The private equity landscape is undergoing a rapid transformation. Driven by a confluence of factors, including escalating regulatory pressure, rising investor expectations, and growing consumer demand for sustainable products and services, private equity decarbonisation due diligence has become a central focus. This dynamic environment presents both challenges and opportunities for private equity firms. Navigating this complex landscape requires a strategic approach that carefully considers the cost of decarbonisation across the entire investment cycle.

When discussing the cost of decarbonisation with our clients, we are frequently asked:

- How feasible will it be for my target acquisition to contribute to our decarbonisation commitments?

- Which decarbonisation levers should our portfolio company prioritise?

- At exit, what would be the return on investment?

We explore these questions in more detail below through the lens of each stage of the decarbonisation due diligence investment lifecycle.

1. Pre-Acquisition: Assessing Decarbonisation Potential and Costs

In the pre-acquisition phase, private equity firms are increasingly undertaking decarbonisation due diligence as part of their ESG analysis.

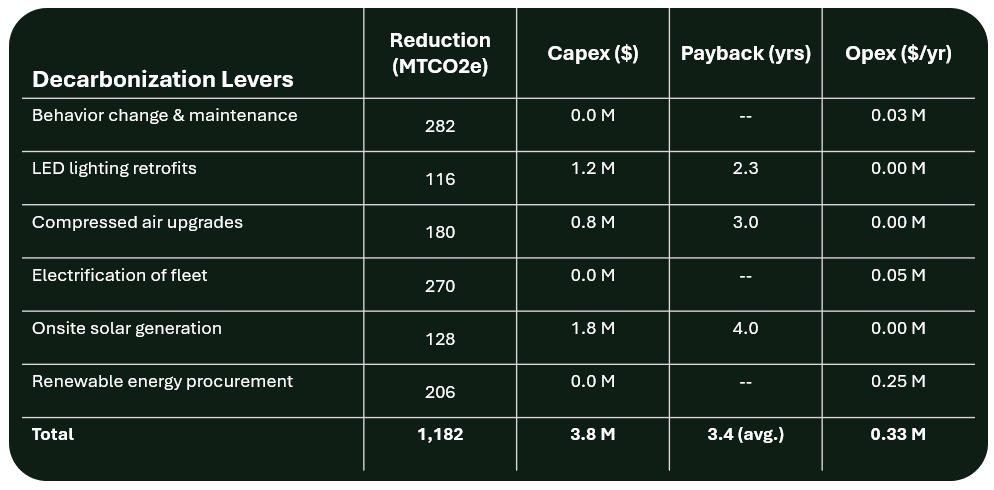

A decarbonisation due diligence evaluates a target’s climate maturity and greenhouse gas (GHG) emissions, identifies GHG hotspots, and assesses the potential reductions and costs of likely decarbonisation levers the company could pursue.

The objective of decarbonisation due diligence is twofold.

First, to quantify the current and future costs associated with decarbonisation, including the capex, opex and payback for implementing the decarbonisation levers over the hold period.

Second, to assess the transition risks related to carbon-related regulations, which are likely to tighten in the coming years, imposing significant cost risks on companies with high carbon footprints, operationally and across their value chains.

By including decarbonisation due diligence as part of ESG due diligence, private equity firms are more informed of the potential:

- Cost savings that could be realised by reducing emissions

- Decarbonised attractiveness for future buyers

- Cost of inaction from transition risks

Ultimately, this positions private equity to create competitive advantage through decarbonisation by asking the right questions. For most PE firms, executing effectively on decarbonisation due diligence will mean partnering with advisors that have a library of costed levers, including the lived experience of companies already decarbonising, to help verify return on investment data.

2. Ownership Period: Implementing Decarbonisation Strategies

The ownership phase is where value can be created through decarbonisation. Investments that have completed a decarbonisation due diligence have a head start on implementing smart decarbonisation and transition risk mitigation strategies that were identified and considered during diligence.

Setting Targets

Many private equity firms are already driving decarbonisation efforts by setting clear, general partner level, science-based targets (SBTs) or equivalent, e.g. net zero investment framework (NZIF) targets. This encourages portfolio companies to set SBTs, integrated into their broader ESG strategies, ensuring that decarbonisation is not treated as a standalone initiative but as part of a holistic approach to sustainability.

Investing in Decarbonisation

From energy efficiency to low-carbon technologies, investing in decarbonisation and mitigating transition risks, can lead to cost savings, improved operational efficiencies, and help meet the increasing demands of portfolio companies’ customers and suppliers. Additionally, companies that demonstrate leadership in decarbonisation are likely to enhance their brand value, attract and keep top talent, and gain preferential treatment from customers and investors who prioritise sustainability.

Measuring and Reporting Progress

During the ownership period, it is also crucial to continuously monitor and report on progress towards decarbonisation goals, often through digital solutions. This not only ensures accountability but also allows for adjustments to be made as needed, for example, based on shifts in market conditions.

Moreover, private equity firms are beginning to re-consider the potential for sustainable investing in carbon credit projects as part of their broader decarbonisation strategy. While these measures should not replace direct emissions reductions, they can be valuable tools in achieving long-term net zero alignment.

Decarbonising Methodologies for Private Equity

Determine what the best decarbonisation methodology is for your firm with this private equity guide.

3. Exit: Valuing Decarbonisation in the Sale Process

The final stage of the investment cycle is where the value created through decarbonisation efforts is realised.

As ESG continues to be an important factor for investors, companies that have successfully implemented decarbonisation strategies are likely to command higher valuations.

Highlighting Decarbonisation Achievements

When preparing for exit, private equity firms are beginning to clearly articulate the decarbonisation journey of the portfolio company, including the cost savings achieved, the reduction in emissions, and the overall ESG performance. This narrative is valuable for attracting potential buyers, particularly those with a strong focus on sustainable investing.

Demonstrating ESG Commitment

Showcasing the company’s commitment to ESG, including its decarbonisation efforts, can make the company more attractive to investors who prioritise sustainability. This can also open a broader pool of potential acquirers, especially those with specific ESG mandates.

Navigating Future Regulatory Risks

Highlighting the company’s resilience to near-term carbon-related regulations and market shifts can provide reassurance to buyers who are concerned about long-term transition and regulatory risks.

Driving Sustainable Value Through Decarbonisation

By taking a proactive approach to decarbonisation across the entire investment cycle, private equity firms can mitigate financial risks, enhance returns, and position themselves as leaders in the transition to a low-carbon economy.

However, navigating the complexities of decarbonisation requires more than just good intentions. It demands a strategic partner with deep expertise, a proven track record, and a commitment to helping you achieve your value creation and impact goals.

How we can help

Anthesis offers comprehensive expertise in decarbonisation, helping private equity firms:

- Navigate the complexities of decarbonisation: We provide clear guidance on navigating regulations, identifying cost-effective solutions, and managing stakeholder expectations

- Drive sustainable value creation: We work with you to develop and implement strategies that not only reduce your environmental impact but also enhance your financial performance and brand value

- Build a strong ESG profile: We help you communicate your commitment to sustainability to investors, customers, and employees, creating a lasting positive impact

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.