Home Regulations ASRS and AASB S2

ASRS and AASB S2: A Guide to Mandatory Climate Reporting in Australia

5th March 2025

Home Regulations ASRS and AASB S2

5th March 2025

Australia’s mandatory climate-related financial disclosures will begin 1st January 2025 under the Corporations Act 2001 (Corporations Act). To comply with new rules in line with the mandatory Australian Sustainability Reporting Standard (ASRS) AASB S2, both large listed and private companies and financial institutions, are required to assess and disclose information about their climate-related risks and opportunities in a ‘Sustainability Report’.

Whether your organisation falls under Group 1 starting from January 1, 2025, to report to ASRS and AASB S2, subsequent Groups 2 or 3, or is voluntarily reporting to align with stakeholders who must report and have heightened expectations for the supply chain – these new standards may still impact you. This article covers the most common questions around ASRS and AASB S2, to help you understand the requirements, and get started – or progress – your climate-related financial disclosures.

The Australian Sustainability Reporting Standards (ASRS) are new standards for assessing and disclosing information about an entity’s climate and sustainability-related risks and opportunities. The standards are internationally aligned to ensure consistent and transparent reporting.

The ASRS currently includes two standards – one is mandatory and one is voluntary (at this stage). They are:

As AASB S2 underpins mandatory climate reporting, it is the one business leaders are focusing their immediate attention on.

AASB S2 requires reporting entities to assess and disclose information about their climate-related risks and opportunities, with a focus on improving consistency, comparability and transparency of reported information.

Some Australian businesses are also considering AASB S1 to enhance broader sustainability-related disclosures and to prepare for future mandatory standards on nature and other topics.

The Australian Accounting Standards Board (AASB) developed the ASRS based on the International Financial Reporting Standards (IFRS) S1 and S2, issued by the International Sustainability Standards Board (ISSB), which set a comprehensive global baseline for sustainability-related financial disclosures.

The IFRS sustainability standards are being implemented by many jurisdictions globally and build on the work of the previous reporting guidance from the Taskforce for Climate-related Financial Disclosures (TCFD).

No. In Australia, AASB S2 includes relevant provisions from AASB S1 / IFRS S1 for the purpose of climate-related disclosures – avoiding the need to consider AASB S1 separately.

You may wish to consider AASB S1 for nature and other sustainability-related disclosures.

One of the first steps is to understand if and when you are captured by the new mandatory reporting rules. Your organisation may also choose to voluntarily report to ASRS and AASB S2.

Your organisation or financial product may be captured if it is required to publish financial statements under the Corporations Act, including if it is:

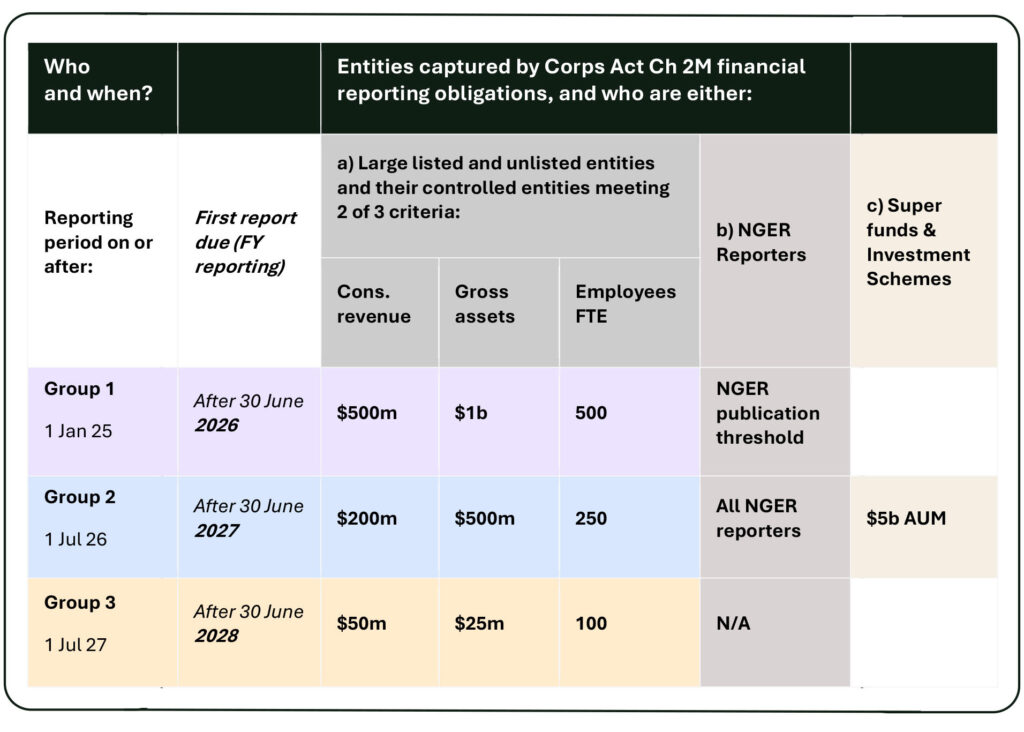

Reporting is being phased in based on a range of entity size and emissions criteria. To understand if your organisation falls under Group 1, 2 or 3, see the criteria below:

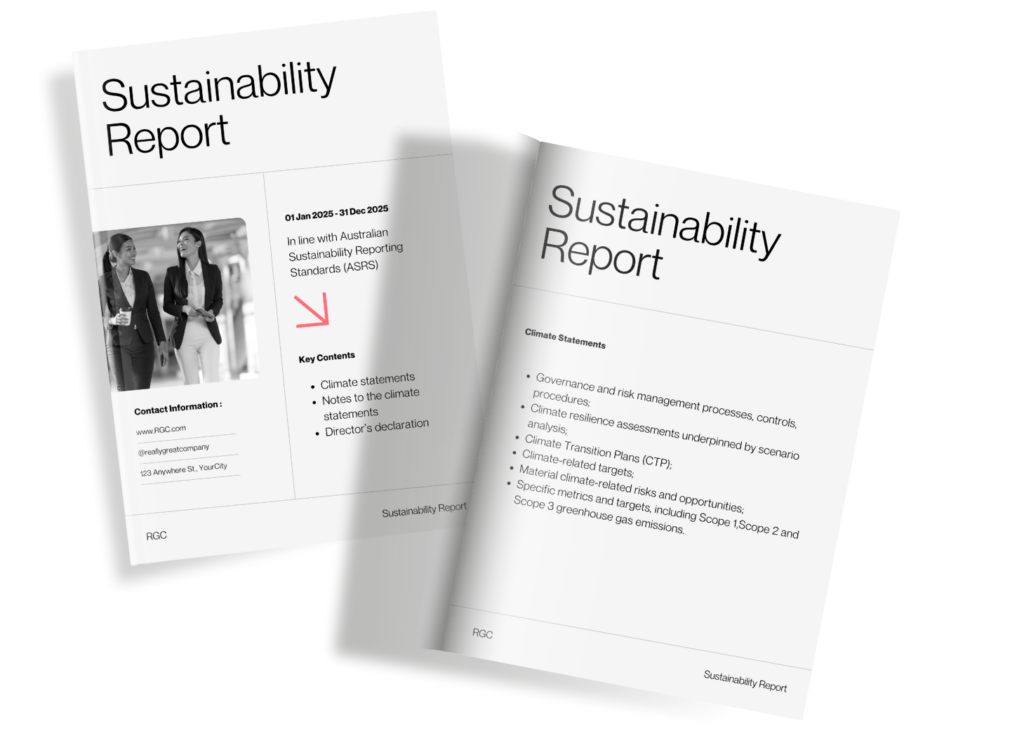

Under the new mandatory climate reporting rules in Australia, companies must prepare an annual ‘Sustainability Report’ which forms part of annual reporting – alongside financial statements.

The timing of publication must be consistent with the requirements under the Corporations Act for corporate reporting. More on that below under timelines.

Under the Corporations Act, the Sustainability Report consists of:

Climate Statements

Climate Statements must include information on climate-related risks and opportunities in line with AASB S2. This requires information including on:

The directors’ declaration is a critical part of the Sustainability Report. This is similar but distinct from the director’s declaration for financial statements.

The declaration confirms that the climate-related disclosures (i.e. the climate statement and notes) comply with the Corporations Act and AASB S2.

Reporting commences from 1 January 2025 and applies to your first full reporting period on or after that date.

The reporting period for Sustainability Reports must align with your financial reporting.

Report timing aligns with your first full financial reporting period on or after 1 January 2025.

For example, if you complete financial reporting for the period 1 July to 30 June, your first reporting period is 1 July 2025 to 30 June 2026 (FY26).

Commonwealth public sector entities will also be captured by new Commonwealth Climate Disclosure requirements, tailored for the public sector. Read here for more information on Public Vs Private Climate-related Financial Regulations in Australia.

ASRS and AASB S2 allows for a 1-year relief for reporting Scope 3 emissions (which cover indirect emissions related to your organisation’s value chain and financing or investment activities). This means reporting Scope 3 emissions will be mandatory from your second reporting period.

Are there penalties for non-compliance with ASRS and AASB S2?

The non-compliance penalties under ASRS and AASB S2 closely mirror financial reporting penalties under the Corporations Act.

As the regulator, ASIC has stated it recognises there will be a period of transition as industry builds its capabilities and implements the organisational changes required to comply with these mandatory climate-related reporting requirements. Accordingly, they will take ‘a pragmatic and proportionate approach to supervision and enforcement as industry adjusts to the new requirements.’

ASIC is expected to release new or updated regulatory guidance from November 2024.

In line with non-compliance penalties for financial reporting, directors may face personal liability for misleading statements in Sustainability Reports due to a lack of due diligence. False or misleading climate statements could result in penalties up to $15 million or 10% of annual turnover, with directors personally liable.

The smallest company size thresholds (i.e., in Group 3) match those for large proprietary companies under the Corporations Act, meaning most SMEs are excluded.

The Legislation allows the Minister to lower these thresholds in the future, potentially including more entities.

The government has tasked the Australian Auditing and Assurance Board (AUASB) with phasing in assurance requirements for sustainability reporting. This will likely start with limited assurance of GHG emissions reporting from year 1.

Full assurance of climate disclosures will be from 1 July 2030 (in line with the amendments to the Corporations Act) and include an audit opinion (being a positive assurance the report complies with the Corporations Act and applicable AASB standards).

The AUASB roadmap for phasing-in assurance is expected by the end of 2024.

Following the AASB consultation process, the AASB has made some key changes to the final Standards. The overarching change is to more closely mirror the ISSB standards IFRS S1 and S2. This includes:

The need for standardised, mandated reporting is being recognised globally, with countries around the world implementing climate-related disclosure requirements similar to Australia.

For the last decade, Australian companies have been reporting on their climate-related sustainability efforts using a range of global and voluntary standards. This lack of unified structure poses challenges for stakeholders in understanding and comparing a company’s approach, objectives and prospects towards climate and sustainability – particularly in the context of risk management, targets and transition plans.

Investors now want to understand clearly how companies incorporate sustainability considerations into their strategic decision-making, risk management, and financial statements. They want to know how a company’s sustainability-related risk and opportunities align with its strategy and business model and, ultimately, its prospects for creating long-term value.

From submissions to the consultation it is clear many business leaders view the ASRS as a crucial step toward improving transparency and accountability in sustainability reporting. They see it as both a compliance requirement and an opportunity to enhance governance, drive innovation, and meet market expectations. Leaders also welcome the government’s commitment to position Australia as a global sustainability leader by promoting sustainable finance.

Key benefits of climate-related reporting in line with ASRS and AASB S2 and AASB S1 include:

Here are some key questions your organisation should be asking itself to begin preparing for compliance to ASRS and AASB S2.

The Australian Accounting Standards Board (AASB) developed the ASRS to align the International Financial Reporting Standards (IFRS) Foundation’s Sustainability Disclosure Standards (also known as ISSB Standards).

These standards provide a consistent and comprehensive global baseline across IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information; and IFRS S2 Climate-related Disclosures. The standards also build on the work of the Taskforce for Climate-related Financial Disclosures (TCFD).

In Europe, the ESRS (European Sustainability Reporting Standards) are part of the CSRD (Corporate Sustainability Reporting Directive), which mandates sustainability reporting for large companies in the EU, focusing on environmental, social, and governance (ESG) issues.

In the U.S., the Securities and Exchange Commission (SEC) is responsible for regulating sustainability and climate-related disclosures. The SEC proposed climate disclosure rules in 2022, requiring publicly listed companies to disclose their GHG emissions, climate-related risks, and impacts on financial performance.

Many countries around the world are implementing mandatory climate and sustainability disclosures. Learn more about Singapore and the wider APAC region here and the global state of play here.

With 1 January 2025 fast approaching, key steps you should take now include:

Anthesis is among a select group of firms with extensive expertise in all aspects of climate disclosures, supported by advanced digital tools and software. Our experts understand the complexity required for compliance and have the skills to drive long-term resilience and sustainable performance for your business.

Anthesis experts can guide you through the full process of reporting to the Australian sustainability standards or assist with particular elements of reporting such as analysing your climate-related risks and opportunities, scenario analysis, Scope 3 reporting and climate transition planning. We can guide you on how to integrate outcomes into strategic plans and risk management processes, ensuring you’re prepared for compliance. Our digital solution Mero is designed to align with ASRS disclosures, providing a streamlined solution for data collection and management. It ensures transparency, data integrity and rigour, supporting your reporting processes and assurance requirements.

As technical experts and trusted advisors to some of the world’s most well-known companies for over a decade, we’re here to help you through this new era of reporting.

Call us for a chat on +61 3 7035 1740 or reach out to our experts via email or the form below.