Table of Contents

Share this article

What’s Happened?

Yesterday, the European Commission announced a new package of proposals aimed at streamlining sustainability reporting requirements. While still subject to legislative approval, businesses are already feeling the impact of uncertainty around potential changes to key regulations, including the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), and the EU Taxonomy.

This article provides clarity on what we know, what happens next, and how businesses should respond.

What We Know About the EU Sustainability Simplification Omnibus Package

In November 2024, the President of the European Commission indicated that the EU was considering consolidating sustainability regulations into one Omnibus to reduce the regulatory burden for companies. On the 26th of February 2025, the Commission released the new package of proposals.

The Package is designed to streamline and simplify sustainability reporting requirements for EU businesses and align existing regulatory frameworks. The changes will impact certain requirements under the following sustainability reporting requirements:

- Corporate Sustainability Reporting Directive (CSRD): An EU directive requiring companies to disclose environmental, social, and governance (ESG) impacts to enhance corporate transparency and accountability.

- Corporate Sustainability Due Diligence Directive (CSDDD): An EU directive mandating companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their operations and chains of activities.

- EU Taxonomy Regulation: A classification system defining environmentally sustainable economic activities to guide investment and corporate sustainability practices in the EU.

- Carbon Border Adjustment Mechanism (CBAM): An EU regulation that imposes a carbon price to imported goods entering the EU to prevent carbon leakage and promote global emissions reduction.

Additionally, there will be implications for investment programs and sustainable finance reporting. This Package is part of a series of proposals aimed at simplifying and addressing connections between pieces of legislation.

Key Changes

The package introduces the following key changes:

- An 80% reduction in scope for the CSRD, limiting mandatory CSRD compliance to companies with more than 1,000 employees and either €50 million+ turnover or €25 million+ balance sheet

- A two-year postponement for those that remain in scope of CSRD but haven’t yet reported, giving more time for other companies to prepare and recalibrate

- No delay for EU listed companies already reporting to CSRD

- The removal of the possibility for expanded assurance (reasonable assurance)

- Removal of plans for sector-specific standards under CSRD

- A revision and simplification of the European Sustainability Reporting Standards, including a reduction in the number of data points required

- A one-year postponement of CSDDD for the first phase of application for the largest in-scope companies

- Relieving companies in scope of CSDDD from the obligation to systematically conduct in-depth assessments of adverse impacts in Tier 2+ supply chains (unless there is plausible information suggesting that adverse impacts have arisen or may arise there)

- Reducing the frequency of periodic assessments and monitoring required in the CSDDD from annual to every 5 years, with ad hoc assessments where necessary

- Removal of the requirement to implement climate transition plans (CTPs) previously included in the CSDDD (although maintaining the requirement to develop CTPs and include actions that have been implemented or planned)

- A limit to the amount of data companies can request from smaller companies in their value chain

- Relaxation of rules for companies with more than 1,000 employees and a turnover below EUR 450 million by making the reporting of Taxonomy voluntary, and the option of reporting on partial Taxonomy-alignment

- A voluntary SME reporting standard (VSME) will be used as support for developing voluntary standards for the rest of the companies no longer in scope of the CSRD

The requirement for Double Materiality remains a key element of the CSRD, meaning that in scope companies must report on both how sustainability affects their business and their impact on people and the environment.

What’s Driving This Initiative?

This Package is the European Union’s response to concerns about the complexity of sustainability reporting requirements and remaining competitive within the broader global economic landscape. Some believe that sustainability regulations create an uneven playing field compared to markets like the United States and China and complex requirements create a burden for companies. Anti-ESG lobbyists, including oil and gas companies and industries resistant to a net zero future, argue that excessive regulation puts Europe at a disadvantage.

Our perspective is that, while there is certainly scope to streamline the regulations, properly implemented, these regulations should enhance competitiveness by increasing transparency and promoting cleaner and more environmentally aligned products and services. The core concepts of ESG regulation, including the CSRD and CSDDD, are sound and make good business sense. The EU has always moved faster on ESG compared to other markets and this should be a competitive advantage the EU should seek to maintain. Governments, large businesses, and regulatory bodies have also expressed support for the existing regulations, raising concerns about the uncertainty this review process has introduced.

The pushback against sustainability regulation is not new. We saw similar resistance when financial disclosure requirements were introduced, yet today, transparent financial reporting is considered fundamental to market confidence. In the future, failing to report on sustainability in a standardised way will likely be viewed as equally unacceptable. The concept of auditing ESG data may seem new now, but financial auditing underwent a similar transition, evolving into a highly regulated and rigorous requirement over time.

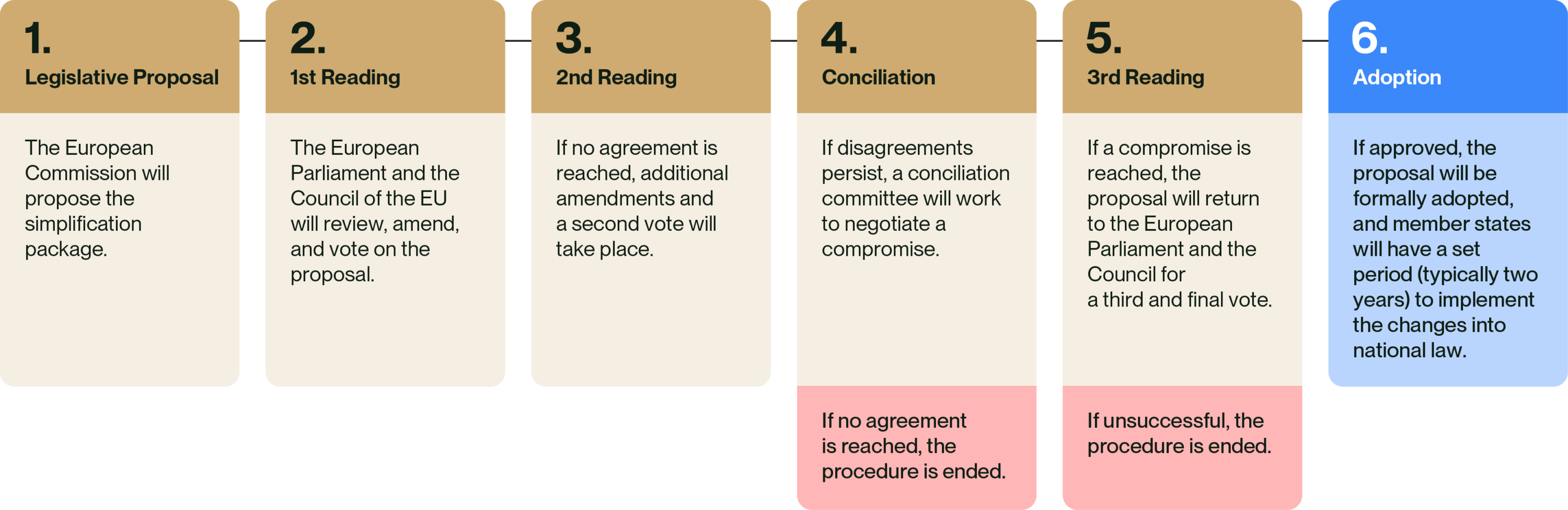

What Happens Next?

The proposed changes are now subject to a lengthy legislative process that could take 6-12 months or longer. Some elements, for example, the delay in the timeline of the CSRD, might be adopted quicker than other proposed changes.

For now, it’s important to note that the proposed Simplification Omnibus Package does not suspend the requirements of the existing regulations, and current laws still apply.

The likely process is as follows:

How Should Your Business Respond?

Despite ongoing uncertainty, businesses should continue with sustainability reporting and compliance efforts. The ESG agenda is not driven by regulators—it is driven by investors, consumers, and corporate stakeholders. This hasn’t changed. The introduction of standardised regulations is intended to enable fair comparisons and enhance transparency, not to lead the agenda.

For companies uncertain about what to do next, we advise speaking to your Anthesis representative, legal advisors, and financial auditors. The proposed changes are subject to amendment and need interpretation for each business’s unique structure.

EU listed large companies – maintain business as usual

If you reported against CSRD in FY2024, and the Non-Financial Reporting Directive (NFRD) before that, there are no compliance changes for you in terms of thresholds or timelines. There will likely be an updated set of ESRS with fewer data points in due course.

Businesses due to report against the CSRD in FY2025 – do not press pause on your planned actions

If you are working towards your Double Materiality Assessment or on closing your implementation gaps, go ahead as planned. If you delay and the regulations do not change as expected—or if the legislative process takes longer than anticipated—you could be at risk of non compliance. There is wider value than just compliance to pressing forward with a robust materiality assessment, ESG strategy setting, putting in place effective performance improvement plans and preparing voluntary sustainability reports for stakeholders.

Small and medium-sized companies – take a stakeholder-focused approach

Even if reporting requirements shift, it remains beneficial to begin compliance efforts now. Implementing best practices, such as a Double Materiality Assessment, will enable you to meet investor expectations. At the same time, it will improve your corporate reputation and support your value chain relationships while helping you to identify and benefit from better risk management and cost efficiencies ahead of potential regulatory changes.

Adapt, Don’t Pause

The fundamental principles of EU sustainability regulation represent best practices. Concepts such as Double Materiality provide strategic value, improve governance, and facilitate transparent stakeholder communication. Given that the legislative process could take a year or longer, businesses shouldn’t risk waiting for final clarity on the changes before taking action.

Stay the course and make sure your company can ensure compliance while remaining adaptable to the potential changes, if approved. By taking proactive steps now, you can position your organisation for success in a shifting regulatory landscape and, at the same time, continue to invest in initiatives that build resilience and create business value.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.