Contents

Share this article

The European Commission recently proposed the EU Simplification Omnibus Package (Omnibus Package) aimed at streamlining sustainability reporting requirements. While still subject to legislative approval, businesses are already feeling the impact of uncertainty around potential changes to key regulations, such as the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the EU Taxonomy, the Carbon Border Adjustment Mechanism (CBAM), and European public investment programs in venture capital and growth.

As these changes unfold, it is crucial for Private Equity (PE) firms and their portfolio companies to understand the implications and adapt their strategies accordingly.

Key Changes and Their Impacts

CSRD

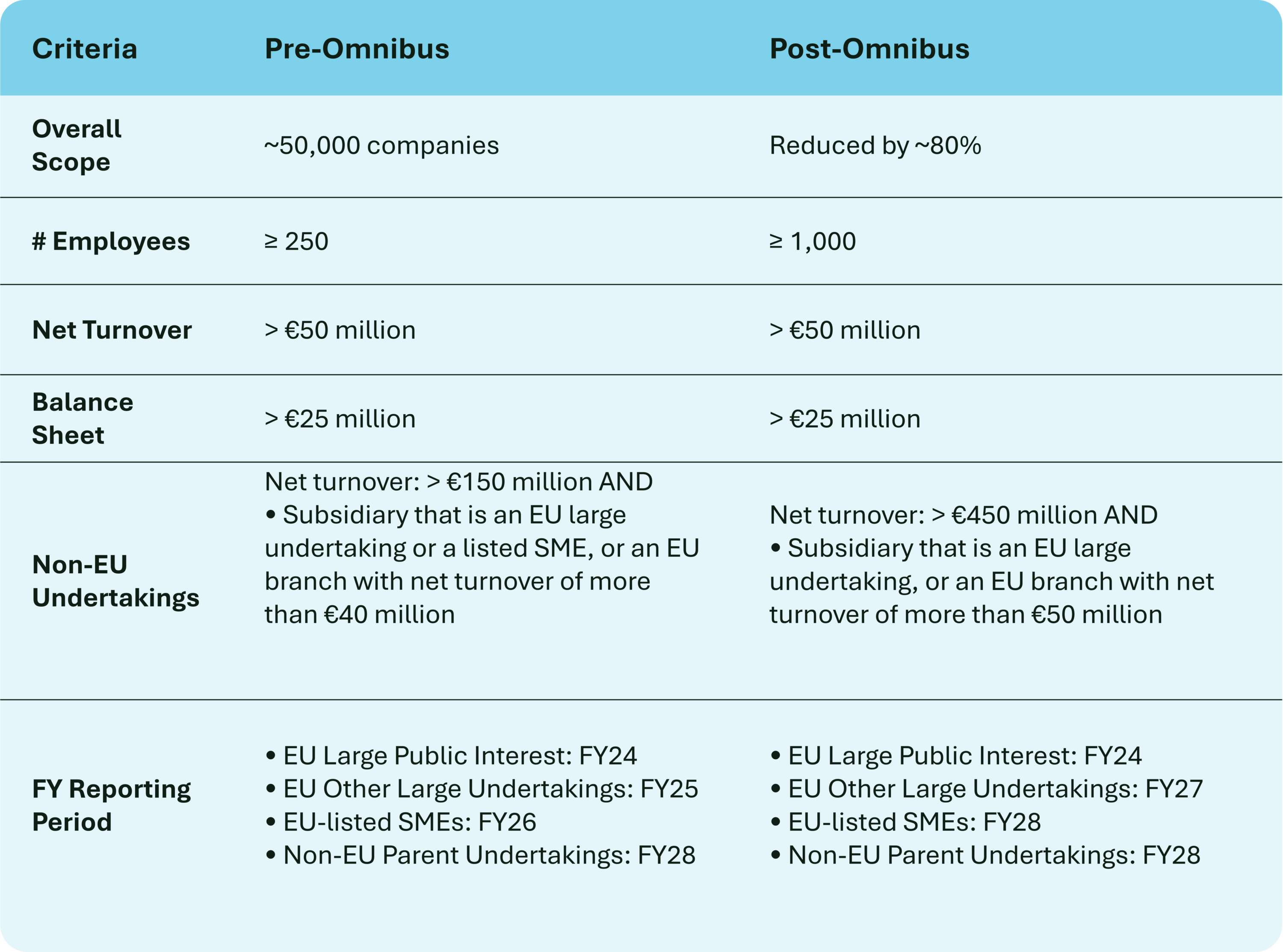

The Omnibus Package proposes several significant changes intended to relieve companies, particularly small and medium-sized enterprises (SMEs), of the associated administrative burden. One of the most significant of the proposed changes has been to narrow the scope of the CSRD. In summary:

For PE firms, this change in the scope of CSRD reporting means that if the proposed changes are implemented, many of their portfolio companies are likely to be released from the reporting obligations of CSRD or be subject to a 2-year delay. Consequently, there will be a reduction or spreading out of compliance obligations and costs. However, those that remain in scope will have to satisfy the new requirements, which may require further reporting.

The Omnibus Package offers positive impacts for companies that remain within its scope. With more time to prepare and align, businesses can strategically plan their compliance efforts, ensuring a smoother transition and better integration of sustainability practices. The simplified data requirements and reduced assurance/verification obligations further ease the compliance burden, allowing companies to focus on meaningful sustainability initiatives rather than administrative tasks. This period of adjustment is a great opportunity for companies to refine their reporting processes and enhance their overall sustainability strategy.

On the other hand, voluntary compliance can lead to industry and sector differentiation, setting companies as leaders in sustainability. This proactive approach can significantly enhance market reputation, showcasing a commitment to transparency and responsibility. An early alignment with future reporting standards through simplified reporting can provide a competitive edge, as companies will be better prepared for eventual mandatory requirements.

EU Taxonomy

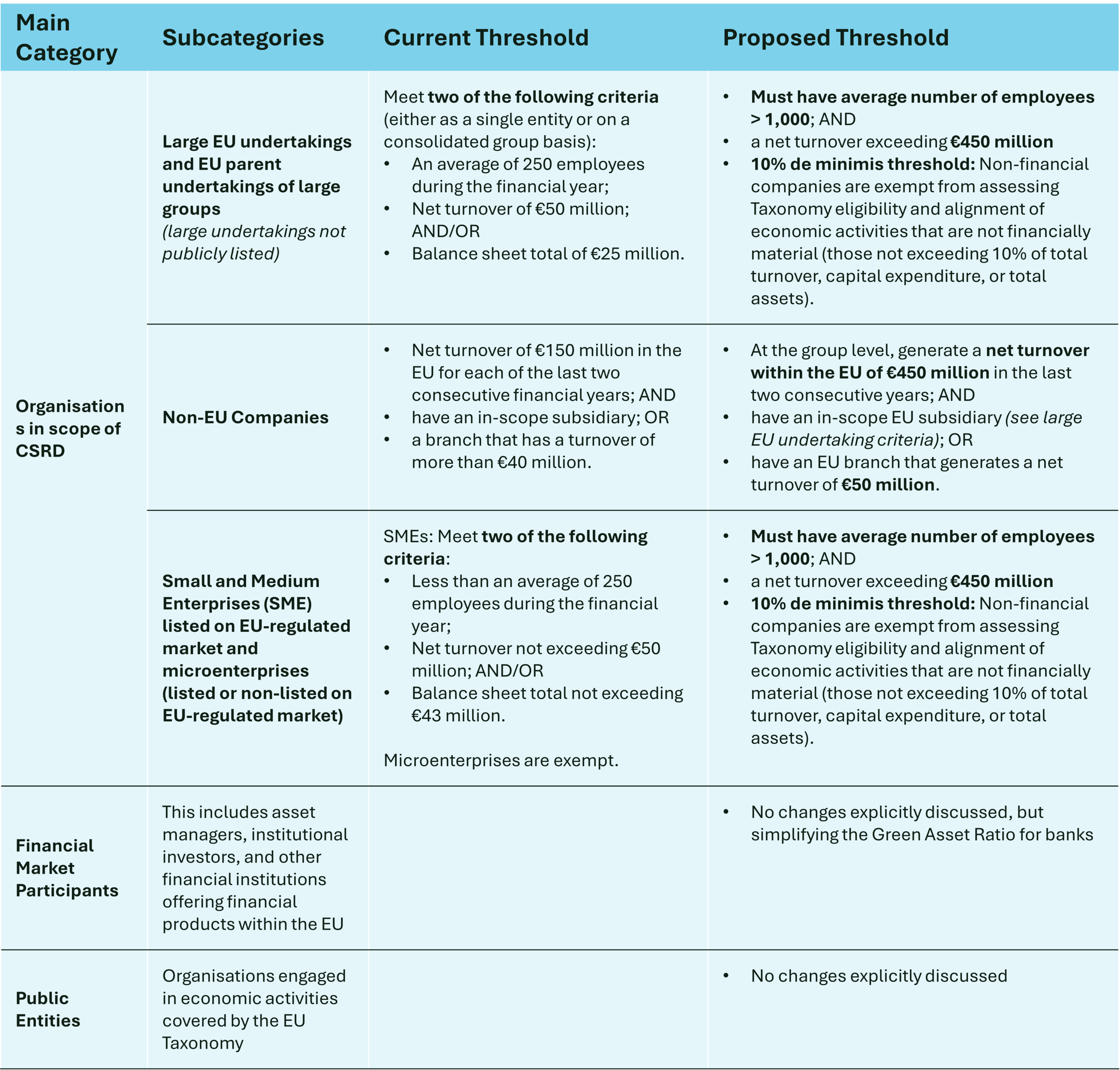

Another important proposed change relates to the EU Taxonomy disclosure obligations, as summarised below:

Companies that fall outside the proposed thresholds can choose to report voluntarily. The Commission will develop a template for required disclosure that reduces the required data points by approximately 70%.

A major advantage of aligning with the EU Taxonomy is access to funding. The EU Taxonomy helps to identify economically sustainable activities and provides a clear basis for the identification of sustainable investment. For PE firms, this means that portfolio companies aligning with the EU Taxonomy can become more attractive to a broader range of investors, potentially leading to increased capital inflows.

Engaging in voluntary EU Taxonomy reporting can also yield benefits such as enhanced transparency, accountability, and improved reputation. KPIs calculated as part of this exercise could be leveraged for ESG ratings and other voluntary reporting.

Financial market participants (such as investment firms, pension funds, asset managers, insurance companies, and banks) in scope of SFDR will consider EU Taxonomy in their disclosures – those aligning with SFDR article 9 need Taxonomy information in order to invest. Thus, aligning with EU Taxonomy can lead to enhanced financing opportunities.

To capitalise on these opportunities, PE firms should encourage their portfolio companies to integrate the EU Taxonomy into their business strategies. This involves identifying and reporting on activities that meet the Taxonomy’s criteria for environmental sustainability. By doing so, companies can demonstrate their commitment to sustainability, which can enhance their appeal to investors and improve their access to financing.

CSDDD

Further, the Omnibus Package proposes a one-year postponement of the transposition deadline and the first wave of application of the CSDDD to 2028. This delay will allow additional time for companies to prepare for compliance with the new requirements, as summarised below:

- Transposition deadline: Transposition and the 1st phase of CSDDD application for largest in-scope companies is postponed to 26th July 2028.

- Release of Additional Guidance: The Commission to publish guidelines by July 2026, helping align due diligence processes with CSDDD.

- Assessment Scope: In-depth assessment of adverse impacts limited to Tier 1 suppliers, with relaxed requirements for companies with <500 employees.

- Assessment Frequency: Due diligence assessments reduced from annual to every 5 years, with ad hoc assessments when necessary.

- Obligation to Terminate Business Relationships Removed: No penalisation if companies believe enhanced prevention plan will succeed.

- Data Requests from SMEs: Large companies can only request data from SMEs aligned with CSRD voluntary sustainability reporting standards (VSME) unless extra data is necessary for compliance.

- Climate Transition Plans: The obligation to implement climate transition plans (CTPs) is removed, but companies must still develop them.

- Civil Liability: Harmonised EU conditions for civil liability are removed, leaving national legal systems to set conditions.

- Pecuniary Penalties: No cap on pecuniary penalties.

- More focused stakeholder list: Including company employees, business partners, workers, and affected communities.

The goal of the proposed Omnibus Package is to align the CSDDD’s reporting obligations with those of the CSRD. This alignment minimises complexity and administrative burden for companies that are subject to both Directives.

CSDDD encourages sustainable and responsible corporate behaviour that supports the company, its stakeholders, and society in general. The Directive encourages further transparency, allowing stakeholders to make fair and informed decisions.

Guidance for PE and Their Portfolio Companies

In light of the changes brought on by the Omnibus Package, private equity firms need to offer clear guidance to portfolio companies on how to manage the new regulatory environment. Here are several key recommendations to consider:

- Understand the new requirements and how they affect your portfolio: Familiarise yourself with the changes to the CSRD, EU Taxonomy Regulation, and CSDDD. This includes understanding the new thresholds and reporting requirements, as well as any timelines for implementation. Ensure you have your portfolio mapped according to new requirements.

- Conduct a high-level gap analysis: Undertake a careful gap analysis that will pinpoint the areas in which reporting and due diligence procedures may require enhancement. This involves comparing current practices with the new requirements and identifying any gaps that need to be addressed.

- Engage with your portfolio to outline the steps needed to meet the new requirements, including any changes to internal processes, data collection, and reporting mechanisms.

- Communicate in a clear and transparent way: Ensure that commitments to sustainability and compliance with the new regulations are conveyed. This can help build trust and enhance the portfolio reputation.

- Focus on initiatives that create business value: The demand for sustainable finance products hasn’t changed. While navigating this evolving space and waiting for clarity on deadlines, investing in initiatives that build resilience and create business value will position companies for long-term success.

Challenges and Considerations

While the proposed Omnibus Package aims to simplify and reduce the regulatory burden, it also presents several challenges for PE firms and their portfolio companies. One of the main challenges is the need to balance compliance with the new requirements while maintaining competitiveness.

Additionally, the phased implementation of the new requirements implies that companies will need to stay informed about ongoing changes and updates. This requires a proactive review of compliance with applicable regulations at the organisation level, with companies regularly reviewing and updating their practices to ensure they remain in line with the latest requirements.

It is also important to note that in case the Omnibus package is not approved, companies may face continued uncertainty and potential delays in aligning with evolving sustainability standards, which can potentially impact their strategic planning and market positioning. This could result in higher compliance costs and administrative workloads for companies while trying to manage a fragmented regulatory landscape.

By understanding the new requirements, conducting thorough gap analyses, and actively engaging with portfolio companies, PE firms can unlock value from ESG efforts beyond compliance and navigate this new landscape effectively.

Get in touch to discuss how we can help you to understand the proposed changes and how they will impact your portfolio.

Related Content

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.