Share this article

One of the challenges our clients face when setting net zero emissions targets is the lack of certainty they have in their suppliers and downstream emissions. If these emissions are included in their target – it’s important to know and trust that viable net zero pathways exist for them. This is why progress like the Sector Pathways Review is exciting and comforting. While there is still so much work to do, being able to see it simply and clearly laid out is helpful. It helps us know where to aim, what to expect, and where the government will likely be providing support.

But the report does acknowledge: “A range of sector pathways can combine to achieve net zero by 2050. All require significant effort.” So by no means is the job done – or the pathway crystal clear.

What’s the Sector Pathways Review all about?

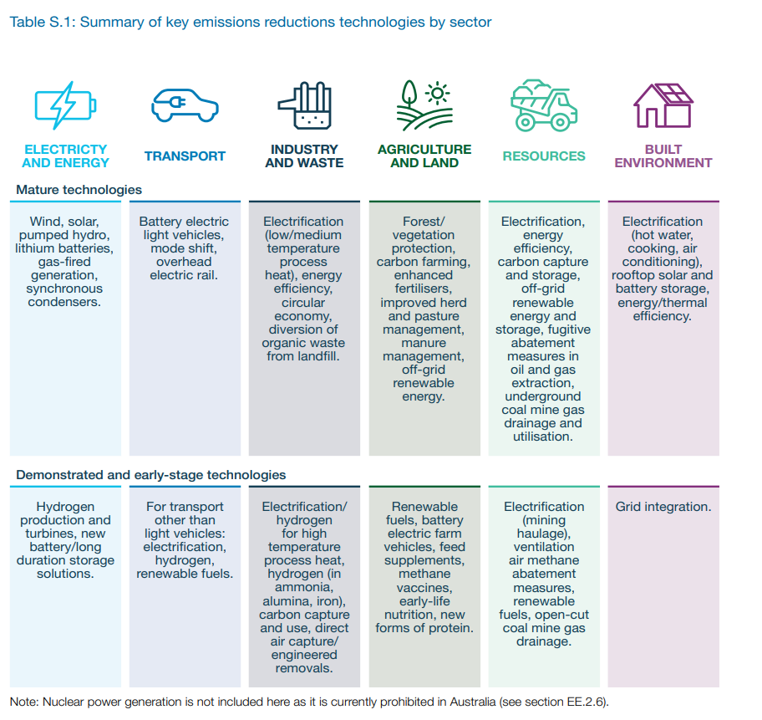

For those who are new to this area, the Sectoral Pathways are the “sets of potential technological and operational changes in each sector, that taken together could potentially deliver net zero emissions in Australia by 2050”.

The sectors considered are those that Australia reviews and tracks as part of our climate commitments: Electricity and energy, Transport, Industry and waste, Agriculture and land, Resources and Built Environment.

The Sector Pathways Review dives into top-down and bottom-up analysis into how these sectors could reduce emissions out to 2050 in line with Australia’s Net Zero target.

Sector Pathways Review – Australia’s key reduction opportunities and strategies for achieving emissions targets

ELECTRIFICATION:

It starts with electricity – and rightly so – this is the area of the economy which has arguably the greatest potential to unlock decarbonisation in other sectors.

The planned electrification of the built environment, transport and the resources sectors are highlighted as mature technologies for these sectors.

LIVESTOCK EMISSIONS:

The report isn’t very optimistic about livestock emission reductions. With so many solutions emerging for enteric methane reduction (such as feed additives) and a focus of many environmental groups to decrease meat consumption, it posits that “major reductions in livestock emissions may not be realised until the late 2030s and in the 2040s. More investment in R&D is needed”.

HYDROGEN:

Hydrogen plays a role in three of the six sectors but is acknowledged as fitting within “demonstrated and early-stage technologies”. It warns that “progress of hydrogen in achieving projected cost and production levels to displace fossil fuels in domestic markets needs to be closely monitored”.

NUCLEAR:

Nuclear is omitted and clearly stated so, due to its current ban under Australian legislation. The report notes that if there is a significant reduction in costs this should be reconsidered.

LAND SECTOR REMOVALS:

The report states that land removals will play a critical role, doing the heavy lifting and abating any 2050 residual emissions as the only sector with negative net emissions.

The combined pathways across all six sectors target reductions from 500MtCO2e to 133MtCO2e (residual emissions), to which the aim would be to have most of these (90%) abated by land sector removals.

That would mean a requirement to triple land sector removals from around 40MtCO2e to 120MtCO2e.

Non-land removals are highlighted as a challenge and risk that still requires access to land and resources. What is concerning about this is there is very little mention of climate risk.

Obviously, inaction now will lead to a heavier dependence upon land-based removals, but global inaction will also mean more climate risks facing our land-based carbon removal projects. The risks posed by climate change on removal projects are only mentioned briefly – but if the 2019-20 bushfire season is anything to go by, we should be thinking about this one carefully.

Put more simply, climate events could undo storage that we are relying on to achieve our targets – which means very high stakes!

INDUSTRY AND WASTE:

For heavier industrial facilities, it’s well known that generating process heat from less emissions-intensive sources will have wide benefits across industries at all scales. But this is not just applicable to large emitters (i.e. facilities covered by the Safeguard Mechanism) – the report highlights the far-reaching potential impacts of process heat interventions across smaller facilities.

Process heat accounts for more than 50% of total scope 1 energy use in industry – which means this is very fertile ground for emissions reduction interventions.

Existing technologies can meet some of the demand for low and medium-temperature requirements, yet the technology to support high-temperature requirements is not yet mature or proven at the scale required for heavy industry, such as ammonia production.

Another key insight from the Sector Pathways Review is that it highlights the important role of planning agencies in the transition and that the onus is not just on industry to make the required change. It discusses how low-emissions industrial precincts could play a meaningful role in overcoming barriers to investment and technology rollout. This will require a high degree of coordination by government agencies and industry.

SAFEGUARD MECHANISM:

The paper expresses that they’ve found many Safeguard Covered facilities that intend to pursue near-term decarbonisation opportunities to meet their obligations. The rate at which this happens will indicate the dependence we have on land-based removals into the future.

What is also interesting is the mention of the expansion of the Safeguard Mechanism as a key approach to achieving the necessary reductions. Whether this means including more facilities or lowering the baseline remains to be seen.

The threshold for Safeguard covered facilities is currently at 100kt CO2e scope 1, but the writing is on the wall that this might drop, with the entry of considerably more organisations and the need for much more sophisticated carbon accounting and increasing audit burdens.

The report also notes the expansion of the Safeguard Mechanism could help to overcome the ‘lack of willingness to pay the green premium’ by entities who currently face no penalty on their emissions profile.

Opportunities and Risks

Obviously, with a government-led and regulated net zero plan in the most critical sectors, there are plenty of opportunities to come.

Opportunities

We have seen recent announcements of the Future Made in Australia plan- partly in response to the US’s Inflation Reduction Act and the EU’s Green Deal Industrial Plan. This includes the recently launched $1bln Solar Sunshot program which is getting rolled out via Arena to increase solar PV manufacturing.

Other opportunities include:

- The transition of Australia’s workforce to build a net zero economy has huge potential. If done right – and that’s with a fair share of ifs and buts – Australia can tap into its wealth of knowledge in the resources and energy sectors and transfer those skills to new, sustainable industries. We know and understand that Australia is mineral-rich and can provide large amounts of critical minerals required for the transition towards net zero.

- Inclusion of First Nations communities, is essential and needs to be done properly. The review highlights the Net Zero Economy Authority’s obligation to address social aspects in its coordination efforts, investment brokerage to create regional jobs, and support for workers through the transition. It also emphasises the need for First Nations’ inclusion, as many large-scale renewable energy projects and resource mining will take place on their land. However, more concrete steps from the government and industry on how to effectively engage First Nations communities are needed. On a positive note, the report does spotlight the 38 active carbon projects and the Indigenous Economic Power Project, though further regulatory work should be pursued to strengthen these initiatives.

Risks

It’s important to highlight some risks that are not addressed in the review or any of the sectoral pathways:

- The risk from a changing climate and how adaptation will need to be factored in: Climate risk is not extensively explored in the pathways. In part this could hinge on assumptions about what the rest of the world will do to mitigate climate change, but it lingers as a gap – especially when our long-term future assumes residual emissions getting abated through land-based sequestration.

- Environmental and Biodiversity considerations. The review includes a section on how to manage competing land use between food production, environmental conservation and carbon sinks. And it does say that there is no problem as we will plan the management of our land in a better way. The risk is that once there is a market developed for each of the usage options, land owners will gear towards the most profitable option. Which might not lead to the expected and wanted outcome.

- The risk of a change in government. To drive the transition will require a vast amount of investments (the review speaks about the need for $122bln to transition the National Electricity Market). For that to happen, investors want certainty which is only partially built into the pathways and which requires more bi-partisan leadership.

- The risk of overshooting the targets and thus not being able to stay on a 1.5 or 2-degree trajectory. This, in turn, leads to higher climate-related physical risks, which ultimately results in greater economic and social disruptions.

- The intensity of the transition is another risk factor not covered by the pathways or the review. To achieve our desired low-carbon future, significant investments in several systems will be required, and these will come at a cost to the planet – in resources, land use and in particular in greenhouse gas emissions, which need to be factored in.

Our Economic Future

One of the biggest questions surrounding Australia’s Net Zero pathway is: what will the future look like?

In a country where 39% of our commodity exports are fossil fuels what are we going to do in a future where the world is chasing net zero? The review suggests Australia can maintain a healthy resources sector but there will be a “shift to increased iron and other metals and minerals production, and away from coal and eventually gas.”

How do we also ensure that imports we are dependent on remain available as demand increases? Our role as an exporter will shift as supply chains decarbonise, but our opportunities as an importer will also be impacted as demand for certain products and technologies increases as the world decarbonises.

In Conclusion

The CCA Sectoral Pathways Review consolidates a lot of research and planning for the future – it lays out potential paths ahead for our key economic sectors, as many stakeholders align towards a common goal – net zero by 2050. While in some areas it presents a realistic picture of the challenges ahead – that a significant amount of coordination will be required, that there are systemic and significant shifts that must happen to our economic outputs, and that not all the solutions are technologically ready – it also presents ideas to overcome those barriers.

We will be watching closely for improvements that roll on from this and shape the way our climate policies and incentives develop – and how we can best guide our clients to success. We will closely watch for hints for the expansion of the Safeguard Mechanism and of NGERs, the evolution and growth of our carbon market to overcome the green premium, as well as guidance and strategies for improvement to nature and nature as a climate resilient solution.

Want to explore how these findings might affect your business?

If you’d like to learn more or need guidance with emissions reduction, target setting or your broader sustainability initiatives please reach out to our experts, we’re here to help.