Contents

Share this article

The urgency of the climate crisis cannot be overstated. The world is teetering dangerously close to surpassing the 1.5°C threshold, a point beyond which irreversible and existential impacts await both humanity and the planet. To avert these dire consequences, immediate and concerted investment efforts are required from all parties. The Science Based Targets initiative (SBTi) is an important initiative for corporates to take their responsibility .

At Anthesis, we have always championed a holistic approach to addressing climate change—one which goes beyond simple reduction targets to embrace broader investments and truly drive meaningful progress. With the recently released guidance about Beyond Value Chain Mitigation (BVCM) by the Science Based Targets initiative (SBTi), our commitment to this integrated approach is further solidified.

Beyond Value Chain Mitigation, as outlined in SBTi’s report ‘Above and Beyond: An SBTi report on the design and implementation of Beyond Value Chain Mitigation (BVCM)’, underscores the critical need to look beyond organisational boundaries when addressing emissions. Setting reduction targets and implementing decarbonisation actions are critical to any net zero target. However, what the SBTi is now recommending is organisations also address historical and remaining emissions by investing in carbon-reducing initiatives beyond their immediate value chains. This parallel approach is crucial in ensuring comprehensive and effective mitigation efforts align to limit global warming to 1.5°C.

How to reach net zero by investing in carbon credits

Funding of BVCM activities, if budgeted correctly and done well, can unlock an array of opportunities and mitigate future financial and regulatory risks, while protecting and enhancing long-term value. Fundamentally, it allows companies to become financially aware of their impact responsibilities and accelerate climate action.

SBTi’s BVCM approach

The SBTi’s BVCM approach outlines two main goals:

- Deliver additional near-term mitigation outcomes to counter peak global emissions (circa 2025) and halve global emissions by 2030.

- Drive additional finance to ‘scale up’ nascent climate solutions and enable activities which unlock the systemic transformation required to achieve global net zero by mid-century.

The BVCM goes beyond traditional value chain abatement efforts and plays a crucial role in mitigating climate risks and enhancing long-term value for businesses.

An important distinction within the SBTi guidance report is the recommendation to apply a Science-Based Carbon Price within the BVCM system design, particularly where there is an intention to make claims. It is likely this pricing element will be ‘stretching’ for many organisations, yet it is a clear sign the era of sustainable avoidance is over.

The Anthesis global team of carbon and climate advisors firmly believe all organisations must simultaneously define reduction and BVCM investment targets as part of their net zero objectives. Only in this way can we ensure all historical and remaining emissions are not forgotten. Net zero is not a sequential process but a synchronised effort to proactively address global emissions.

SBTi recommends companies allocate a budget to invest in high-quality carbon credits equivalent to at least 50% of their unabated or remaining scope 1, 2 and 3 emissions from 2021.

How Anthesis can help

At Anthesis, we recommend aligning a robust transition plan with the SBTi’s BVCM. To do so we advise organisations to take the following steps:

- Develop and disclose a comprehensive greenhouse gas (GHG) emissions report using a digital calculation platform (Anthesis’ RouteZero for example).

- Establish and actively pursue a ‘net-zero’ emissions reduction target

- Invest in high-quality carbon credits which ‘cover’ at least 50% of unabated scope 1, 2, and 3 emissions.

- Use a science-based carbon price to bridge the link between decarbonisation targets and strategic decision-making.

- Consider opting the Climate Activator Certification either organisationally or at product level to reduce in line with the Paris Agreement, balancing the remaining with carbon credits, get all steps 3rd party verified and communicate via the Climate Activator label.

By doing so, organisations take full responsibility for their emissions and contribute to reducing and/or removing global GHGs, beginning from the baseline year of 2021 or earlier.

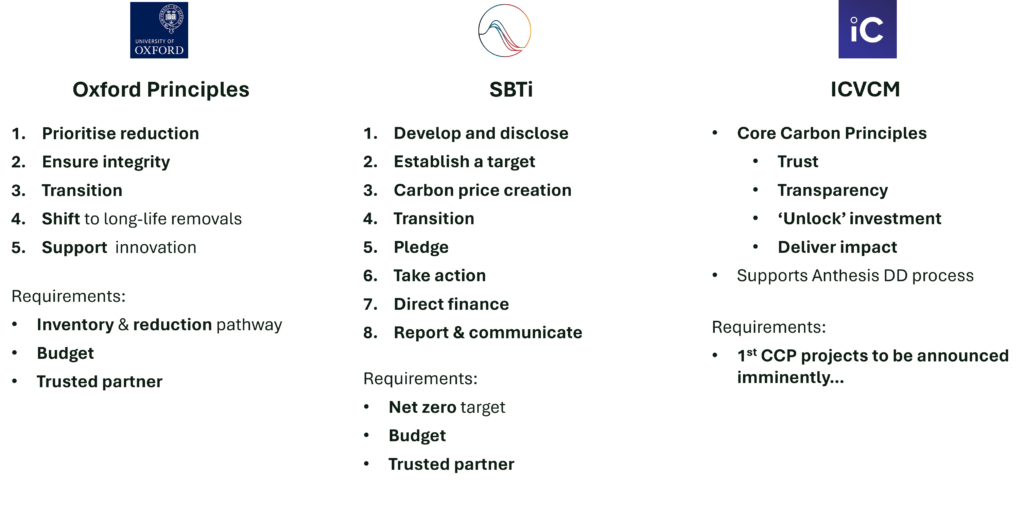

In addition, initiatives like the recently updated Oxford Principles and Voluntary Carbon Market Integrity Initiative (VCMI) offer valuable ‘best practice’ frameworks which complement the BVCM approach. While there may be a diversity of opinions regarding certain initiatives, every contribution, no matter how small, supports the collective reduction of global emissions.

Best practice benchmarks

The historical emissions example highlighted in the BVCM guideline is particularly noteworthy. Encouraging retrospective action allows companies to take immediate and proactive measures to mitigate their climate impacts.

However, budgeting for BVCM initiatives can pose a challenge for some organisations. To prevent this from becoming a barrier, adapting to the varying BVCM ‘ability to pay’ scenarios outlined in the guidance is a challenge worth embracing.

Equally, and not a barrier to BVCM entry yet worth exploring is establishing an internal carbon price. A tangible ‘cost of carbon’ could play a pivotal role in outlining the importance of budget allocation for BVCM activities. Anthesis can provide guidance on Science Based Carbon Pricing, ensuring a meaningful and tangible relevance for your decarbonisation journey. Reaching the SBTi’s recommended threshold of 50% coverage may seem daunting, however, every step toward that goal is a step worth taking to reduce our global impact.

In conclusion, the SBTi’s BVCM represents a call to action for all organisations to make tangible and meaningful climate mitigation contributions. This initiative is not about meeting regulatory requirements, but rather seizing the opportunity to invest in a more sustainable future—one where businesses thrive alongside ecosystems and communities.

Together, we can accelerate climate action and build a brighter, more resilient future for generations to come. Arrive at sustainable performance with Anthesis.

If you would like to explore more, please get in touch with our team.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.