Contents

- Handling Climate Risk

- Impacts of Climate Change

- Quantifying Climate Risk

- Additional Resources

- Contact Us

Share this article

This article was originally published in 2022, and was updated in 2024.

In 2023, the global impacts of climate change became increasingly evident with extreme weather events causing unprecedented economic losses. Europe experienced expansive heatwaves, the Northeast US saw severe flooding, Canada had historic wildfires and ocean temperatures off Florida’s coast reached record highs, affecting marine ecosystems.

These events highlighted the urgent need for businesses to understand and mitigate climate risks. Regulatory bodies worldwide are enhancing their mandatory disclosure requirements like CSRD (EU), UK CFD (UK), and SB261 (California), with frameworks like TCFD, ESRS and the IFRS standards driving transparency. Despite the complexity, these regulations aim to ensure companies are resilient to climate change, aiding long-term investment decisions and strategic planning.

Regulations continuously focus on how organisations understand their climate risks and opportunities and how they are being managed. This involves various complexities depending on the regulations and standards but generally consists of progressively looking to quantify screening, financial impact, and materiality to better understand risks. Further managing risks by building a road map towards climate transition and resilience is enhanced through these regulations.

Supporting Clients in Handling Climate Risk

To help clients understand and manage their risks and opportunities, Anthesis offers support in:

- Scenario-based Climate Risk Assessment: Assessment of physical and transition climate risks utilising a tiered approach that delivers qualitative, quantitative and financial risk insights to support our clients’ disclosures, corporate governance, strategy, target setting, and enterprise risk management activities.

- Reporting & Disclosure: Comprehensive assessments of our clients’ reporting requirements through deploying our proprietary benchmarking, gap analysis, and maturity assessment frameworks and methodologies.

- Engagement & Education: Tailored education and engagement services that support our clients in proactively raising knowledge and understanding of the range of climate risks and opportunities within their business, enabling them to undertake aligned and effective engagement with investors, regulators, customers, and suppliers across their value chains.

- Climate Transition Planning: Expertise in developing comprehensive, bespoke climate transition plans (CTPs) that align with best practice frameworks – grounding ambition, accountability, credibility of climate action, and transparent communication. Our breadth of capabilities allow us to meet clients ‘where they are at’, and enables them throughout each aspect of their climate journey, culminating in the publication of a ‘blueprint’ for a resilient and sustainable climate business strategy to meet expectations from regulators, investors, and wider stakeholders.

Are you confident your capital allocation strategies will remain efficient in the face of climate change?

Despite uncertainties around the precise effects of climate change at a local level, impacts can still be modelled with sufficient confidence to provide valuable input to business planning and enterprise risk management.

Encouraged by the Task Force on Climate-related Financial Disclosures, more and more companies are turning to scenario modelling to quantify and understand the business risks arising from climate change. Scenario modelling is useful for understanding how resilient an organisation and its business strategy will likely be in the face of climate-related risks and opportunities. It also helps to provide investors, lenders, and insurance underwriters with the information they need to assess and price climate-related risks and opportunities.

Impacts of Climate Change

Climate change can present many challenges depending on your organisation and the sector in which you operate. These may include:

- Increasing temperatures

- Changing patterns and amounts of precipitation

- Increasing frequency, intensity, and duration of extreme events

- Increased flooding, severe winds, storm surges, heat waves, and wildfires

- Increases in drought

- Rising sea levels

- Decreases in ice, snow cover, and permafrost

- Alterations in growing seasons

- Increases in threats to human health

- Vector-borne diseases

- Reduced food security

- Population displacement

These risks are already manifesting with business impacts across operations, supply chains, and markets.

Physical Climate Risks

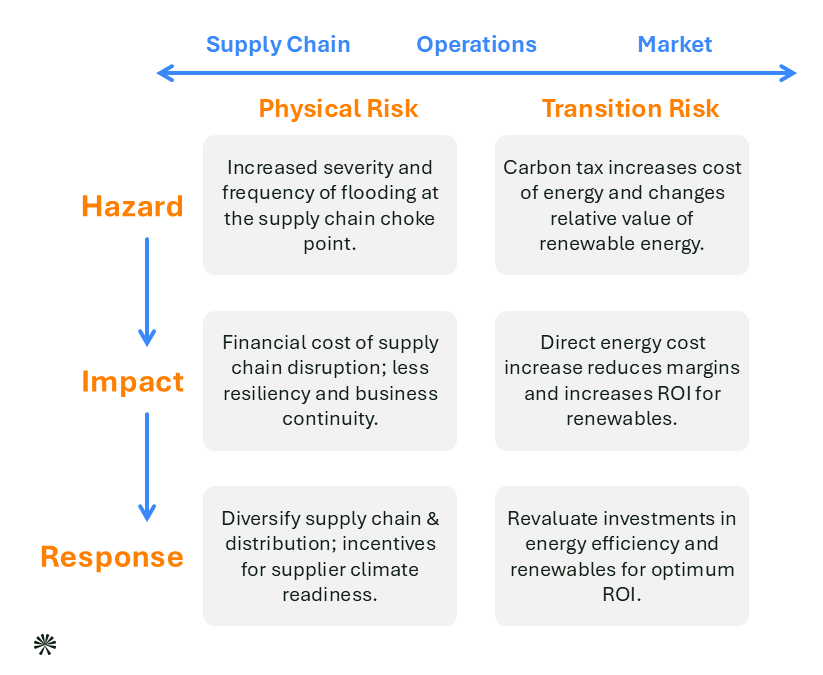

Physical climate risks stem from chronic, or incremental, changes in climate – like temperature rises, reduced water supply in some regions, changing growing seasons, changes in drought cycles, and sea level rise. They also include acute or event-based risks from more intense rainfall events, increases in powerful cyclones, and hurricanes/typhoons. Some risks combine chronic and acute risks. For example, big storm surges from storms may combine with higher sea levels to increase hazards.

Transition Climate Risks

Transitional climate risks arise from how society responds to climate change in public policy and as consumers in the market, as well as how technology evolves lower-carbon alternatives. We often think of this risk as a price on carbon or regulation of carbon emissions, but the transition to a lower-carbon economy will involve other sources of risk, and not just in energy and other highly carbon-exposed industries.

Why Should I Quantify Climate Risk and Opportunities?

There are many reasons to evaluate and quantify the impact of climate change. In particular, to:

- Optimise costs for asset operation, maintenance, and insurance

- Assure value chain business continuity

- Maximise revenue potential through new business models

- Attract capital and reassure investors

- Position for and respond to regulation

- Complete CDP reports and all appropriate channels to promote transparency

Additional Resources

Extreme weather events and increasing regulations are driving up costs to businesses and governments. How can companies prepare for the financial consequences of physical climate risks, such as wildfires, heat waves, and hurricanes? Leveraging climate scenario analysis provides your organisation with greater insight into your risk exposure to physical climate hazards, helping inform risk management, strategic planning, and financial planning.

Podcast: Quantifying Climate Risks & Opportunities

In this episode, the Anthesis team discuss the emerging risks and opportunities of climate change, and how organisations can begin to quantify them.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.