Table of Contents

- What Makes a Compelling ESG Report?

- How to Get Started on an ESG Report

- Finding the Value of ESG

- Contact Us

Share this article

Investors, regulators and stakeholders are demanding greater levels of transparency, making ESG reporting an important tool for building trust, demonstrating impact, and showcasing a private equity firm’s commitment to ESG and sustainable growth.

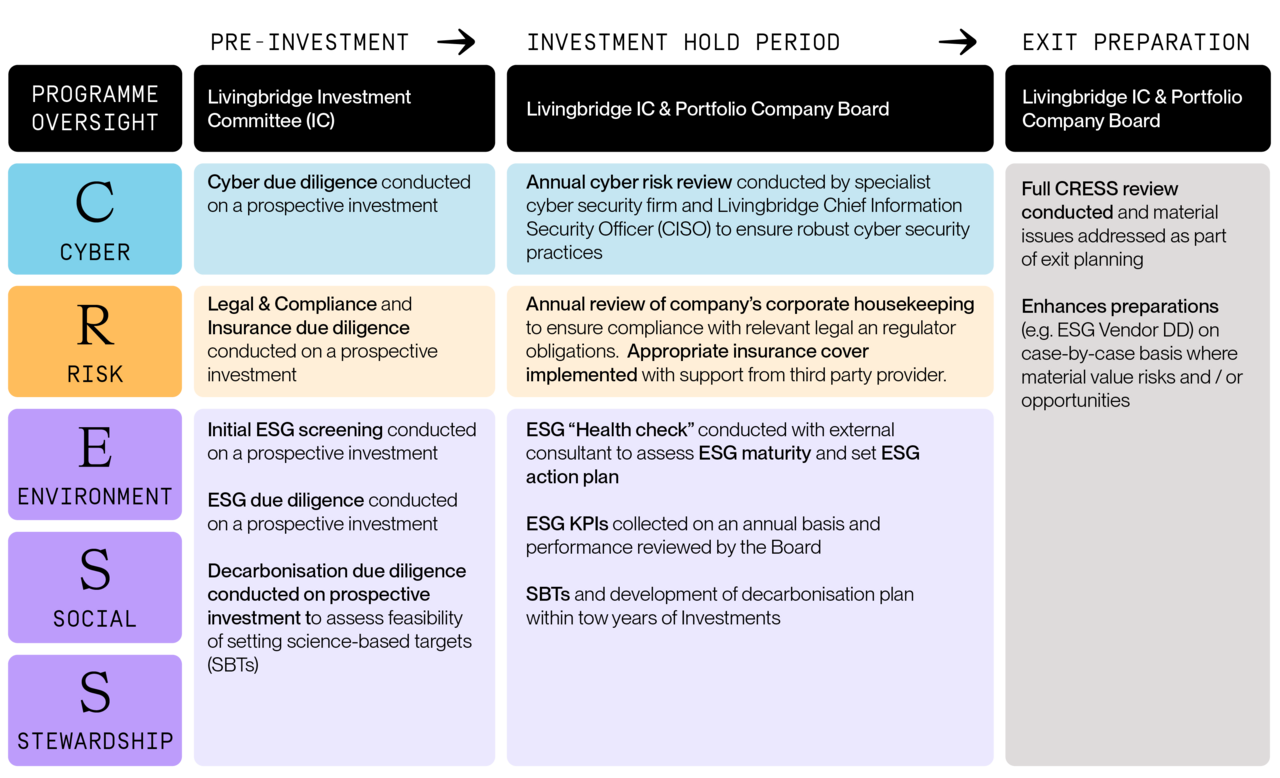

An ESG report brings a General Partner’s (GPs) responsible investment approach to life through qualitative insights and quantitative data. It illustrates a firm’s ESG portfolio engagement programme, including the systems, policies and processes integrated within their own operations and investment strategy to drive sustainable performance.

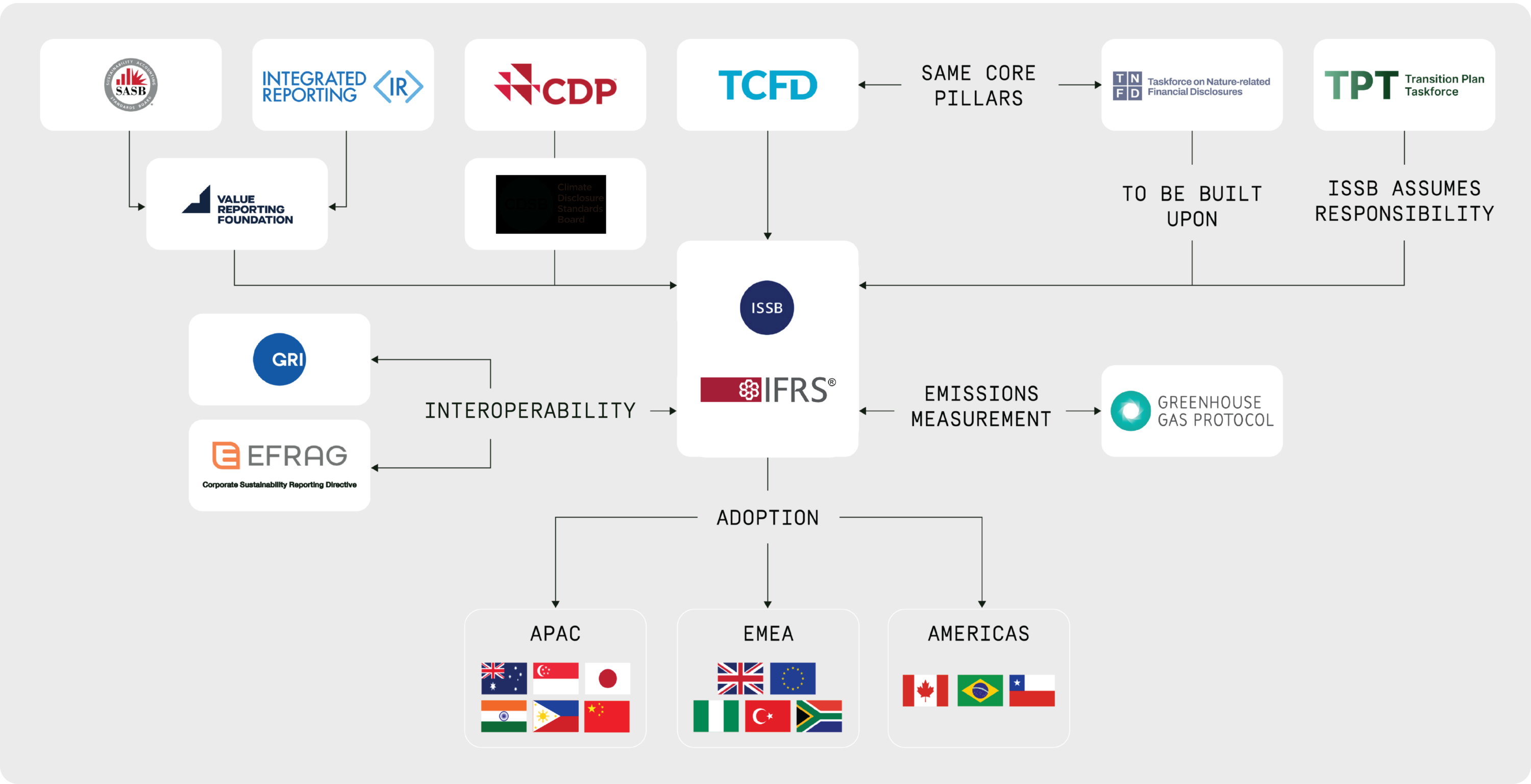

With growing regulatory and industry expectations, GPs face increasing pressure to provide stakeholders with more ESG data driven by frameworks such as the Sustainable Finance Disclosure Regulation (SFDR), Task Force on Climate-related Financial Disclosures (TCFD), Ethical Data Coalition Initiative (EDCI), Principles for Responsible Investment (PRI), and Science Based Targets initiative (SBTi). Consequently, the annual ESG report is now a vital communications tool for GPs. Based on our experience of helping over a dozen PE firms with their ESG reporting, we have outlined key trends and best practices for preparing useful, engaging ESG reports.

What makes a compelling ESG report?

Private equity ESG reporting has unique challenges – not least how to report on a diverse portfolio, covering multiple sectors and geographies. GPs also tend to use an annual ESG report to provide updates on their own ESG activities, governance processes and operational systems. To achieve clarity and engagement, these reports should combine clear structure with compelling visuals.

As a result, we see few private equity sponsors using mainstream corporate sustainability reporting frameworks such as the Global Reporting Initiative (GRI). Instead, sector-specific best practices have emerged, including :

1. Strategic positioning

A well-positioned ESG report should reinforce a GP’s identity and leadership in ESG, demonstrating how its values, internal policies and governance structures shape its approach. Whether as an impact investor, a sector specialist or a B Corp, the report should clearly articulate the GP’s strategic priorities and why specific ESG issues are material to its investment portfolio and philosophy. By outlining public commitments, third-party certifications, and accountability mechanisms, GPs can build trust and credibility with investors, portfolio companies, and broader stakeholders.

2. Commitments and goals

Stakeholders expect a clear narrative that explains a GP’s material ESG topics – those identified through stakeholder engagement as most relevant to the private equity firm’s investment strategy, risk profile and value creation approach – and the concrete steps taken to address them.

Equally important is articulating why these goals matter, both for the private equity sponsor and its portfolio. For instance, a GP investing primarily in food retailers might consider responsible food sourcing, food safety and fair labour standards as material topics within its ESG strategy.

Certain ESG metrics, such as Scope 3 financed emissions and female representation on portfolio company boards, are becoming industry standards, driven by a broader push for accountability. Initiatives like the Science Based Targets initiative (SBTi), the 30% Club, and HeForShe are driving these efforts. With more GPs aligning to these standards, stakeholders are demanding transparent, year-on-year updates on how GPs, and their portfolio companies, are taking action and addressing challenges. A well-crafted ESG report doesn’t just document progress – it sets the course for future impact.

3. Showcase value creation opportunities

Private equity ESG reports tend to highlight initiatives at both the firm and portfolio levels, aligning with the GP’s investment proposition and fiduciary duty. However, merely stating what portfolio companies are doing is not enough. Instead, the report should illustrate how responsible investment is embedded throughout the ownership period and how GPs actively encourage portfolio management teams to drive action. Case studies, testimonials and graphs are the perfect way to demonstrate impact. However, GPs must ensure their use of language and visuals is not misleading or overstate any achievements.

4. Data transparency and credibility

A growing portfolio can make reporting comparable data challenging. Establishing a structured data collection process, communicated at the start of the ownership period, ensures transparency. Robust year-on-year data is critical to demonstrate progress, identify gaps, and develop performance improvement programmes, helping firms track ESG performance in a consistent and meaningful way.

GPs can take several approaches when collecting data for ESG reports, including:

- Reporting on the influence of the portfolio against the GP’s minimum standards, such as key policies, plans and governance structures.

- Presenting data thematically by grouping portfolio companies by sector to highlight material trends. This can help Limited Partners and other key stakeholders see how ESG considerations vary across the portfolio and sector-specific impacts.

- Aligning with industry-standard data sets, including those outlined in frameworks like Ethical Data Coalition Initiative (EDCI) and Principles for Responsible Investment (PRI), alongside GP-specific metrics tailored to the firm’s strategic priorities. This ensures consistency and relevance when communicating progress.

Collecting all this data across the portfolio is a logistical challenge and one that means many GPs are turning to data management software, such as Anthesis’ Mero to collect, validate and aggregate all this data.

Metrics for ESG reporting

The ESG Data Convergence Initiative (EDCI) has emerged as a key framework for private equity firms, driving consistency in how ESG performance is measured and disclosed. EDCI metrics focus on core areas such as carbon footprint, diversity, health and safety, new hires and employee engagement. By leveraging standardised frameworks such as the EDCI, GPs can provide investors with clear, comparable data while also aligning ESG efforts with value creation and risk mitigation strategies.

5. Communication through design

Printed ESG reports are becoming a thing of the past with more interactive formats incorporating QR codes and videos, providing dynamic, real-time engagement in a more environmentally conscious format. Infographics, charts, and dashboards simplify complex ESG data while visualising year-on-year trends reinforces transparency and accountability.

Importantly, the design of the report should not only reflect the GP’s overall brand, aligning with its positioning, culture and values but also ensure that the messaging is authentic and grounded in real actions. A compelling design must visually communicate the GP’s genuine commitment to responsible investment in an authentic way.

How to get started on an ESG report

Getting started on an ESG report involves a structured, collaborative approach. For GPs, establishing an internal working group will help align on key messages, responsibilities and internal timelines. This group can support with ESG data collection and analysis, both at the firm and portfolio level, narrative development and provide valuable input into the overall report design.

Early engagement with portfolio companies is crucial given their critical role in providing valuable data, sharing case studies, and bringing a GP’s approach to responsible investment to life.

Finally, engaging with external advisors and leveraging data management platforms can streamline the ESG report writing experience by providing specialist expertise and automating the portfolio data collection process.

Finding the value of ESG

By combining credible data, compelling case studies and thoughtful design, GPs can demonstrate progress, enhance stakeholder engagement and drive sustainable value. As ESG expectations continue to evolve, compelling reports will offer dynamic, investor-friendly and seamless integration into the firm’s investment philosophy.

With our global team of PE subject matter experts and specialist strategy and reporting capabilities, Anthesis is well-positioned to guide GPs and their portfolio companies through the complexities of ESG report writing.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.