Home – Case Studies – ESG Data Management for Corficolombiana’s Investment Portfolio

Transforming ESG Data Management

For Corficolombiana’s Diverse Investment Portfolio with Mero

Home – Case Studies – ESG Data Management for Corficolombiana’s Investment Portfolio

For Corficolombiana’s Diverse Investment Portfolio with Mero

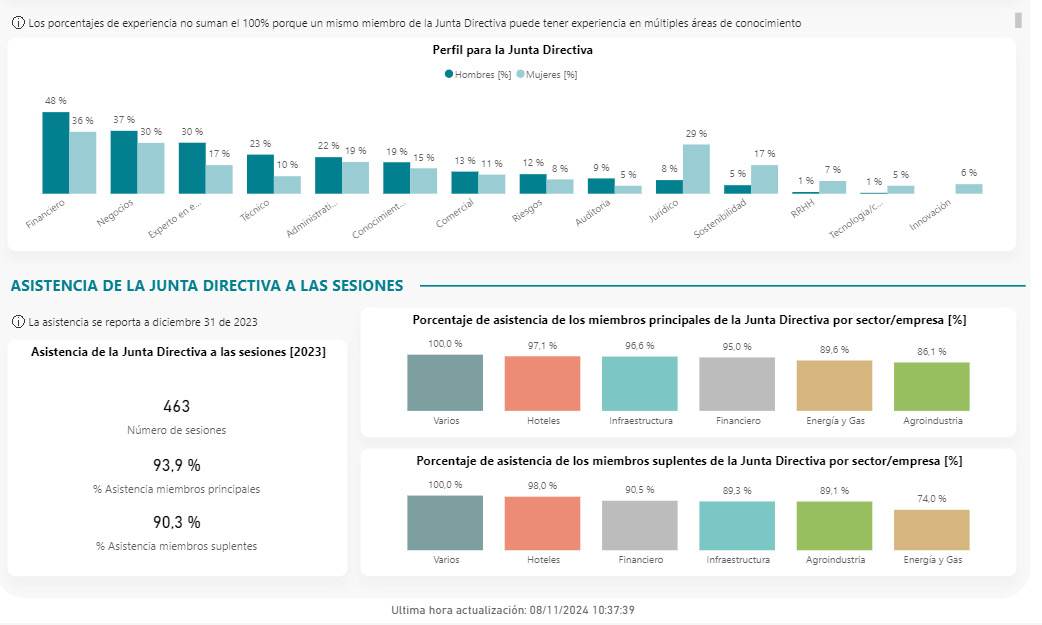

Corficolombiana, one of Colombia’s largest financial corporations, operates across five key economic sectors: Infrastructure, Energy and Gas, Financial Services, Hospitality, and Agribusiness. With investments spread across these diverse sectors, there was a critical need to centralise ESG data to streamline management processes and improve the efficiency and structure of reporting.

ESG information was consolidated using Excel sheets sent via email to the Holding company. This process was labor-intensive, with results only available annually and with a high margin of error.

Mero was customised to collect ESG information from each portfolio company via standardised forms tailored to the industries in which Corficolombiana invests. This setup facilitates individual performance assessments for each investment while also enabling a comprehensive analysis of the entire portfolio.

Using specialised systems like Mero to monitor ESG indicators across various investments is essential for generating actionable insights. This approach supports ongoing, precise evaluations of investment performance, helping to identify areas for improvement and flag potential risks.

Explore how Mero can empower your organisation’s ESG data management and help meet compliance needs seamlessly. Book a demo to see firsthand how Mero can support your journey to effective ESG data management.

We’d love to hear from you

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.