Contents

- The Role of Finance in Sustainability Reporting

- Steps to Build a Sustainability-aligned Finance Function

- Readiness Assessment

- Due Diligence Mapping

- Contact us

Share this article

The Role of Finance in Sustainability Reporting

Organizations aiming to enhance their ESG reporting could utilize the rigorous methods applied in financial reporting to improve the precision of non-financial data. By addressing specific gaps in line with established reporting frameworks, standards, or regulations, enhanced ESG reporting could lead to a more transparent understanding of risks and opportunities. This, in turn, fosters improved financial results and strengthens the organization’s social license to operate, thanks to more accurate and clear non-financial information.

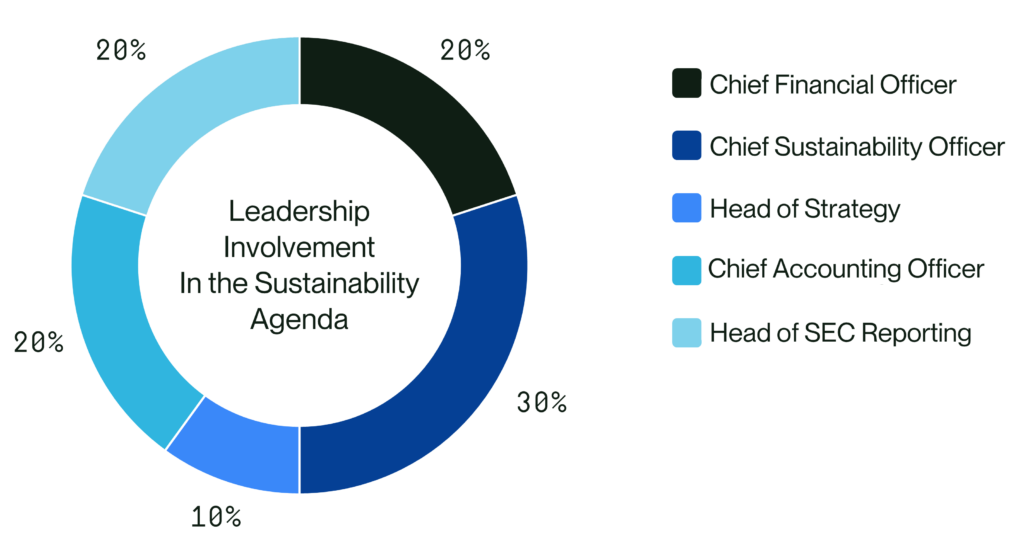

This paper sets out the convergence of sustainability and finance by outlining financial reporting processes that could significantly strengthen the accuracy of sustainability reporting. Based on recent research[1], we are seeing the finance function take an increasingly active role in participating in organizations’ sustainability agenda [2]:

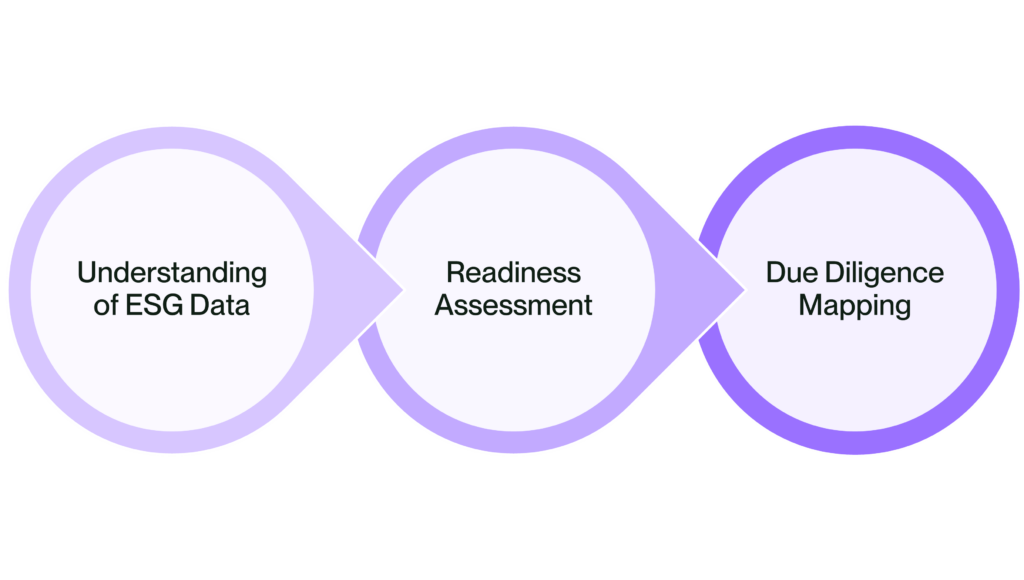

To further improve the consistency, comparability, and reliability of sustainability reporting, organizations can implement the following steps to establish a sustainability-aligned finance function that can drive compliance with mandatory sustainability reporting standards and regulations:

Steps to Build a Sustainability-aligned Finance Function

1. Understanding of ESG Data

The first step is to have a solid understanding of the ESG data by asking foundational questions: What data do I have? What data do I need? Where are the gaps and how can I close them? Non-financial data needs to be relevant, accurate, comparable, and complete to ensure sustainability reporting is detailed, transparent, and up to date.

The finance function, already adept at managing financial data with precision, is well-positioned to tackle the challenges of sustainability data. By establishing and implementing robust data collection processes and management controls similar to those used for financial information, finance teams can significantly enhance the integrity and credibility of sustainability data. This not only assures reliable information but also empowers senior management to make informed decisions grounded in solid sustainability insights.

Along with answering the aforementioned foundational questions on ESG data, the following key focus areas in the table below will ensure the necessary assessments are in place to enhance sustainability reporting:

| Key Focus Area | Critical Questions | Best Practice Guidelines |

|---|---|---|

| Data Storage & Accessibility | How is the information stored and accessed? Is it centrally available or siloed and only accessible to one or two individuals? | Ensure data is stored in a central repository, accessible to multiple stakeholders, facilitating ease of access and promoting transparency. |

| Data Quality Control and Verification | What internal checkpoints or audit processes are in place to verify data quality before disclosure? | Implement stringent internal checkpoints or audit processes to verify data, ensuring its accuracy and reliability prior to disclosure. |

| Completeness and Unbiased Reporting | How is the integrity of data maintained to ensure it is complete and unbiased? | Adopt a data quality assurance process to safeguard against greenwashing, ensuring data is comprehensive and impartial. |

| Data Comparability and Corroboration | Can the data be corroborated with evidence from both internal and external sources? | Validate data through comparison with internal and external sources, including site visits, plant inspections, and performance analyses, to ensure its credibility. |

2. Readiness Assessment

The second step involves creating a readiness assessment to facilitate the application of financial principles to sustainability reporting. This includes establishing robust data governance, refining internal processes and controls, and integrating specific systems such as IT infrastructure and software tools tailored for sustainability data capture. The assessment should encompass a range of initiatives, each designed to ensure the collection of high-quality data, thereby enhancing the overall effectiveness of sustainability reporting. The readiness assessment can include a combination of approaches that consist of the following initiatives:

- Gap analysis,

- Audit programs,

- Non-financial assurance under ISAE 3000 on qualitative and quantitative data[3],

- Risk register and data collection tools,

Existing and upcoming mandatory reporting regulations demand equal scrutiny and expectations for both financial and non-financial information. Consequently, high-quality ESG reporting transcends stakeholder communication and necessitates regulatory-grade, auditable sustainability data. This shift underscores the need for robust data governance and management principles to support the integrity and reliability of ESG reporting in line with regulatory standards.

3. Due Diligence Mapping

The third step involves developing a detailed mapping process to align key elements of sustainability due diligence with the disclosures in sustainability reports. This mapping should clearly identify and integrate essential components of sustainability assessment, such as environmental impact, social responsibility, and governance issues, with the corresponding disclosures to ensure comprehensive and transparent reporting.

A thorough due diligence system ensures that sustainability professionals and senior leadership bodies are kept abreast of ESG material impacts (actual or potential adverse impacts). However, due diligence goes beyond staying informed; it involves actively managing and addressing impacts by prioritizing them according to their severity. This approach ensures that prevention, mitigation, and action are focused on the most significant issues first. [4]

Due diligence, coupled with audit and assurance processes, though similar, serve distinct roles in bolstering trust in reported non-financial information. Audit procedures systematically review the data, while assurance provides an additional layer of confidence by verifying the reliability of the information presented. Together, they form a comprehensive approach to ensure the credibility of non-financial reporting.

By implementing controls and processes from financial reporting into the management of ESG data, organizations can make considerable strides in enhancing the accuracy and reliability of their sustainability reporting. This approach aligns with the high standards of financial data handling, thereby addressing stakeholders’ concerns about the credibility of reported sustainability information.

However, it is worth noting that reasonable assurance of sustainability reporting is a challenge due to the absence of sustainability assurance standards[5]. In the short term, limited assurance, which involves a less detailed review and provides a moderate level of confidence, might be a practical goal. In contrast, reasonable assurance, aimed at the long term, offers a higher level of confidence through a more in-depth examination of sustainability reports. This distinction clarifies the depth and extent of scrutiny applied in each assurance approach.

The central theme of this paper, while effectively outlining financial reporting principles applicable to sustainability data, could be further strengthened by explicitly highlighting the role and value of the Finance function in managing ESG data. It is crucial to delve deeper into how and why the Finance team is uniquely equipped to support ESG data management and reporting.

[1] Sustainability action report: Survey findings on ESG disclosure and preparedness, March 2022, Deloitte

[2] How finance professionals are helping ESG reporting – ESG data and controls survey findings, May 2022 – E&Y

[3] ISAE 3000 (Revised), Assurance Engagements Other than Audits or Reviews of Historical Financial Information

[4] ESRS 1 General Principles – Project Task Force on Sustainability Reporting Standards

[5] Corporate Sustainability Reporting and Auditing – European Commission

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.