Table of Contents

- CBAM Overview

- Canada's CBAM Advantage

- Aluminum

- Steel

- How Anthesis Can Help

- Canadian CBAM Guide

- Contact Us

Share this article

Starting in 2026, the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) will impose a carbon price on imported energy-intensive goods, including steel and aluminum. The impact on carbon-intensive producers will be significant. For Canada’s low-carbon steel and aluminum sectors, however, CBAM presents a critical growth opportunity and a chance to diversify sales throughout the EU, helping producers weather the rapidly evolving tariff landscape in the United States. With proactive action, Canadian producers may gain a decisive edge over global competitors.

Download our CBAM Guide for Canadian Steel & Aluminum Producers

CBAM Overview

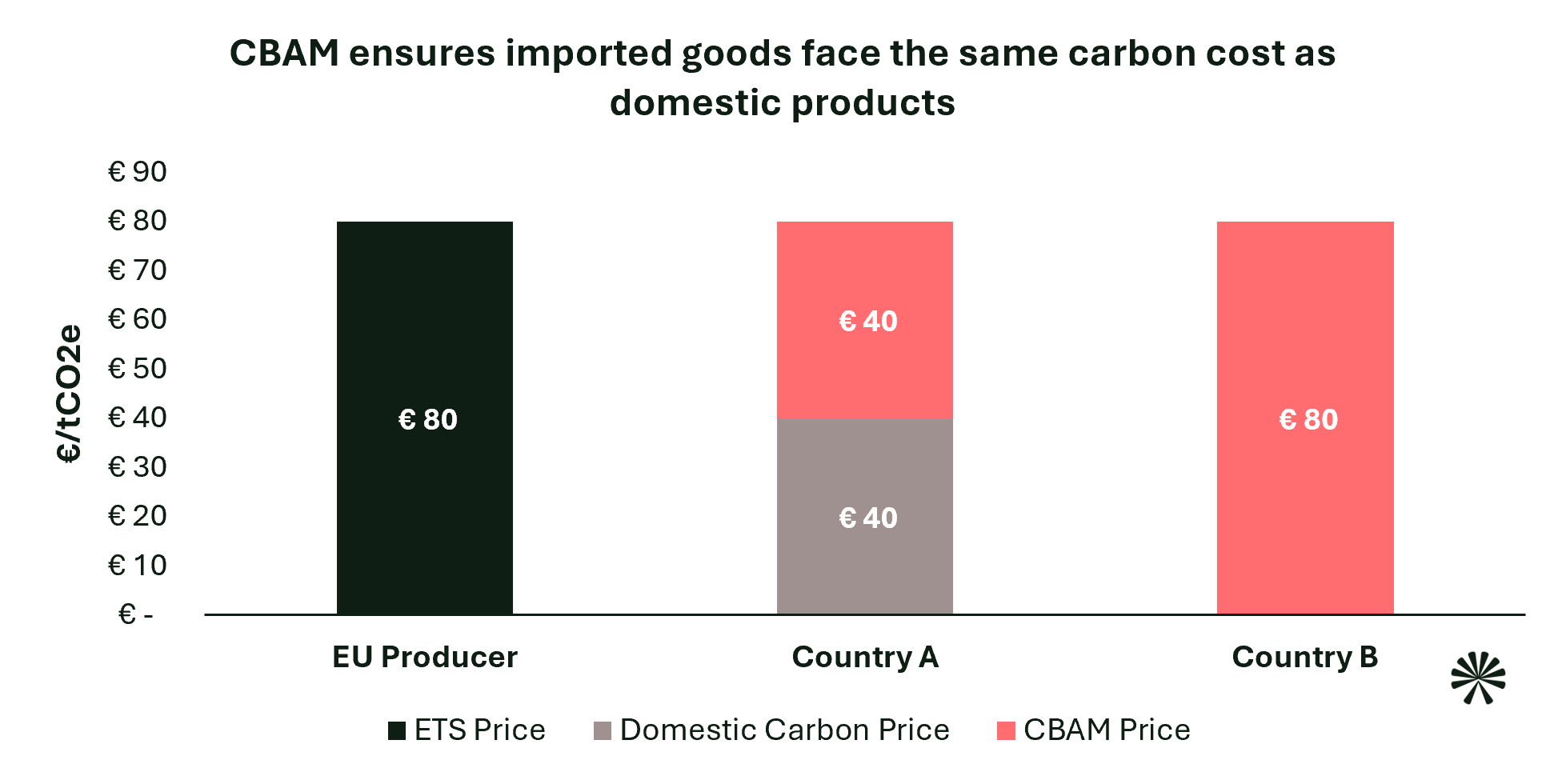

CBAM is the counterpart to the EU’s own domestic carbon pricing system, the Emissions Trading Scheme (ETS). Its goal is simple: ensure that imported goods face the same net carbon costs as the ETS applies to goods produced within the EU.

By neutralizing the competitive disadvantage EU producers face under the ETS, CBAM levels the playing field between domestic and foreign producers—turning decarbonization into a competitive advantage for any company seeking to sell into EU markets.

Notably, EU importers and customers will be looking for non-EU suppliers who are:

- Trusted, reliable data partners – Suppliers that provide timely, accurate, and verifiable CBAM data will be highly valued by EU importers.

- Low-carbon leaders – Suppliers whose CBAM data demonstrate lower embedded emissions and reduced CBAM exposure will be in high demand, as EU importers seek to minimize financial and regulatory risks.

Canada’s CBAM Advantage

With proposed U.S. tariffs targeting Canadian steel and aluminum exports, CBAM offers a timely and strategic opportunity for Canadian producers to diversify into EU markets, where carbon efficiency matters more than trade protectionism. Canadian producers can leverage their low-carbon status to position themselves as preferred suppliers for EU buyers seeking to reduce carbon-related costs.

Aluminum

Industry Overview

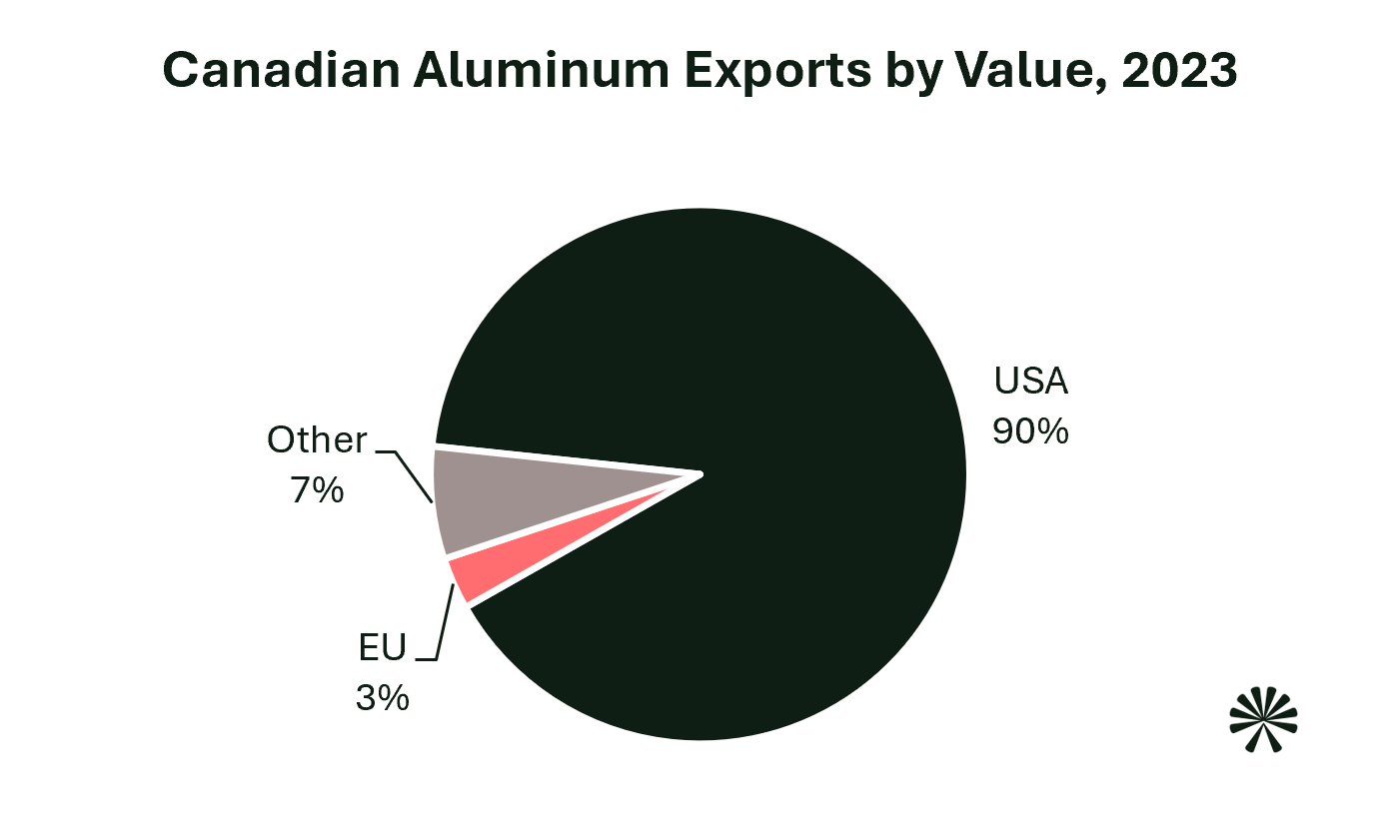

Canada is the world’s fourth-largest aluminum producer, with 10 primary aluminum smelters located in Quebec and British Columbia. In 2023, 90% of the country’s aluminum exports went to the US; just 3% went to the EU (Government of Canada, 2025).

CBAM Advantage

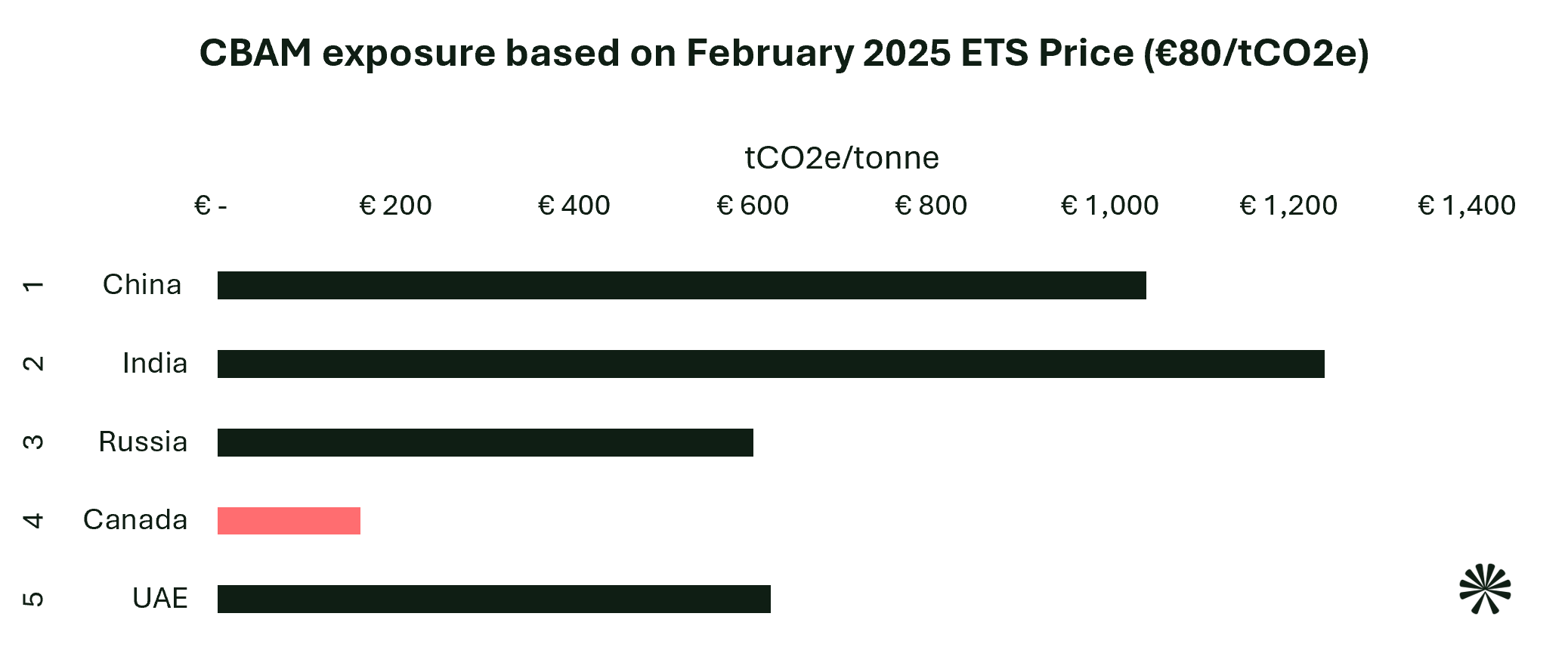

Owing to extensive use of hydroelectricity, Canadian aluminum has by far the lowest carbon footprint of any major producer. As a result, CBAM goods made from Canadian aluminium will face a fraction of the CBAM costs applied to other major producers upon entering the EU.

Steel

Industry Overview

Canada ranks 16th globally in steel production, with 10 production plants: seven Electric Arc Furnace (EAF) plants and three Blast Oxygen Furnace (BOF) plants.

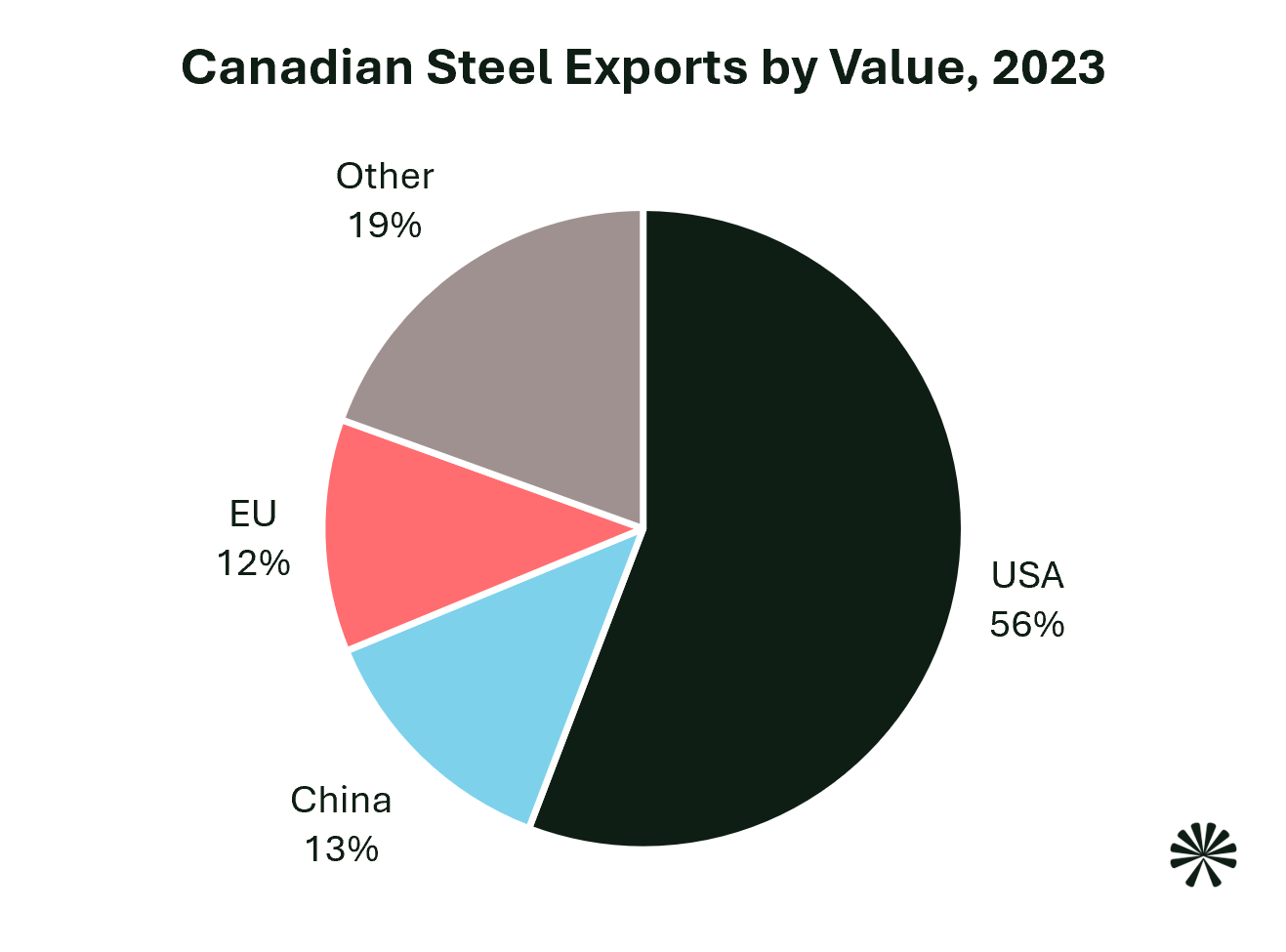

Canadian steel exports are more diversified than aluminum and enjoy a strong EU foothold on which to build. Nonetheless, the sector remains heavily dependent on the U.S. market, accounting for 56% of exports in 2023 (Government of Canada, 2025).

CBAM Advantage

Canadian steel has the lowest carbon footprint among major producers. Like aluminium, the country’s EAF plants benefit from clean energy grids with carbon intensities below 30 gCO2e/kWh, while its three BOF plants are among the world’s least carbon intensive. Though the cost differential under CBAM is less dramatic than for aluminum, goods made from Canadian steel still hold a clear cost advantage under CBAM.

How Anthesis Can Help

Faced with an uncertain U.S. tariff landscape, CBAM presents a strategic opportunity for Canadian aluminum and steel producers to expand and diversify their presence in EU markets. With CBAM’s carbon pricing set to take effect in 2026, EU importers are already seeking low-carbon suppliers to decarbonize their supply chains and minimize CBAM costs.

To learn more about how CBAM carbon pricing works, what products are covered, and the 5 steps Canadian producers should start taking to demonstrate their CBAM advantage to EU customers and importers, download our quick guide:

Anthesis provides end-to-end support in preparing and implementing your CBAM strategy. Contact our CBAM expert. today to get started.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.