Updated: Nov. 2024

Contents

Share this article

The autumn 2024 budget has confirmed that DRS will go ahead in the UK in 2027 in England, Scotland & Northern Ireland. Each nation will have its own scheme that will be interoperable. The Department for Environment, Food and Rural Affairs (Defra) published the outcomes to the government’s 2021Deposit Return Scheme (DRS) consultation for England, Wales and Northern Ireland in 2023.

The new system includes a number of logistical considerations for obligated stakeholders that require immediate attention such as labelling changes and complexities around various nuances across the devolved nations to ensure compliance by October 2027.

Note: in November 2024 Wales announced it would no longer participate in the joint DRS development therefore this guide is not applicable to Wales.

Who will the Deposit Return Scheme affect?

All UK producers will be responsible for registering and paying into the new Deposit Return Scheme, including:

- Brand owners or drinks manufacturers.

- Importers of drinks for the UK market.

- Retailers (including online retailers) are only responsible for where they place their own brand drinks on the market.

Producers who place fewer than 5,000 units on the market are exempt.

Manufacturers of the drink containers (bottles/cans) are not responsible.

Retailers

Retailer responsibilities:

- Required to add the deposit value to the purchase price.

- Must display the deposit alongside the product price.

- Must host return points or operate a take back scheme.

There will be an exemptions process and if retailers are not hosting a return point, they must display a sign saying where the closest one is. Retail premises in an urban area that is 100m2 or less will not be required to operate a return point.

Other types of organisations that sell in-scope drinks containers including hospitality venues, food to go stores, schools, gyms, sports or recreation centres, community centres, and mobile caterers that sell in-scope drinks containers will not be required to host a return point, but will be able to apply to host a voluntary return point.

Large online retailers will be no longer be obliged to operate a take back scheme from day 1.Venues, such as pubs and restaurants, that function as a closed loop environment, are not required to pass on the deposit to consumers and are not obligated to host return points. However, they will be required to ensure that the empty drinks containers collected onsite are returned to the DMO.

Local Authorities

Concerns have been voiced by Local Authorities about the loss of income from losing the valuable Polyethylene terephthalate (PET) bottle waste stream which helps fund household collections. It is also possible that the reduction in council costs through reduced littering will offset this. Defra have stated that councils will be able to collect containers that end up in household collections schemes and can collect the deposits from the DMO. An impact assessment is due to be published by the government later this year.

Discover Our Sustainable Packaging Solutions

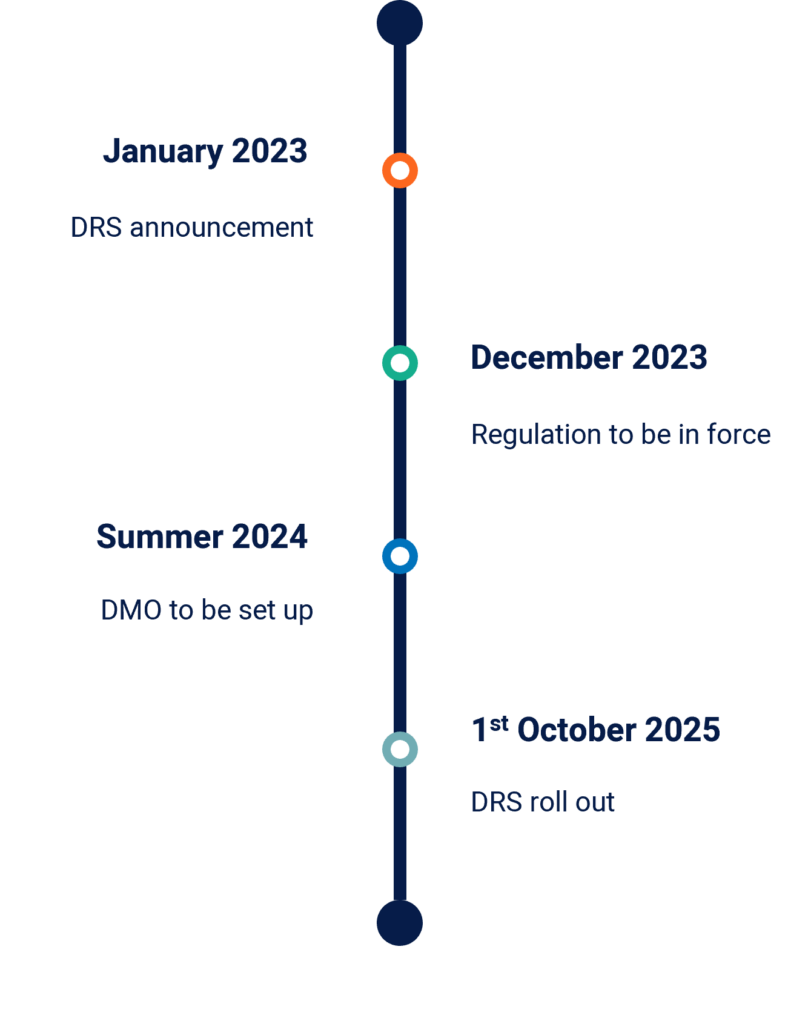

Key dates for the Scheme

The finalisation of the regulations and appointment of the DMO will be by end of 2024 and the spring of 2025 respectively.

It is proposed that the inclusion of commencement date for 1st October 2027. It is acknowledged that this is an ambitious timeline and so the continuation of working closely with the relevant stakeholders is preferred to assess feasibility as the implementation details are formed.

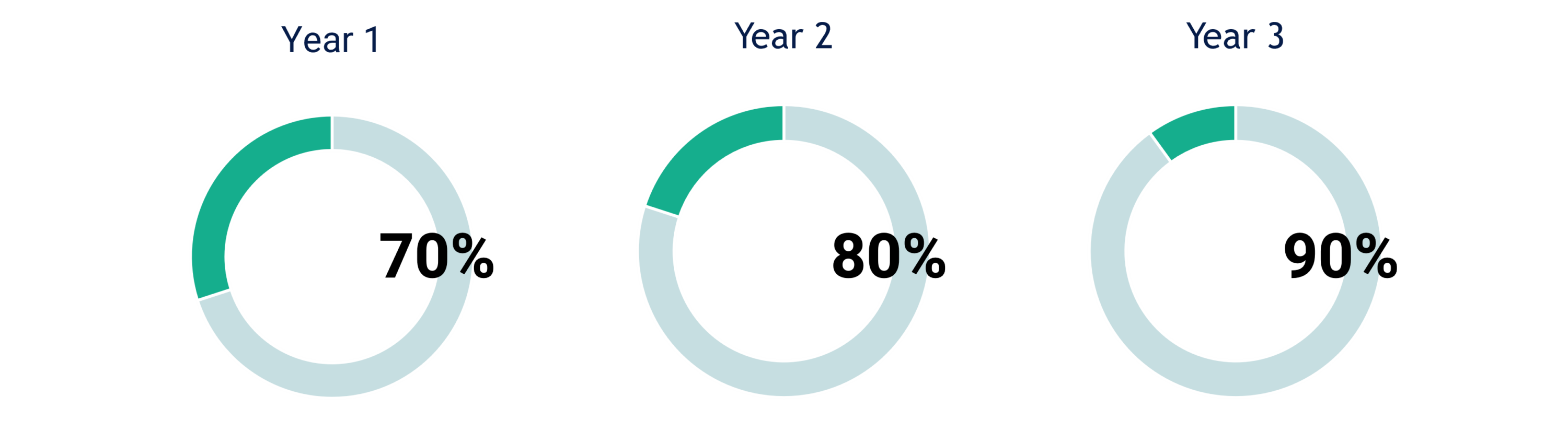

Targets

Within the first three years of the scheme being operational, the government have set a target to reach 90% or higher collection rates through the new DRS system.

From year 3 onwards, each individual material must achieve a minimum 85% collection rate to avoid one material subsidising the collection target for others.

In-scope materials

The materials in the scope of DRS in England and Northern Ireland include PET bottles, and steel and aluminium cans. In-scope materials include drinks containers between 150ml-3L.

In-scope materials for the Deposit Return Scheme:

- Steel & Aluminium cans

- PET plastic drinks containers

High-density polyethylene (HDPE), commonly used in milk bottles is not in-scope of DRS.

Labelling

It is recognised that clear and consistent labelling will be important for consumer communication and to ensure automation for return points. All three nations intend to mandate the use of both a mark to identify the product as part of a DRS and the use of an identification marker such as a barcode or QR code to enable the container to be recognised at the return point. The specific details and design of these markings would be for the DMO(s) to decide and is expected to be consistent across the UK.

The DMO has not yet been chosen and will be appointed through an application process set out in the regulations. It is possible there will be a separate DMO in each devolved nation. The deposit rate for all three Nations will be consistent and will be set by the DMO(s) after consultation with producers. The DMO’s responsibility is to consider the size of a producer, based partly on the number of drinks containers placed on the UK market, in relation to the fee amount. Detailed guidance on VAT on deposits is expected from HMRC, VAT will only be collected on unredeemed deposits.

The DMO will be responsible for receiving and processing any exemption letters from retailers selling in-scope containers. They will also be obligated to consider the strategic placement of return points, to ensure an accessible and comprehensive network of return points. Online retailers will also sit with the DMO’s remit, ensuring a takeback service is offered in respect of online purchases from day one.

There will be a gap between the launch of Extended Producer Responsibility (EPR) for packaging and the launch of DRS for drinks containers. Producers of packaging due to be captured under the DRS will be required to continue to meet current recycling obligations through the PRN system and will not need to join the new EPR system during the gap.

How can Anthesis support you?

Navigating the various new packaging regulations coming into force in England, Scotland and Northern Ireland is going to be difficult for businesses, DRS being no exception. With an already complicated regulatory landscape, it is critical for businesses to understand their obligations proactively and avoid being in a reactive position, to reduce the risk of being non-compliant or paying fees unnecessarily.

Anthesis has a long history and practical experience with DRS systems, with our experts being part of a high-profile and nationally significant project, responsible for designing and implementing Scotland’s Deposit Return Scheme on behalf of the Scottish Government including the level of the deposit, return points and materials in scope. Our experts can support your organisation as you begin the process of engaging with key stakeholders, including producers, retailers, hospitality businesses, European DRS operators, private waste management companies and appointed DMOs, all the way through to enduring compliance in each devolved nation across packaging portfolios.

Our experts have international EPR, packaging, material taxation and takeback experience, where successful DRS systems and business management of these requirements have been in place for many years. We can support our clients to manage the transition into a DRS system and provide the tools to assist clients to manage their responsibilities.

Further Reading