Contents

Share this article

Many organisations struggle to understand what’s involved in Scope 3 emissions reporting and with good reason. Navigating the concepts, frameworks and requirements that cover accounting for these emissions is challenging, demanding a deep dive into indirect environmental impacts across the entire value chain. However, as climate action becomes more critical, the understanding and effective management of Scope 3 emissions is not only increasingly common, but is now evolving into a regulatory and strategic imperative for many companies. This article digs into the intricacies of Scope 3 emissions and scope 3 reporting, examining what are scope 3 emissions, scope 3 categories, relevance testing, upstream and downstream emissions, hotspots and a six step guide to understanding, estimating and reporting Scope 3 emissions. It also explores the importance of transparency and the benefits of comprehensive Scope 3 data gathering and emissions reporting.

Defining Scope 1, 2 and 3 Emissions

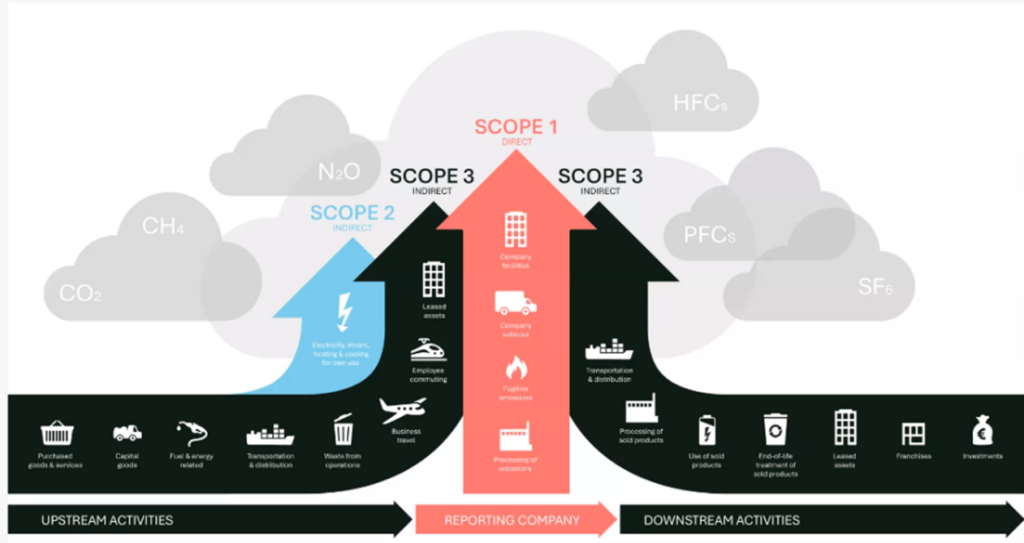

Greenhouse gas emissions – or GHG Emissions – are emissions that contribute to global warming, the most significant being carbon dioxide, methane and nitrous oxide, usually expressed as carbon dioxide equivalent or CO2e. When talking about GHG Emissions for a company, and the emissions they should decrease, we talk about operational boundaries and the three scopes of emissions.

- Scope 1 emissions covers direct emissions from activities conducted in facilities owned or operated by the company.

- Scope 2 emissions account for indirect emissions from electricity usage, where the actual emissions occur offsite. Reducing Scope 1 and 2 emissions is critical and is now broadly considered the bare minimum of emissions reporting and in Australia companies who meet certain thresholds must report their Scope 1 and 2 emissions to the National Greenhouse and Energy Reporting Scheme (NGERs).

- Scope 3 emissions include all other indirect emissions related to a company’s operations, both upstream and downstream. See Scope 1, 2 and 3 emissions examples below.

Scope 3 Emissions and the GHG Protocol Scope 3 Corporate Standard

Scope 3 emissions typically represent the largest portion of a company’s carbon footprint, encompassing all indirect emissions from activities such as sourcing materials and product use. Addressing these emissions encourages collaboration across supply chains to reduce emissions, a key aspect of decarbonisation. Importantly, Scope 3 emissions often involve meaningful double counting—your organisation’s Scope 3 emissions might be another organisation’s Scope 1 and 2. By focusing on Scope 3, companies are prompted not merely to outsource their activities to third parties but to seek meaningful ways to reduce emissions throughout their value chain.

The backbone of most scope 3 greenhouse gas emissions calculations is the GHG Protocol Standard. In addition to producing standards for scope 1 and 2, the GHG Protocol also produced the GHG Protocol Scope 3 Corporate Standard.

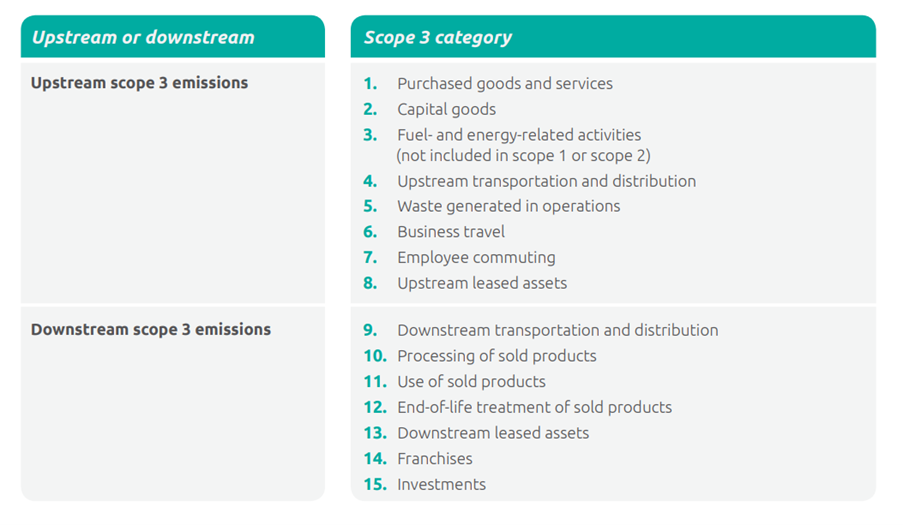

This standard outlines 15 categories of scope 3 emissions that should be considered by an organisation, and which are indirectly produced as a result of the organisations activities and purpose. Scope 3 emissions can be broken into upstream and downstream scope 3 categories.

Scope 3 emissions examples

GHG Protocol: List of scope 3 categories

Scope 3 Categories – Upstream and Downstream Emissions

Upstream Scope 3 categories encompass emissions sources that occur as a result of activities that need to happen for an organisation to operate. This includes the embodied emissions associated with goods and services procured for a company, but also emissions associated with staff commuting to the office, or travel undertaken as part of business.

Upstream emissions are most important for what’s often referred to as an organisational inventory, such as one in line with Australia’s carbon neutral standard – Climate Active.

Downstream scope 3 categories predominantly consist of emissions sources that occur as a result of the output of the business, including the use of the products a business sells, or the investments they make. These sources become very important for product based inventories.

What is Scope 3 Relevance Testing?

Scope 3 emissions are usually the most complex to estimate, often because the data needed to estimate them lies with third parties that need to be collected and shared.

High-level estimates are possible in the first instance, but accurate scope 3 estimates will require supply chain collaboration.

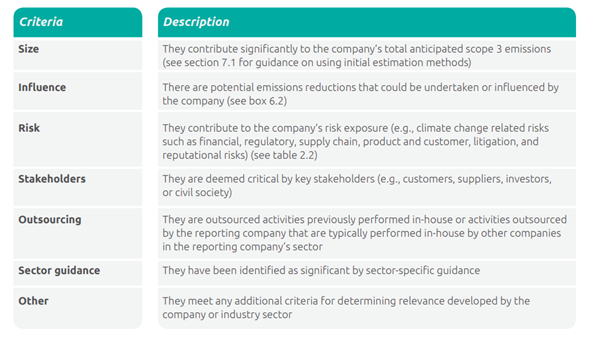

Depending on the type of business, different scope 3 emissions categories will be more or less relevant.

The business should first decide what the purpose of the inventory is, map the emissions sources, and then undertake a relevance test or relevance assessment, which will help prioritise – or in some cases exclude emissions sources.

A relevance test looks at the size of the emissions sources, the company’s ability to influence them, the risk they pose to the organisation as well as other key criteria.

GHG Protocol: Criteria for identifying relevant scope 3 activities

6 Steps to Understanding, Estimating and Reporting Scope 3 Emissions

Broadly, the approach we take in understanding, estimating and reporting scope 3 emissions is below:

- Understand the why: First it’s important to understand why your company is looking into your emissions profile and broadly where you are heading. If a company is aiming to set a Net Zero target under the Science Based Target initiative, versus effectively communicating the emissions associated with its products, or aiming for carbon neutrality, your goals and what needs to be included will differ.

- Set the boundary: Next, you should map the organisational and operational boundary. This requires reviewing the legal or organisational structure, and ensuring all entities that are relevant are included. Next is a process to map out all activities that could result in emissions.

- Investigate and collect data: After mapping the supply chain, a relevance test should be completed followed by a review of the data that would need to be gathered to estimate the emissions. This should consider the feasibility of collecting that data, whether it actually exists, and making appropriate assumptions and estimates where needed.

- Estimate emissions: At this stage you estimate the businesses emissions. This is usually through use of an emissions factor that converts the activity data to emissions – for example, emissions factors exist to estimate how many kg of CO2e is emitted per dollar spent on a particular good, or per km travelled in a plane.

- Report: Disclosing your emissions either in a sustainability report or annual report is best practice, and should be accompanied by transparent, clear assumptions and explaining limitations, approximations and assumptions made.

Transparency is absolutely critical here and doing this wrong can result in greenwashing claims. - Continuous improvement: After your inventory is completed, the next stage is to update and maintain an inventory management plan. This looks at opportunities to improve the accuracy and quality of data and emissions estimates online to refine and improve.

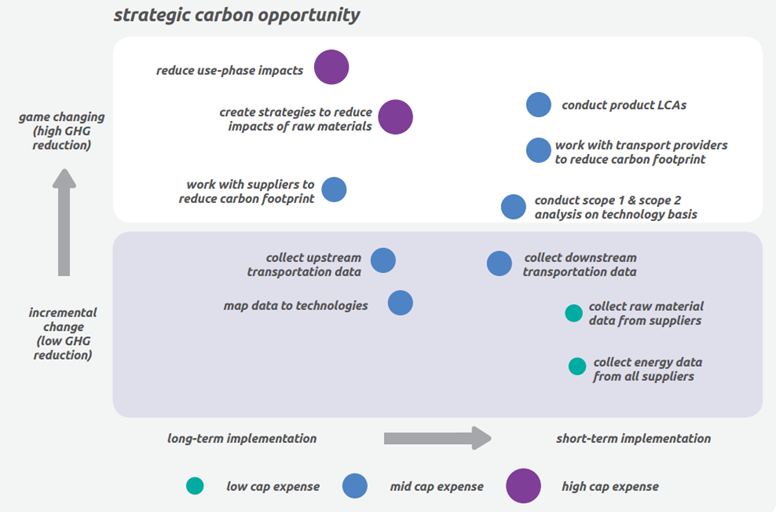

Reviewing the Data – Hotspot Analysis

To gain an understanding of the most material emissions sources, companies can begin with a hotspot analysis that screens emissions categories and undertakes high-level estimates. Without a hotspot inventory, companies might already have an indication of which emissions categories will be more material based on their industry.

For manufacturers, emissions are likely higher in Scope 1 and 2, but upstream emissions can also be significant, depending on the volume of processed inputs procured to manufacture products. However, for products, categories 10, 11, and 12—which concern processing, use, and end-of-life treatment—can be very significant. These categories should be scrutinised carefully to determine if there are any attributable emissions associated with these stages, and whether they can be accurately estimated.

For fossil fuel or oil and gas producers, the ‘use of sold product’ category includes emissions associated with the combustion of products, which will be highly significant and typically much higher than other categories.

If a company holds investments, category 15, which focuses on investments, can be very significant, often exceeding Scope 1 and 2 emissions. For instance, operational emissions (Scope 1 and 2) of a bank are much smaller than the mortgage-related emissions categorised under Scope 3 category 15.

Besides the GHG Protocol, there are other specific standards and guidelines for different industries, such as the the Partnership for Carbon Accounting Financials (PCAF) for finance, and sector-specific guidance from various industry bodies.

Reporting Scope 3 Emissions – Transparency is Key

Calculating all 15 categories of emissions is not always necessary; some may not be relevant to a company. Moreover, if data for certain categories are unavailable, companies can begin reporting and clearly state that other categories will be calculated in the future. If data does not exist, explaining why it has been excluded is acceptable.

Transparency is the most critical aspect of reporting scope 3 emissions.

Many initial estimates are just that—estimates—and are expected to improve over time. It is more crucial for companies to start, showing intention and a willingness to expand and refine their efforts progressively.

Companies should clearly list their boundaries, assumptions, inclusions, and exclusions. Best practices include explaining plans for future improvements. Many companies provide high-level calculation workbook Excel summaries, or break down emissions by scope and category in their annual or sustainability reports.

Companies must be cautious with the claims they make, especially concerning Net Zero and Carbon Neutral ambitions and targets. For more details on what these terms mean and when they should not be used, companies can refer to the Net Zero roadmap.

It is important to recognise that emissions reporting will become increasingly stringent over time. Standards are improving, emissions factors and reporting methods are being updated, and legislation on Scope 3 emissions is approaching with the new Australian Sustainability Reporting Standards (ASRS). Emissions reporting should be approached with the same rigor as financial reporting, acknowledging that it is an ongoing journey.

With the growing scrutiny, companies might also consider whether to obtain external assurance on their emissions estimates. This will likely become a requirement in the future, and planning and budgeting for it now is a prudent first step.

Benefits of Reporting Scope 3 Emissions

Increasingly, supply chain actors are elevating their emissions estimates – if a company hasn’t received a request from a customer for the emissions from its product or organisation, it’s only a matter of time.

- Being ready with estimates – clearly articulated with limitations, inclusions, and assumptions – will make customers’ sustainability managers happy and potentially win more business and new clients.

- Demonstrating low emissions ambitions, robust and verified targets (such as through SBTi) and a willingness to engage in meaningful climate action can provide a leading edge against competitors.

- It’s also worth noting, in many markets and industries, it’s no longer an optional exercise, but an expected undertaking, including the integration of data requests and requirements into procurement processes.

- As momentum increases, investors are also mandating emissions inventories and targets, especially when the investor themselves has set emissions targets – anything new they invest in will also need to be on a decarbonisation journey to the same level of ambition.

Learn how Anthesis supported global retailer Target with its Scope 3 Science-based target.

GHG Protocol: SC Johnson’s framework to assess reduction opportunities along the value chain

Scope 3 Emissions Reporting in Australia

For Australian businesses scope 3 reporting has traditionally been voluntary.

With the introduction of the new Australian Sustainability Reporting Standards (ASRS), companies are required to disclose their Scope 3 greenhouse gas (GHG) emissions.

For now there is a transitional provision:

- First Reporting Year: Disclosure of Scope 3 emissions is not mandatory.

- Second Reporting Year Onwards: Disclosure of Scope 3 emissions becomes mandatory.

This phased approach gives companies additional time to accurately measure and report Scope 3 emissions.

As highlighted in this article, measuring Scope 3 data is complex and time-intensive, but it will soon be mandatory for many Australian businesses.

And for those aiming to build resilient supply chains and lead their industries in sustainability, Scope 3 reporting is no longer a voluntary option – it’s essential.

Simplify your Scope 3 Data with Emissions Reporting Software

Many digital platforms now help you collate and manage your data for Scope 1, 2, and 3 emissions reporting. RouteZero is one such tool that streamlines GHG inventory management by aligning with the GHG Protocol, offering real-time data access, automated dashboards, and scalability for businesses of any size.

Backed by expert support, it simplifies the complexities of Scope 3 reporting, enabling your organisation to identify carbon hotspots, set science-based targets, and drive meaningful decarbonisation.

Need help with your Scope 3 Emissions Reporting?

If you’d like to learn more, or need help on your journey to understand and report your scope 3 emissions please reach out to our experts.

Download our Scope 3 guide that addresses the most common topics and considerations Anthesis hears from clients across five stages of creating a successful supplier engagement program,