Contents

- Public and Private Climate Disclosure

- Public vs Private – Entities Covered

- Relevant Legislative Instruments

- Assurance and Verification

- Supporting Programmes and Policies

Share this article

Public Vs Private Climate-related Financial Regulations at a Glance

The past year has seen a slew of new climate-related frameworks, standards, regulations and consultations released in Australia and beyond. Adding to the already dense mix of acronyms, we have seen several additional ones being added this year. In this guide, we break down Public Vs Private Climate-related Financial Regulations, the entities overseeing the various frameworks, and the essentials that you need to know for preparing and reporting in the months ahead.

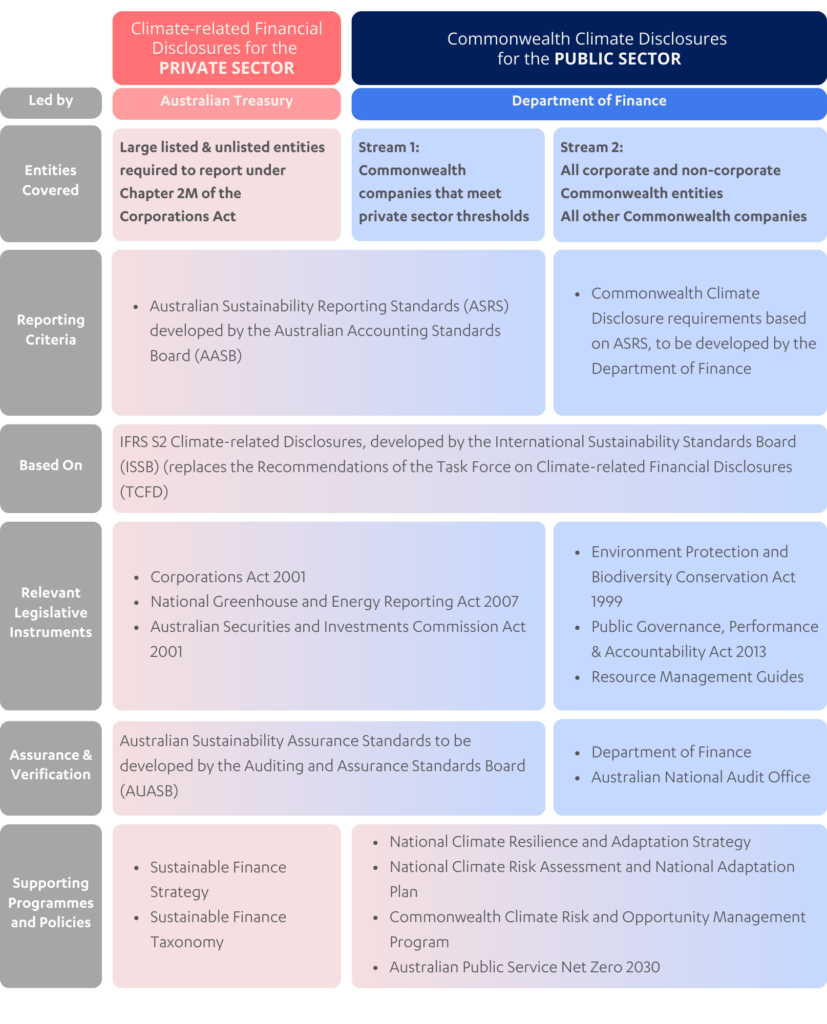

At a glance public vs private climate-related financial regulations and standards in Australia

Public and Private Climate Disclosure Programmes

The Australian Government is committed to improving the quality of climate-related financial disclosures in both the public and private sectors.

The government’s commitment to introducing internationally-aligned mandatory climate disclosure requirements will enable financial market participants to accurately price in climate-related risks and opportunities, supporting the transition to a low-carbon economy.

The climate-related disclosure policy for the private sector is being led by the Australian Treasury, while the Commonwealth Climate Disclosures for the public sector are being led by the Department of Finance.

Public vs Private Climate-related Financial Regulations – Entities Covered

Private sector reporting entities include large listed and unlisted companies that are required to report under Chapter 2 M of the Corporations Act 2001 {Corporations Act).

This includes all controlling corporations under the National Greenhouse and Energy Reporting Act 2007 (NGER Act), and all asset owners with over $5 billion AU in assets under management. A phased reporting timeline is proposed commencing from January 2025. Our article on the exposure draft takes a closer look at the draft legislative framework for the private sector.

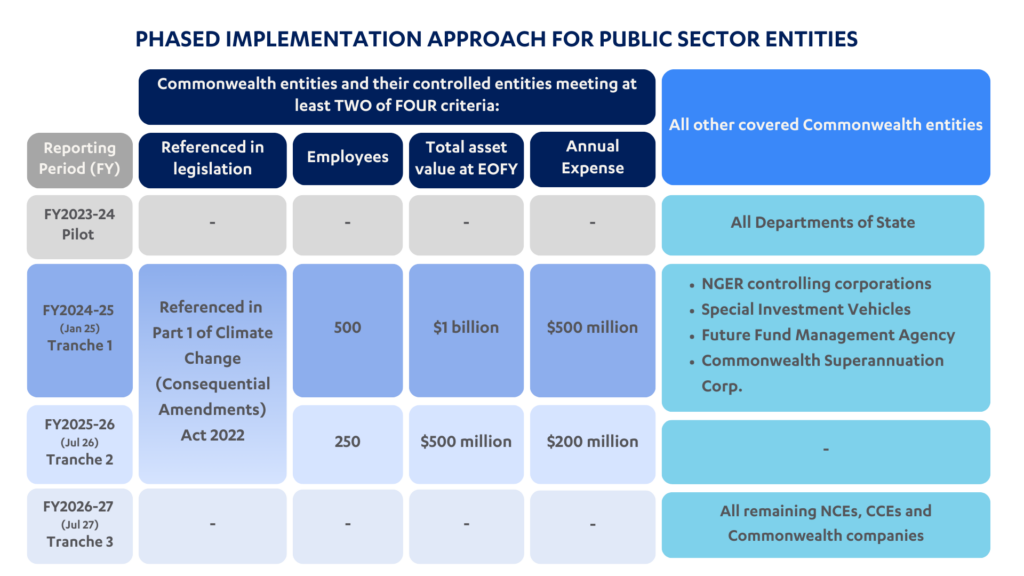

Public sector entities will be covered in two streams, with Stream 2 entities being required to report through a phased approach over four years commencing from the FY24-25 reporting period.

- Stream 1: Commonwealth companies that meet the proposed private sector thresholds

- Stream 2: All corporate (CCEs) and noncorporate Commonwealth entities (NCEs), and all other Commonwealth companies

The reporting content and requirements for climate-related disclosures for all private sector entities as well as Stream 1 Commonwealth companies will be set out in the Australian Sustainability Reporting Standards (ASRS), developed by the Australian Accounting Standards Board (AASB).

The AASB released the Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information in

October 2023 and it was open for comment until 1 March 2024.

The AASB standards are based on the standards developed by the International Sustainability Standards Board (ISSB) specifically IFRS S2 Climate-related Disclosures. The ISSB standards replace and expand on the previous best practice framework on climate risk disclosures, the recommendations of the Task Force on Climate-related Disclosures (TCFD), against which many large Australian entities have begun reporting.

Commonwealth Climate Disclosure requirements for Stream 2 public sector entities are being developed by the Department of Finance. Reporting obligations will be defined according to the three Commonwealth entity types. Although they will largely align with both the international ISSB standards and the national AASB standards, there will be specific amendments to account for the structure, objectives and functions of Commonwealth entities, their regulatory environments and various other Government policies. It is expected the Commonwealth Climate Disclosure requirements will be finalised in Q2 2024.

Relevant Legislative Instruments

For the private sector and Stream 1 Commonwealth companies, climate-related financial disclosures will be mandated through amendments to the Corporations Act (further details here) and will be subject to the existing liability framework under both the Corporations Act and the Australian Securities and lnvestments Commission Act 2001 (ASIC Act). Amendments to the Corporations Act will be put forward to the Australian Parliament.

The Australian Securities and Investments Commission (ASIC), created by the ASIC Act, has regulatory oversight of the Corporations Act. The ASIC Act also creates other statutory bodies including AASB and the Auditing and Assurance Standards Board (AUASB), further information below.

It is proposed that the disclosure requirements for Stream 2 Commonwealth entities and companies will be enacted through amendments to the following legislative instruments:

- Environment Protection and Biodiversity Conservation Act 1999 (E P BC Act), specifically s5116A on annual reports to deal with environmental matters

- Public Governance, Performance and Accountability Act 2013 {PGPA Act),

- Resource Management Guides, specifically RMG 136 on annual reports for corporate Commonwealth entities

Assurance and Verification

Climate disclosures of private and public Stream 1 reporting entities will be subject to similar assurance requirements to those currently in the Corporations Act for financial reports. Assurance will be required in line with new sustainability assurance standards, which will be developed by the AUASB based on the final standard from the International Auditing and Assurance Standards Board (IAASB).

Several assurance pathways have been proposed in Treasury’s latest consultation, including a phased pathway to full reasonable assurance of all climate disclosures from 1 July 2030. This pathway will be set out by the AUASB.

The assurance and verification of Stream 2 public entities will be designed by the Department of Finance in consultation with the Australian National Audit Office (ANAO). The Department of Finance will be responsible for monitoring compliance.

Supporting Programmes and Policies

Various programmes and policies exist as part of the broader climate-related ecosystem. Examples of relevant programmes include the following.

Private Sector

The Treasury is leading the development of Australia’s Sustainable Finance Strategy, which aims to underpin the development of Australia’s sustainable finance markets, enable firms to access capital needed for the transition to a low carbon economy, accurately price climate-related risks and maximise opportunities.

As part of implementing the Sustainable Finance Strategy, the Government has committed to developing an Australian Sustainable Finance taxonomy over 2023-24. This will develop a foundation for Australia’s wider sustainable

finance landscape and support alignment with other international sustainable finance taxonomies and markets.

The initial development will be led by the Australian Sustainable Finance Institute (ASFI), with oversight provided by the Council of Financial Regulators (CFR) Climate Working Group. The CFR Working Group is comprised of Treasury, ASIC, the Australian Prudential Regulation Authority (APRA) and the Reserve Bank of Australia (RBA).

ASFI

Public Sector

The National Climate Resilience and Adaptation Strategy sets out the Government’s commitments to support climate adaptation and mitigation across all levels of government, businesses and the community. This is being implemented by the National Adaptation Policy Office, which coordinates work on climate adaptation across all governments.

The National Climate Risk Assessment and National Adaptation Plan will be delivered over 2023-2025 and will build on the various State territory and local government-level climate risk programmes, delivering a shared national framework and a baseline of current, new and emerging climate risks.

The Australian Government is developing the Climate Risk and Opportunity Management Program (CROMP), which aims to support Commonwealth agencies to identify, manage and disclose physical and transition climate risks and opportunities across Government agencies, policies, programmes, operations, assets and services.

The Australian Public Service Net Zero in Government Operations Strategy (APS Net Zero 2030) outlines the approach for the Government’s commitment to achieve net zero in its operations by 2030. This includes non-corporate Commonwealth entities and includes Scope 1 and 2 emissions at this stage.

Reach out to us for more information on public vs

private climate-related financial regulations and how to

prepare

We support businesses across all stages of their sustainability and climate disclosure reporting including in line with the emerging Australian Sustainability Reporting Standards (ASRS), ISSB standards and other ESG reporting frameworks such as the Global Reporting Initiative. Our experts can also help you understand and expand your GHG inventory in line with the global GHG Protocol, Climate Active, and financed emissions under PCAF (Partnership for Carbon Accounting Financials).

If you’d like to learn more please reach out to our experts we’re here to help.