The real estate sector accounts for a significant proportion of the world’s greenhouse gas (GHG) emissions. With 80% of the 2050 property stock already built, much of the required GHG reductions must come from existing properties. Reducing building energy use is the most impactful action property owners can take to align with the 1.5-degree climate target.

The Carbon Risk Real Estate Monitor (CRREM) tool is widely used in transactions processes for both single properties and portfolios where investment funds require ESG due diligence assessments. It can also be used for property management and sustainability reporting.

With the introduction of the EU’s Corporate Sustainability Reporting Directive (CSRD), many companies will soon be required to report annually on their Scope 1, 2, and 3 emissions. For this purpose, CRREM can be a valuable tool, providing the data to identify operational emissions as well as the risks and opportunities within a real estate portfolio.

Why are Energy Performance Certificates insufficient?

In many countries where energy declarations are mandatory, Energy Performance Certificates (EPCs) serve as the primary tool for reporting building energy consumption. However, EPCs have notable limitations, particularly in identifying opportunities for reducing emissions and evaluating a property’s greenhouse gas (GHG) emission performance over time. Furthermore, tenant energy consumption is often excluded from these calculations. While efforts are underway to harmonise EPC standards across EU countries, the measures suggested by EPCs typically focus on the base building energy, neglecting a more comprehensive approach that accounts for the total energy usage, including both tenant and base building energy consumption. Outside Europe, many countries also lack an equivalent to EPCs, making international comparisons challenging.

This is where the Carbon Risk Real Estate Monitor (CRREM) comes into play, providing a more holistic approach to building energy performance and facilitating greater comparability across regions.

What is CRREM?

The Carbon Risk Real Estate Monitor Tool (CRREM) is a free risk assessment tool developed with EU funding in collaboration with several universities, the GRESB (Global Real Estate Sustainability Benchmark), and the SBTi (Science Based Targets initiative). CRREM is a globally leading tool for operational decarbonisation in the real estate sector. It allows for calculations at both the single property and portfolio levels, assessing total operational energy use, including base building and tenant energy use.

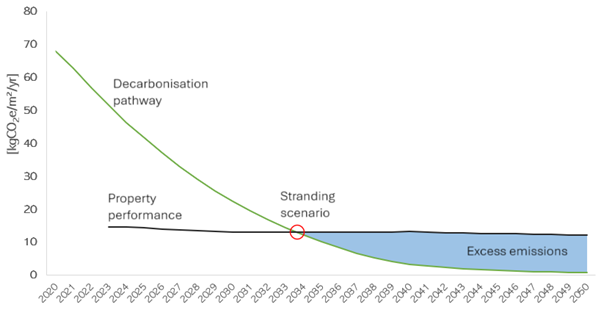

CRREM provides a clear view of how a property aligns with the global greenhouse gas (GHG) budget set for 2050 to meet the goals set in the Paris Agreement. This budget is allocated by country and property type using Science Based Targets and is updated around every three years based on the real estate sector’s performance and the remaining budget until 2050. This process can result in either a steeper or flatter decarbonisation curve, making the overall target easier or harder to meet over time.

For properties at risk of becoming stranded before 2050, CRREM helps identify retrofit actions to improve energy and GHG efficiency, preserving property value and reducing environmental impact.

How can Anthesis help?

We have in-depth knowledge of the CRREM tool and extensive experience in identifying energy efficiency measures and other improvements that can determine whether a property becomes stranded. We assist in interpreting CRREM results and identifying, costing, and prioritising profitable retrofit actions that can:

- Serve as technical/ESG due diligence in property transactions.

- Provide a basis for financing improvement measures in the property’s maintenance plan.

- Identify risks and opportunities related to operational emissions in the real estate portfolio for sustainability reporting under ESRS E1 (CSRD).