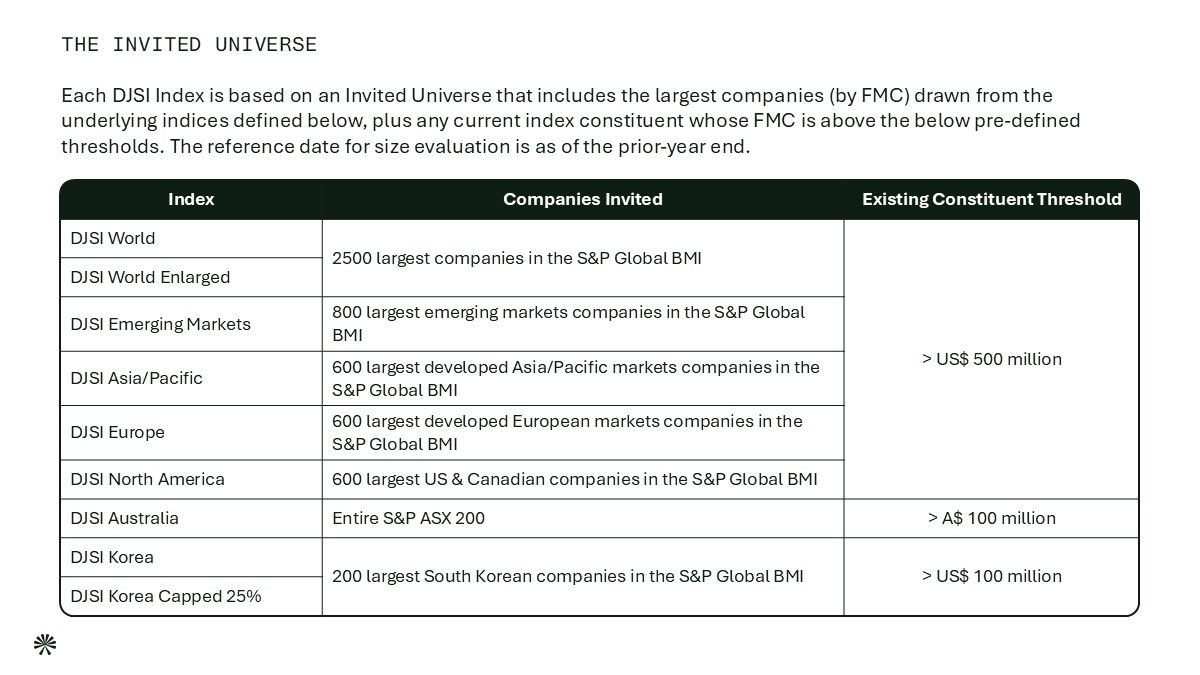

Publicly listed companies can confirm their invitation status and eligibility for various indexes on the S&P website. Eligibility is based on company size within a specific geographic market. Please see the graphic below which presents the invited universe for each DJSI regional index. The most recent DJSI constituent lists are available on the S&P website, and rebalancing occurs each December. Companies not covered by the research universe can also solicit the CSA as a Service and get a Public, Confidential or Provisional (based on hypothetical data) CSA Score.

CSA Participation

Beginning in February, companies can access the CSA questionnaire. Companies are asked to select a 2-month participation window, spanning from April through January.

If looking to be eligible for the DJI Best-In-Class Index or the Sustainability Yearbook, companies should be sure to select a participation window with a submission date no later than August 31st. It is generally easy to request an extension through the CSA portal directly.

All companies who are part of S&P’s research universe will receive an S&P ESG Score, available publicly at the S&P website, which is based only on publicly available information. Companies do not need to directly participate in the CSA questionnaire to be eligible for DJSI inclusion or Yearbook membership. However, it is highly recommended that companies participate actively in the questionnaire because:

- Actively participating companies can submit detailed references and commentary to S&P analysts to ensure that the most relevant information is considered. S&P performs a high-level review of public reporting to score companies that do not actively participate, but S&P often misses certain details, scores companies inconsistently, or makes mistakes in their review, as they are scoring a high volume of companies and are ultimately not beholden to the requests of corporate issuers. They may not be able to find certain company policies outside of a few core documents (ESG Report, 10-K, Code of Conduct, for example).

- Several CSA questions permit the submission of nonpublic data or content. Thus, only companies who directly participate in the CSA are able to submit nonpublic information, as S&P’s review of companies is only based on public information. This enables companies to submit potentially sensitive information and receive credit for it without having to share it publicly.

CSA Questionnaire Structure

The questionnaire will open on the selected participation date, at which time you can choose to auto-populate the questionnaire with any content submitted in prior years. You will also need to select a data privacy option. Most companies choose not to share their data points and only share public information.

The questionnaire is structured by Dimensions, Criteria, and Questions.

Questionnaire example

- Dimension: Governance & Economic

- Criteria: Business Ethics

- Question: Codes of Conduct

The bulk of the questionnaire is the same across all companies, but a company’s industry will also determine the inclusion or exclusion of several questions, based on relevance. For example, all respondents to the CSA questionnaire will be asked core questions on Labor Practices, but an Automobile company will be asked questions regarding Warranty Provisions and Fuel Efficiency, while a Pharmaceutical company will be asked questions around Access to Healthcare and ethical Marketing Practices.

The structure of each question can vary drastically depending on the type of information requested. You will likely need to source information from across your organization to address the questions, and it is important to ensure that the information referenced directly addresses the question being asked.

Anthesis experts can support your response process by organizing data collection and filling out the questionnaire with the most relevant information from your public information and any supplementally collected data or documentation.

Questions may be scored on any combination of the following factors:

- Provision of evidence for requested information, with a preference for publicly available evidence

- Coverage of measures implemented or data reported

- Trend of key indicators over last 3-4 years

- Performance of key indicators in comparison to expected threshold

- Awareness of internal and external issues and measures taken

- Third- party verification of data or processes

In a questionnaire of over 100 questions and thousands of datapoints, it can be challenging to determine which gaps are most impactful for improving your company’s score. Anthesis experts can review your questionnaire for opportunities to improve your response and program to meet S&P CSA criteria.

CSA vs. ESG Scores

S&P shares two different score results for the CSA: A CSA Score and an ESG Score. The CSA Score reflects a company’s raw score on the CSA, based directly on which CSA criteria the company addresses in its reporting. The ESG Score is predicated on the CSA Score but includes a small amount of score modeling to account for discrepancies in scores between companies who actively respond to the CSA and those who do not. This allows end users of S&P data to compare “apples to apples” when comparing a company who actively participates in the CSA versus one that does not.

A company that actively participates in the CSA and provides nonpublic information regarding gender pay data, for example, will have a higher CSA Score than a company only scored based on public information that does not report anything on gender pay. However, these companies may have the same ESG Score. To model the ESG score, S&P makes a generalized estimate of a company’s ESG performance based on factors such as company size, industry, and geographic location. Both ESG Scores and CSA Scores are publicly available, but only CSA Scores determine DJSI index and Sustainability Yearbook composition.

Understanding & Improving Your Score

We recommend taking the following steps to interpret and learn from your CSA results, helping you to improve your score in future years:

- Review Analyst Revisions: S&P provides revised versions of your submitted responses, representing the accepted content that was used for scoring. Reviewing the revised content against your submitted evidence and the additional information provided can help you identify both areas for future improvement and possible oversights by S&P that require direct inquiry.

- Conduct a Gap Analysis: Take stock of where you lost points in your score. Review the questions where you did not score as well as expected, as well as new questions and those that have been changed significantly year-over-year. These questions pose opportunities to improve your disclosure and programs to meet more stringent scoring criteria.

- Submit Direct Inquiries: After receiving your score, you can submit a form through the CSA portal with three inquiries about your score. We recommend doing this after an initial high-level gap assessment and suggest that these three questions focus on opportunities to recoup lost points, rather than general requests for more information. If S&P determines that any of these inquiries may reflect an oversight in scoring, S&P will open a reassessment form for you to request that S&P take a second look at all questions you flag for review. If S&P concurs with your request, an analyst may revise the score.

- Identify Key Datapoints & Keywords: One of the best ways to improve your S&P CSA score is by targeting specific datapoints and keywords for inclusion in your annual ESG reporting, as well as ensuring that all relevant policies are publicly available. If specific datapoints are not tracked yet, connect with the relevant content owner within your organization to discuss if and how that KPI might be measured moving forward.

- Address Deeper Gaps: For deeper gaps that cannot be closed with expanded disclosure alone, consider your organization’s strategic ESG planning. For example, if your organization is performing a double materiality assessment in the next year, look for opportunities to align outputs with requested information in the relevant S&P question. If developing a new commitment, review the relevant S&P criteria against it as one way to evaluate the strength of the policy.

- Get Support: Often, it is advantageous to have a third party review your assessment and identify improvement opportunities. Through supporting several organizations with disclosures such as the CSA, Anthesis has developed expertise to help you understand and improve your score.

Explore our ESG Reporting & Disclosure Solutions

Supporting organisations to understand, disclose and communicate progress and metrics through our ESG reporting services.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.